San Diego California Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

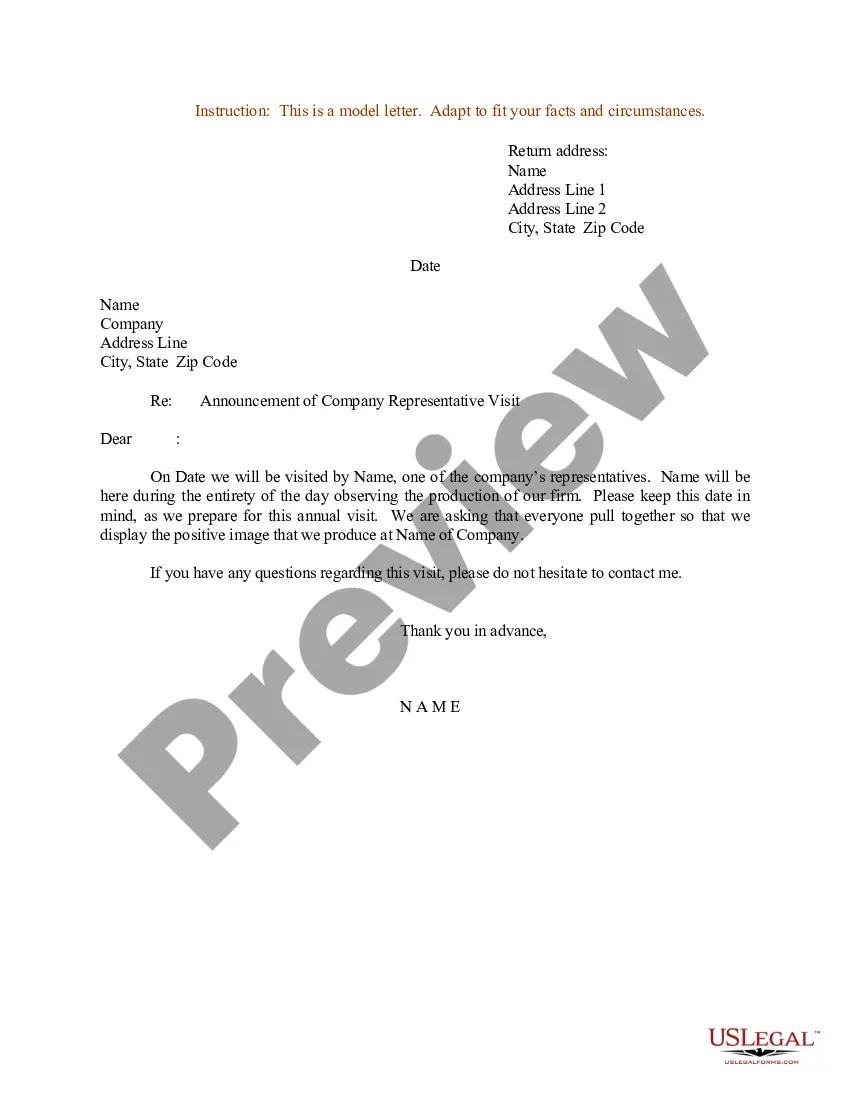

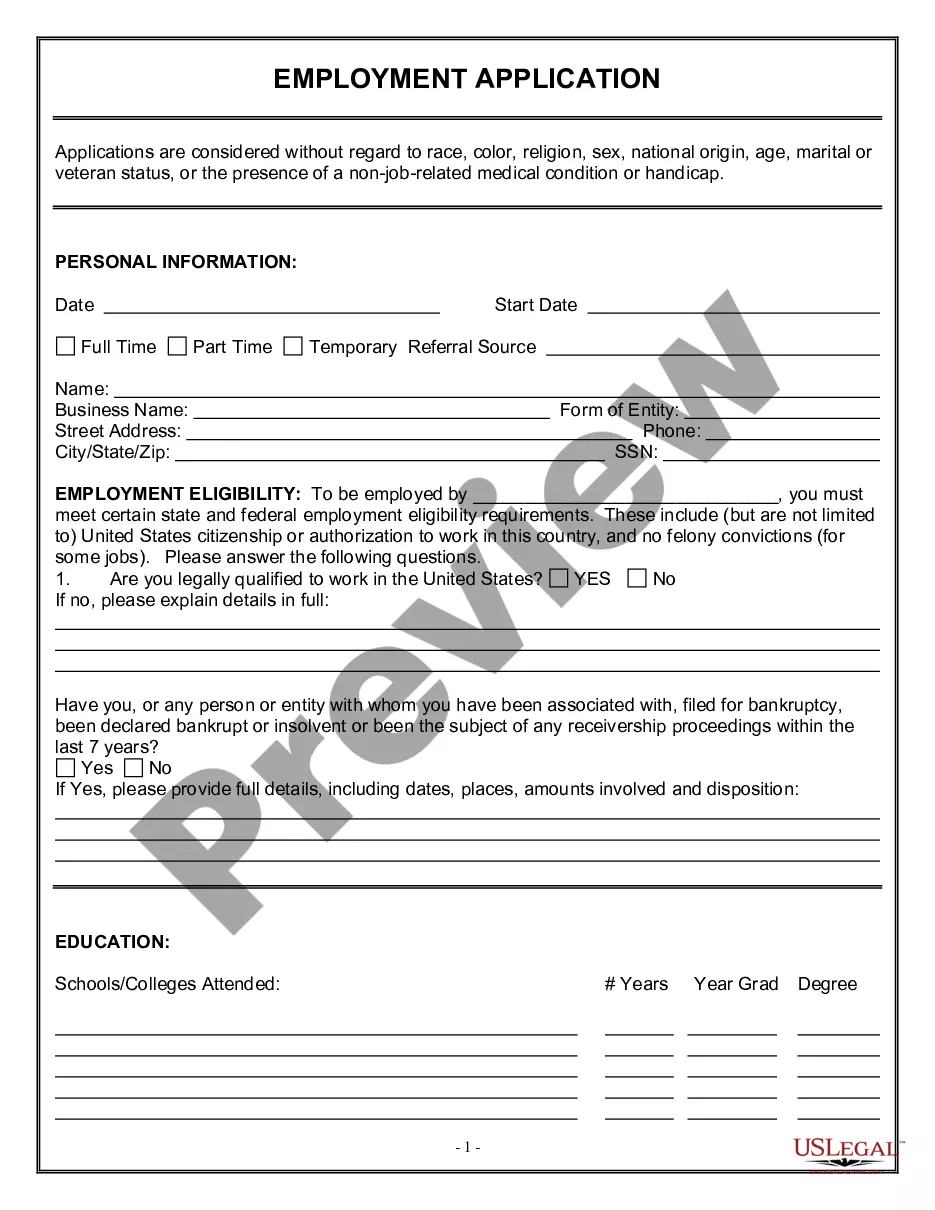

Handling legal documents is essential in the contemporary world. However, you don't always have to seek expert assistance to create some of them from scratch, such as the San Diego Payroll Deduction Authorization Form for Optional Matters - Employee, using a platform like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from across various categories, including living wills, real estate documents, and divorce agreements. All forms are categorized by their applicable state, simplifying the search process.

You can also discover informational resources and guides on the website that make any tasks related to document completion straightforward.

If you’re already a subscriber of US Legal Forms, you can find the required San Diego Payroll Deduction Authorization Form for Optional Matters - Employee, Log In to your account, and download it. It goes without saying that our platform cannot fully replace an attorney. If you're facing an exceptionally complex case, we suggest utilizing a lawyer's services to review your document before signing and submitting it.

With over 25 years in the industry, US Legal Forms has proven to be a preferred platform for various legal documents for millions of users. Join them today and obtain your state-specific paperwork effortlessly!

- Review the document’s preview and outline (if available) to gain an overview of what you will receive after downloading the document.

- Make sure that the template you select is tailored to your state/county/region, as state regulations can influence the legitimacy of certain documents.

- Look through similar document templates or restart your search to find the suitable file.

- Click Buy now and set up your account. If you already possess one, choose to Log In.

- Select the pricing plan, then a suitable payment method, and purchase the San Diego Payroll Deduction Authorization Form for Optional Matters - Employee.

- Decide to save the form template in any available file format.

- Navigate to the My documents tab to re-download the document.

