The Wake North Carolina Payroll Deduction Authorization Form for Optional Matters — Employee is a document that allows employees to authorize deductions from their wages for various optional purposes. This form is specifically designed for employees in Wake County, North Carolina. This payroll deduction authorization form is crucial for employees who wish to participate in optional programs or contribute to specific funds through payroll deductions. By completing this form, employees give their consent to have a specified amount deducted from their wages on a regular basis. There are several types of Wake North Carolina Payroll Deduction Authorization Forms for Optional Matters — Employee, tailored to accommodate various employee needs and interests. Some common types of deductions that this form may cover include: 1. Charitable Contributions: This form allows employees to make voluntary donations to charitable organizations or non-profit foundations directly from their paychecks. Employees can specify the amount they would like to contribute and the frequency of deductions. 2. Savings Programs: This type of form enables employees to participate in employee savings programs, such as retirement plans, individual retirement accounts (IRAs), or investment plans. By opting for such deductions, employees can save for their future financial security conveniently. 3. Health and Wellness Programs: This form might also include options for employees to enroll in various health and wellness programs, such as gym memberships, weight loss programs, or smoking cessation programs. Deductions can be made automatically to cover the associated costs. 4. Employee Loans: Some companies provide financial assistance to their employees through loans. This form allows employees to authorize payroll deductions for loan repayments. By completing this form, employees can ensure timely repayments and avoid penalties. 5. Education Assistance: Employers often offer educational support programs, including tuition reimbursements or student loan repayments. The Wake North Carolina Payroll Deduction Authorization Form for Optional Matters — Employee can include relevant sections to facilitate such deductions for educational purposes. It is important for employees to carefully review the Wake North Carolina Payroll Deduction Authorization Form for Optional Matters before signing and submitting it. By doing so, employees can ensure that they fully understand the deductions they are authorizing and their respective terms and conditions. In summary, the Wake North Carolina Payroll Deduction Authorization Form for Optional Matters — Employee is a crucial document that allows employees to authorize various deductions from their wages for optional programs or contributions. This form makes it convenient for employees to participate in programs such as charitable contributions, savings plans, health and wellness initiatives, employee loans, and educational assistance.

Wake North Carolina Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Wake North Carolina Payroll Deduction Authorization Form For Optional Matters - Employee?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Wake Payroll Deduction Authorization Form for Optional Matters - Employee, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Wake Payroll Deduction Authorization Form for Optional Matters - Employee from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Wake Payroll Deduction Authorization Form for Optional Matters - Employee:

