The Salt Lake Utah Payroll Deduction Authorization Form for Optional Matters — Employee is a crucial document used by employers in Salt Lake City, Utah to facilitate voluntary payroll deductions for various optional purposes chosen by employees. This form outlines the necessary information and authorizations required by employees to initiate these deductions. The Payroll Deduction Authorization Form allows employees to elect payroll deductions for a variety of optional matters based on their preferences and needs. By completing this form, employees can conveniently set up deductions for purposes like retirement plans, health insurance premiums, charitable contributions, savings plans, loan repayments, and more. The form serves as a legally binding agreement between the employer and the employee, ensuring accurate deduction processing as per the employee's instructions. Different types or categories of Salt Lake Utah Payroll Deduction Authorization Forms for Optional Matters — Employee may exist based on the specific deductions they cater to. Here are a few examples: 1. Retirement Plans Deduction Authorization Form: This form is used by employees to authorize deductions from their payroll for contributions towards retirement plans such as 401(k) or IRA accounts. It includes sections for employee information, plan details, chosen contribution amount, and any additional instructions. 2. Health Insurance Premiums Deduction Authorization Form: This form enables employees to authorize deductions for health insurance premiums from their payroll. It typically includes sections for employee details, insurance provider information, selected coverage plan, premium amount, and effective dates. 3. Charitable Contributions Deduction Authorization Form: Employees who wish to contribute a portion of their earnings to eligible charitable organizations can utilize this form. It contains sections for employee particulars, chosen charity, percentage or fixed amount to be deducted, and any relevant terms or conditions. 4. Savings Plans Deduction Authorization Form: This form facilitates payroll deductions for employee-initiated savings plans like 529 college savings plans, individual investment accounts, or other personal savings goals. It generally includes sections for employee details, desired savings contribution amount, designated account details, and any specific guidelines. 5. Loan Repayments Deduction Authorization Form: Employees who have outstanding loans with their employer or another financial institution can use this form to authorize deductions for loan repayments directly from their payroll. The form typically requires employee information, loan details, repayment terms, and any additional instructions. These are just a few examples of the potential variations in Salt Lake Utah Payroll Deduction Authorization Form for Optional Matters — Employee. Employers may tailor these forms to suit their specific deduction categories or requirements, ensuring seamless payroll management and accurate processing of employee deductions.

Salt Lake Utah Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Salt Lake Utah Payroll Deduction Authorization Form For Optional Matters - Employee?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Salt Lake Payroll Deduction Authorization Form for Optional Matters - Employee, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Salt Lake Payroll Deduction Authorization Form for Optional Matters - Employee, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Payroll Deduction Authorization Form for Optional Matters - Employee:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Salt Lake Payroll Deduction Authorization Form for Optional Matters - Employee and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Authority to deduct as practiced in employment setting empowers the employer to set off the monetary accountability of employee against his receivable.

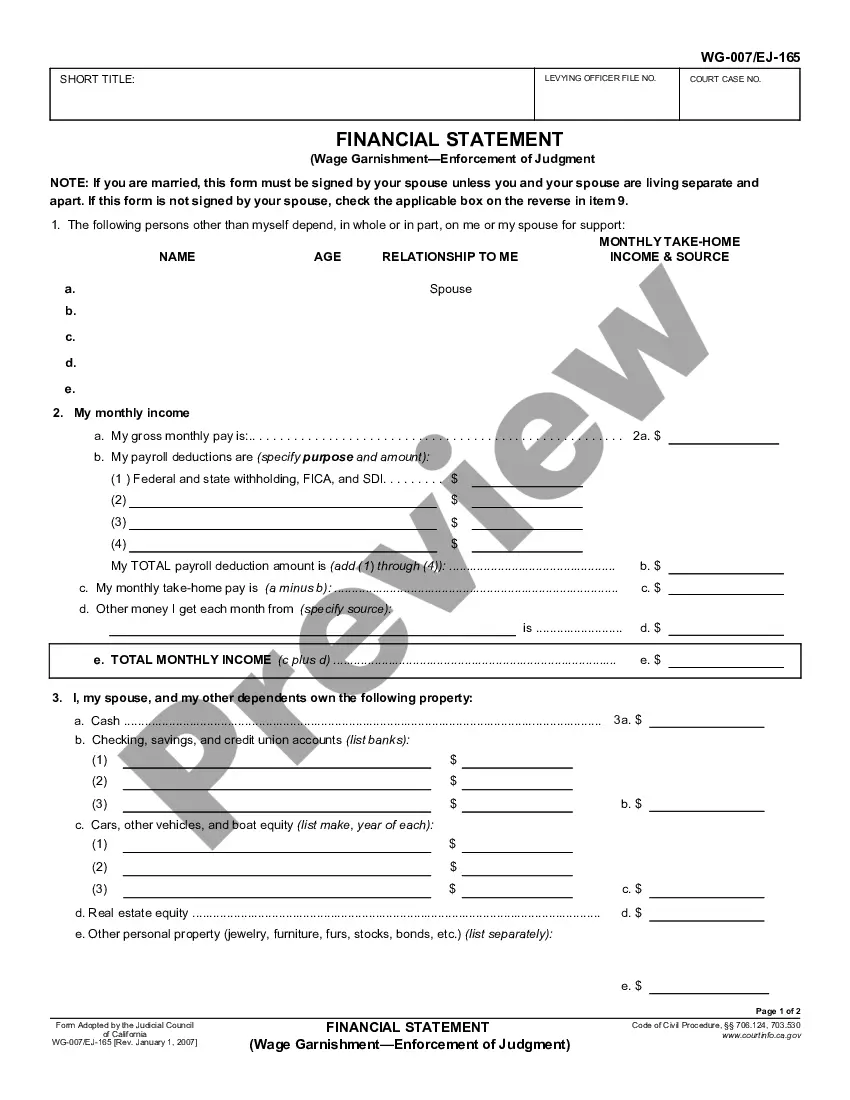

Voluntary Payroll Deductions Retirement or 401(k) plan contributions. Health insurance premiums for medical, dental and vision plans. Life insurance premiums. Contributions to a flexible spending account or pre-tax health savings plan.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

The standard payroll deductions are those that are required by law. They include federal income tax, Social Security, Medicare, state income tax, and court-ordered garnishments.

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

Examples of payroll deductions include federal, state, and local taxes, health insurance premiums, and job-related expenses.

The total amount earned is included in gross pay. This includes any wages, salaries, and overtime earned during that period of time. Deductions include taxes (Federal and state income taxes, FICA). Optional deductions include union dues, retirement account, 200band charitable contributions.

Mandatory payroll deductions FICA tax. Federal Insurance Contributions Act (FICA) tax is made up of Social Security and Medicare taxes.Federal income tax.State and local taxes.Garnishments.Health insurance premiums.Retirement plans.Life insurance premiums.Job-related expenses.

Payroll deductions are the specific amounts that you withhold from an employee's paycheck each pay period. There are two types of deductions: voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and FICA taxes.