"Guarantee Form and Variations" is a American Lawyer Media form. This form is guarantee form and there different variations.

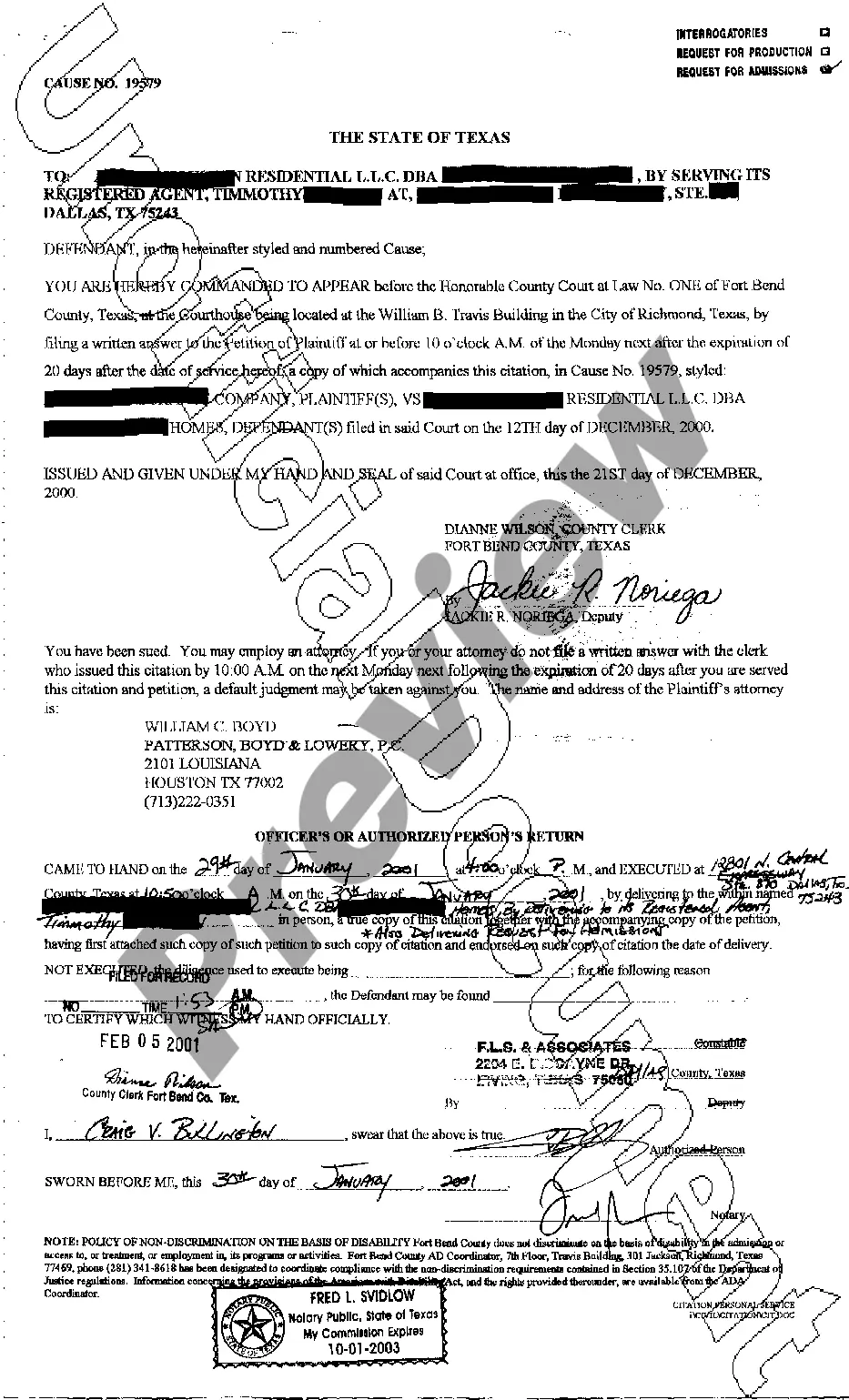