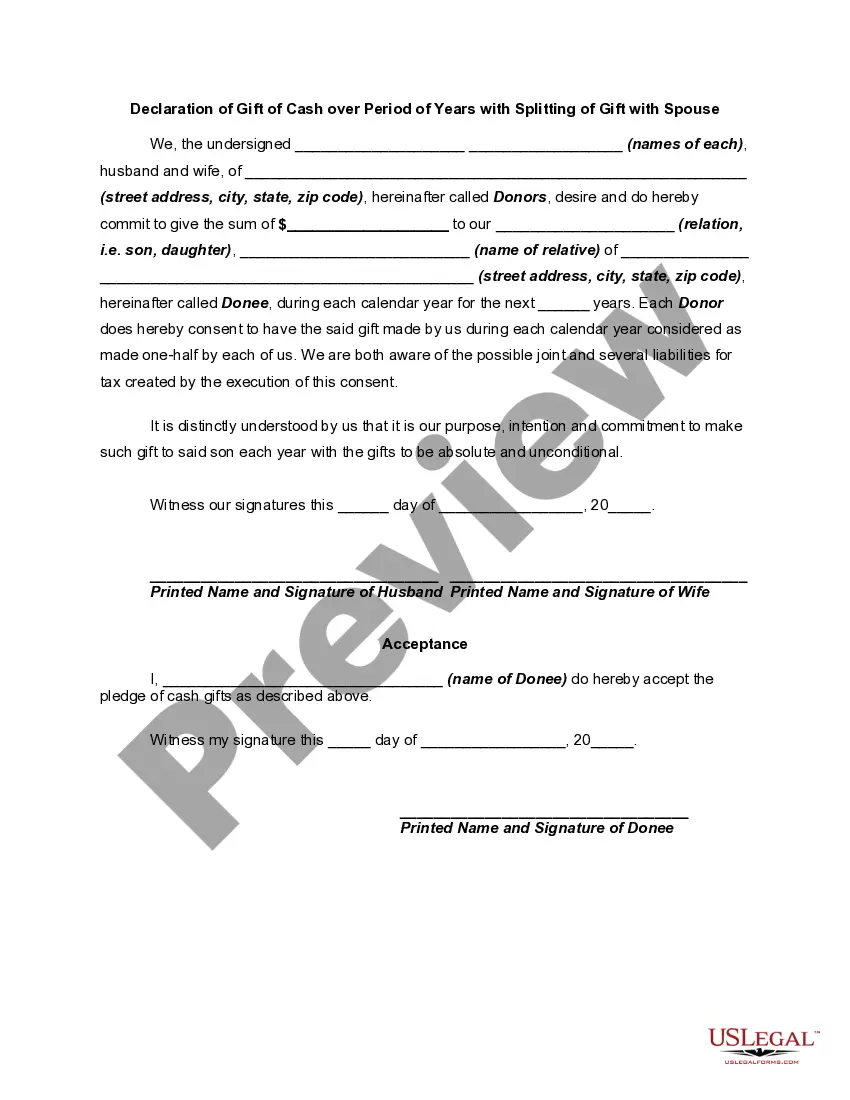

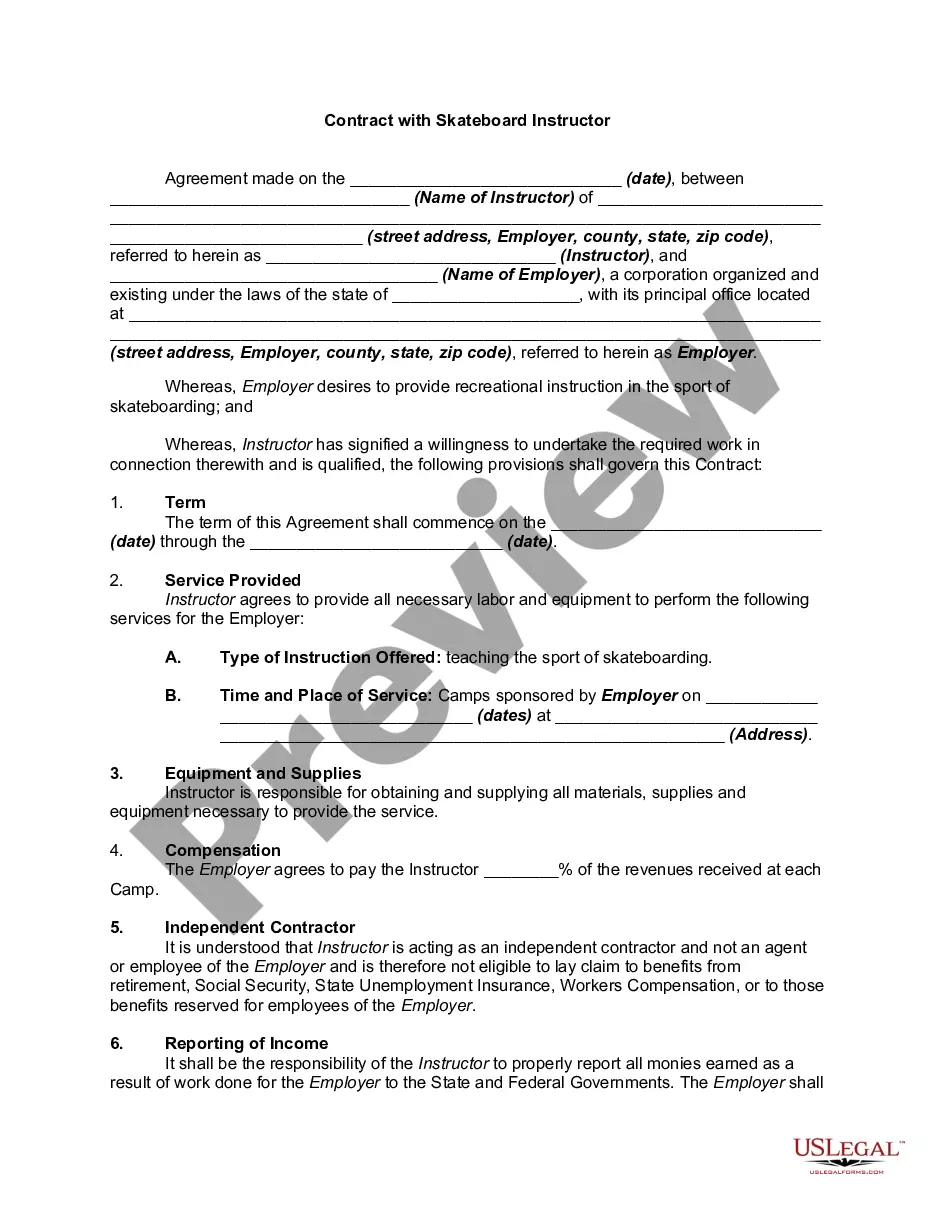

