Palm Beach Florida Payroll Deduction Authorization Form for Optional Matters — Employee is a legal document that allows employees in Palm Beach, Florida, to authorize specific deductions from their paychecks for various optional matters. This form enables employees to make financial contributions towards specific programs or benefits offered by their employer. Some possible types of Palm Beach Florida Payroll Deduction Authorization Forms for Optional Matters — Employee include: 1. Charitable Contributions: This form enables employees to authorize deductions from their paychecks to support charitable organizations or initiatives. Employees can choose to donate a fixed amount or a percentage of their salary to a specific charity. 2. Retirement Plan Contributions: This form allows employees to set up deductions from their paychecks to contribute to their employer-sponsored retirement plans, such as a 401(k). Employees can specify the amount or percentage they wish to contribute towards their retirement savings. 3. Health Insurance Premiums: Employers often provide health insurance options for their employees. The Payroll Deduction Authorization Form allows employees to authorize deductions from their paychecks to cover their share of health insurance premiums. 4. Flexible Spending Accounts: This form allows employees to authorize deductions for contributions to a flexible spending account (FSA). FSA's provide employees with pre-tax dollars to cover eligible medical expenses or dependent care costs. 5. Employee Purchase Programs: Some employers offer employee purchase programs, allowing employees to purchase specific products or services through payroll deductions. This form outlines the terms and conditions for such programs and authorizes deductions accordingly. 6. Employee Benefits Programs: This form can be used to authorize deductions for various employee benefits, such as gym memberships, wellness programs, educational assistance, or transportation benefits. Employees can choose to participate in these programs and have the corresponding costs deducted from their paychecks. It is important to note that these are general examples, and the specific types of Palm Beach Florida Payroll Deduction Authorization Forms for Optional Matters — Employee may vary depending on the policies and offerings of individual employers in Palm Beach, Florida.

Palm Beach Florida Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Palm Beach Florida Payroll Deduction Authorization Form For Optional Matters - Employee?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Palm Beach Payroll Deduction Authorization Form for Optional Matters - Employee, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Palm Beach Payroll Deduction Authorization Form for Optional Matters - Employee from the My Forms tab.

For new users, it's necessary to make some more steps to get the Palm Beach Payroll Deduction Authorization Form for Optional Matters - Employee:

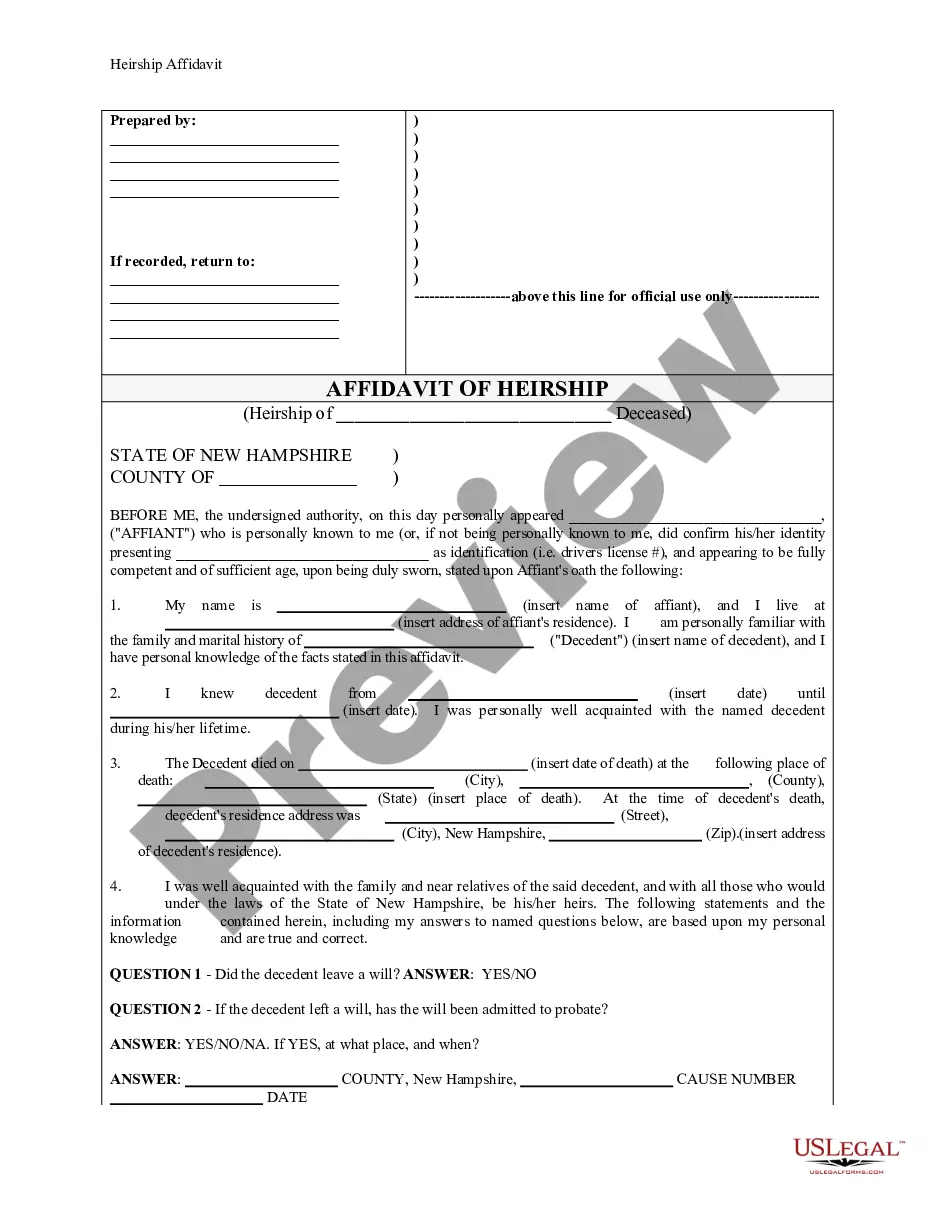

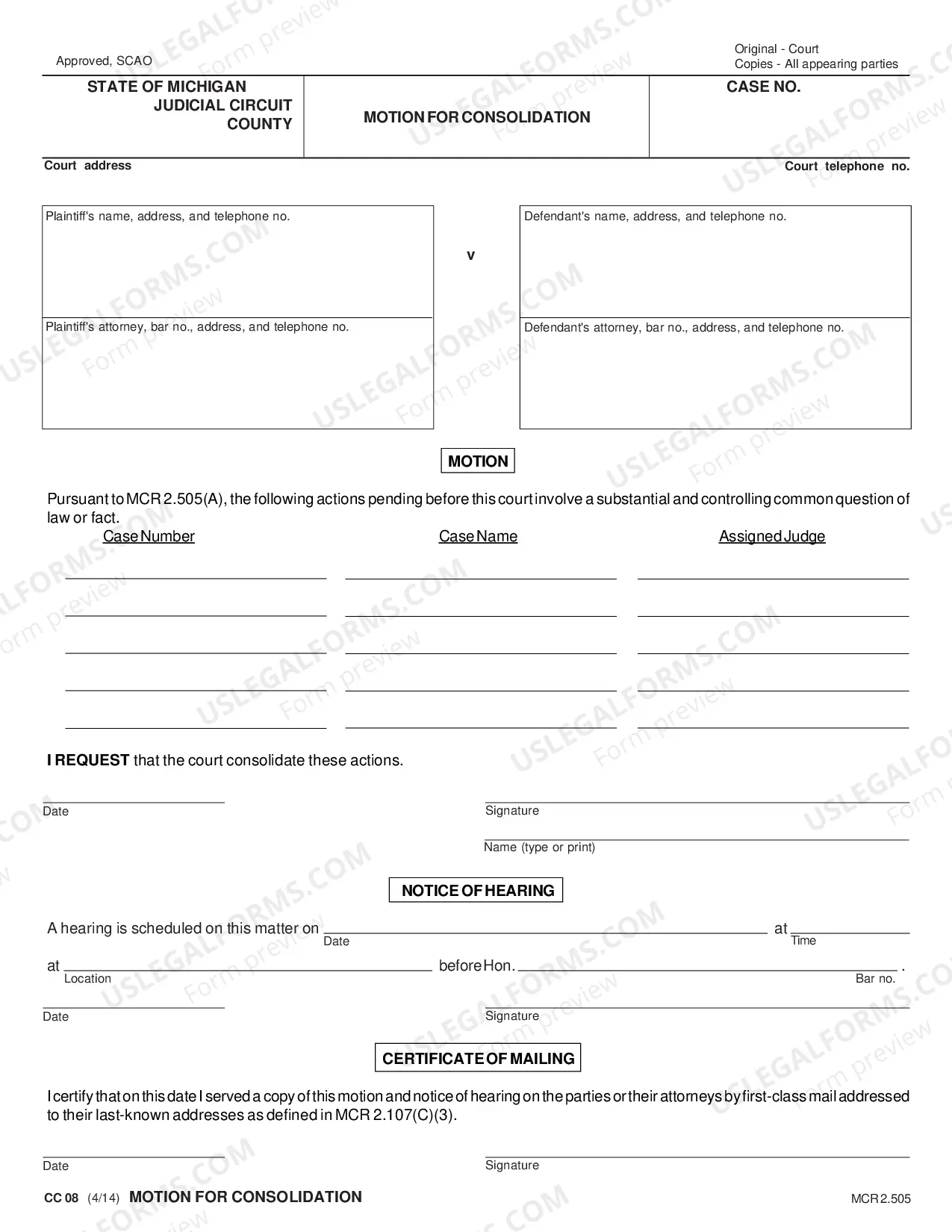

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!