Form popularity

FAQ

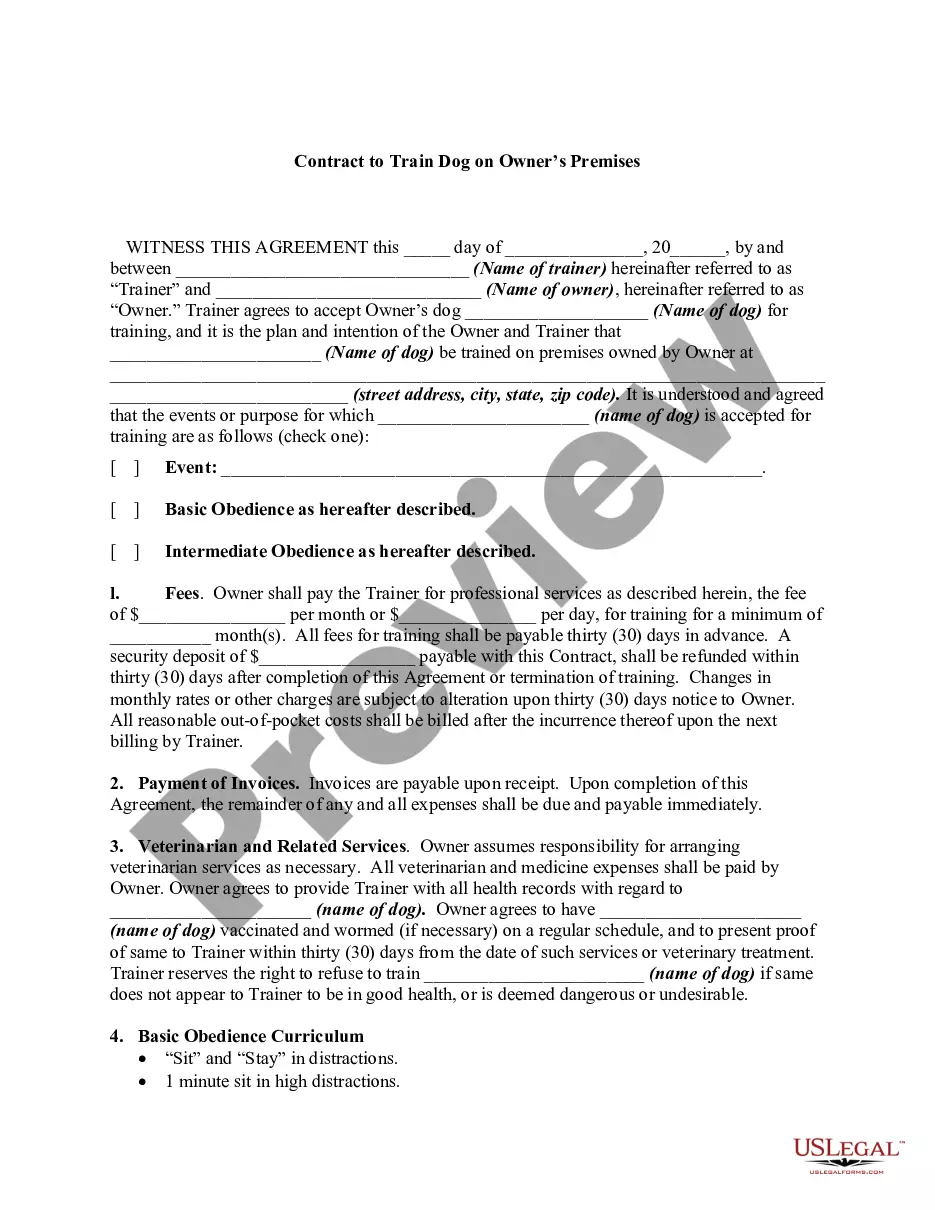

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

Form 2159 (Rev. 5-2020) INSTRUCTIONS TO EMPLOYER. This payroll deduction agreement is subject to your approval. If you agree to participate, please complete the spaces provided under the employer section on the front of this form.

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

Authority to deduct as practiced in employment setting empowers the employer to set off the monetary accountability of employee against his receivable.

Payroll Deduction Authorization Form means the form provided by the Corporation on which an Employee may elect to participate in the Plan and designate the percentage of his or her Compensation to be contributed to his or her Account through payroll deductions.

More Definitions of Payroll Deduction Authorization Payroll Deduction Authorization means the form prescribed by the Board for use by Eligible Employees to authorize payroll deductions, to specify the payroll deduction amount and to designate a Beneficiary, if any, all as provided in this Plan.

Every month, there are SSS deductions. These are mandated by law; very few individuals are exempted from it.As an HR employee, you are in charge of deducting their SSS contribution every month.

Some mandatory payroll tax deductions that employers are required by law to withhold from an employee's paycheck include: Federal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Examples of voluntary payroll deductions include: Retirement or 401(k) plan contributions. Health insurance premiums for medical, dental and vision plans. Life insurance premiums. Contributions to a flexible spending account or pre-tax health savings plan. Short term disability plans. Uniform and/or tools.