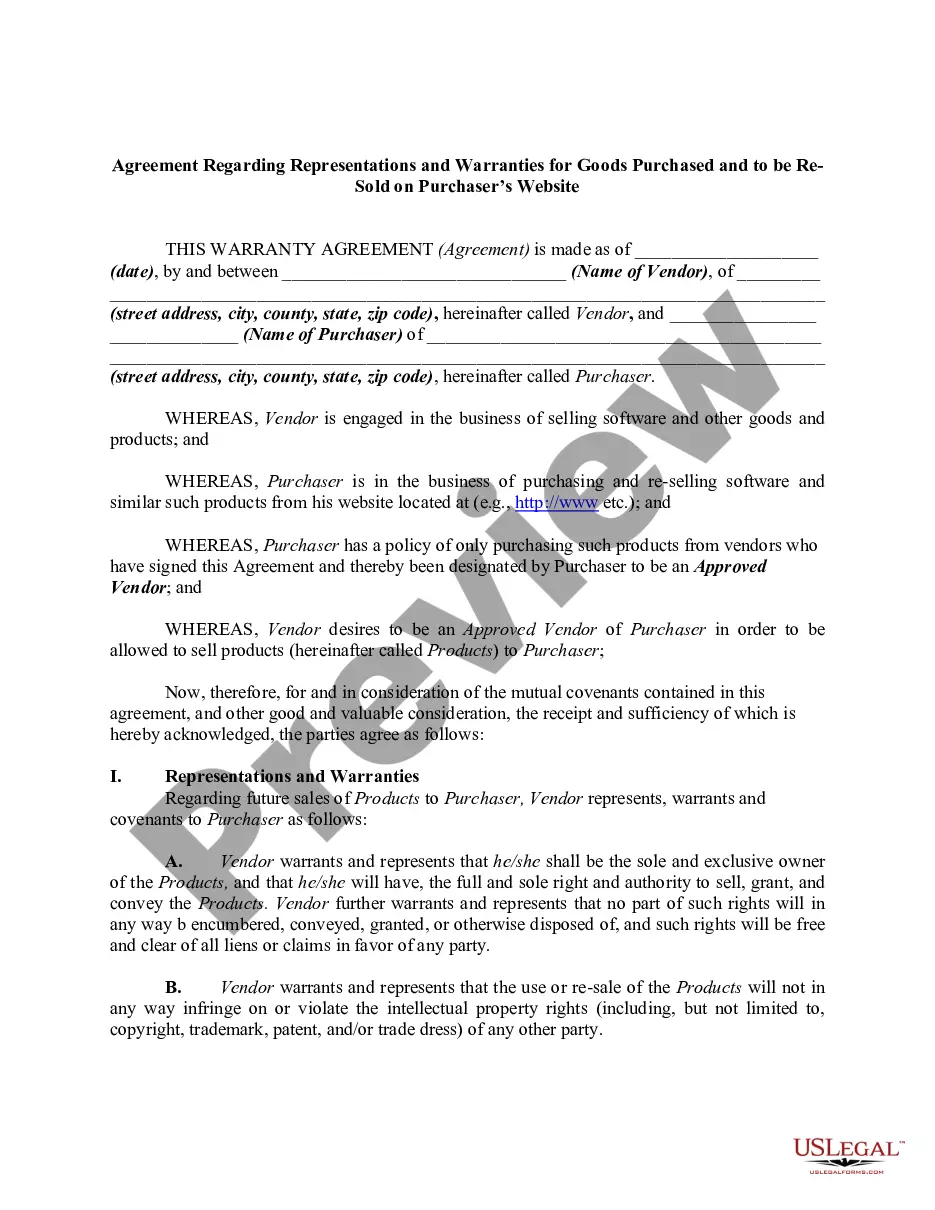

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!