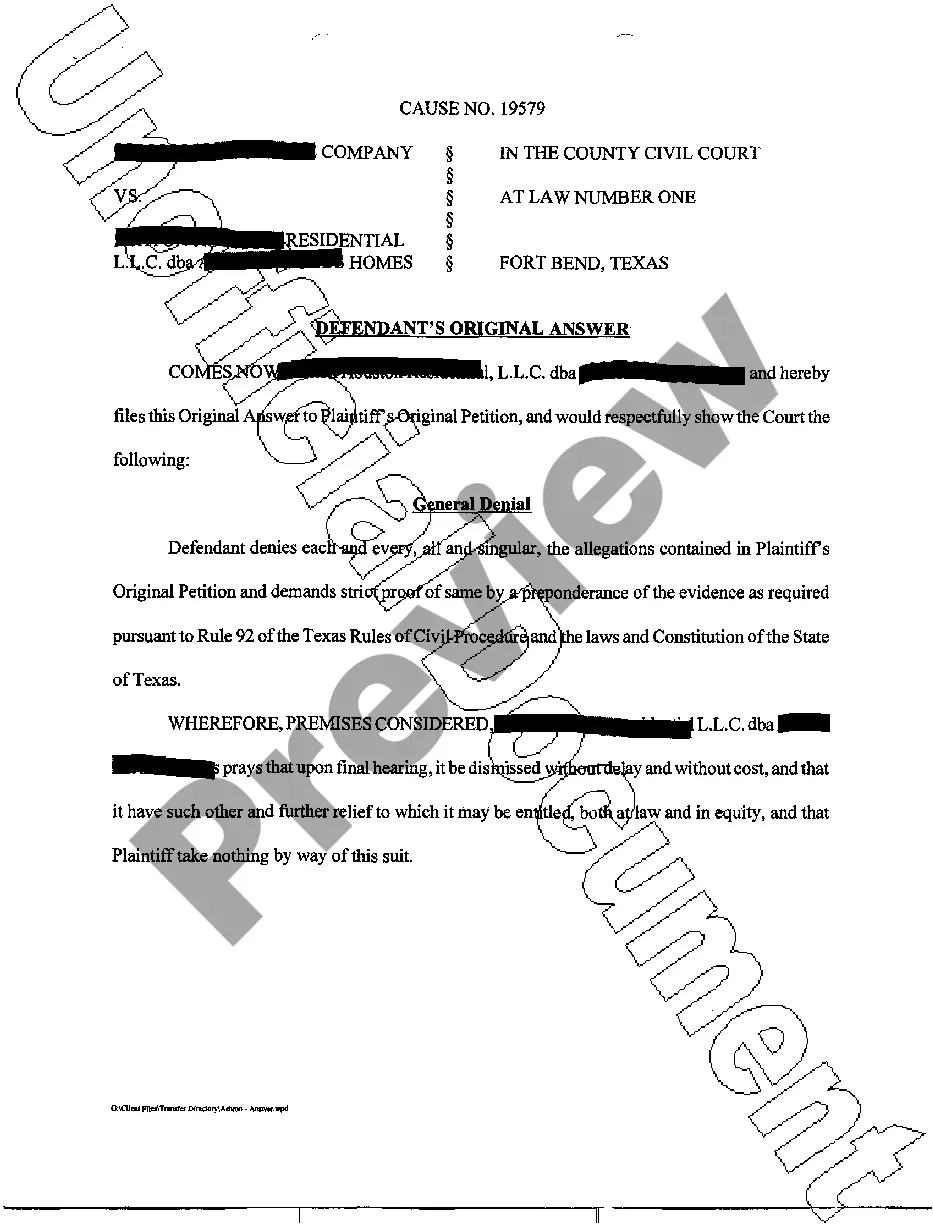

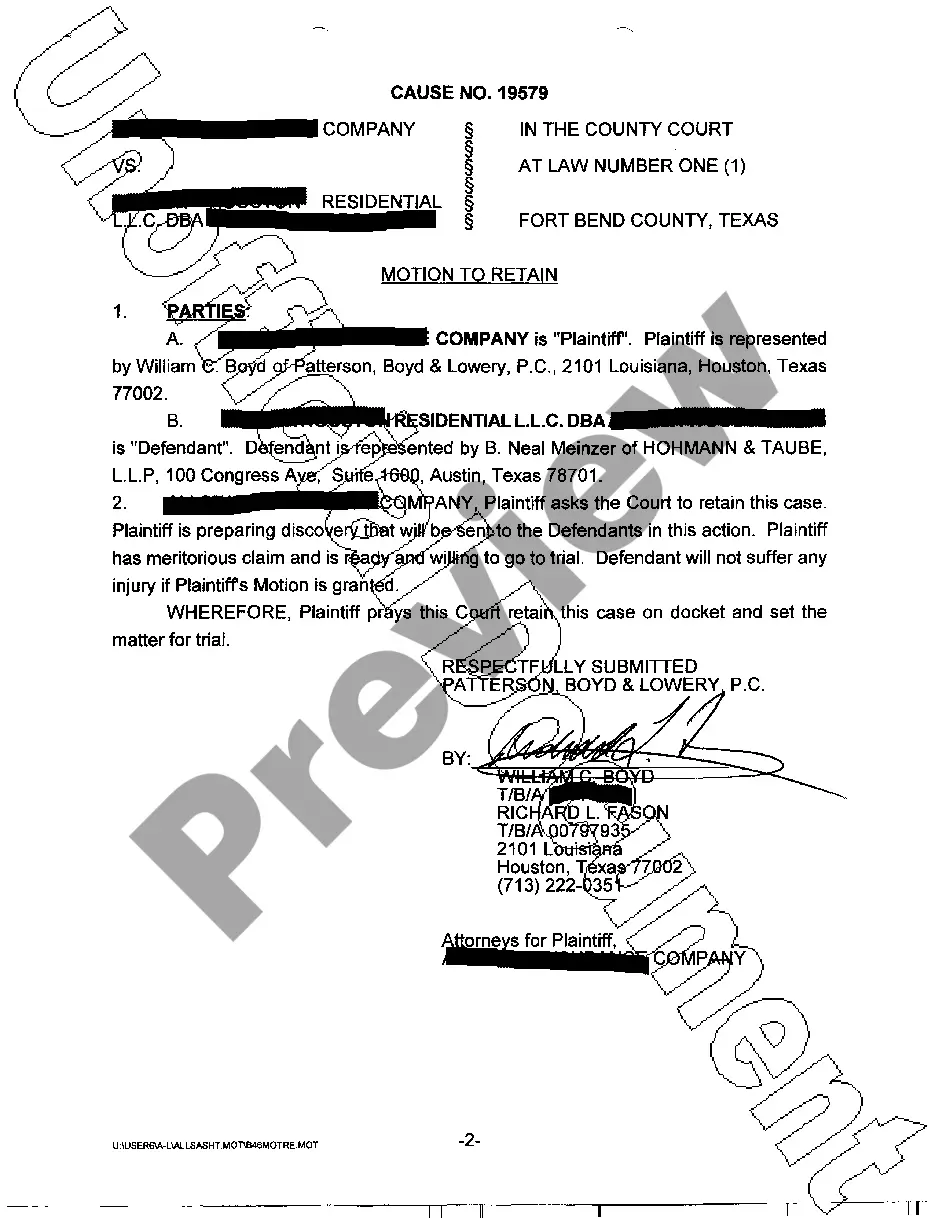

Dallas, Texas Guarantee Form is a legally binding contract commonly used in real estate transactions in the Dallas area. It serves as an assurance or promise made by one party to another to compensate for any potential losses or damages that may occur during the course of a transaction. The Dallas, Texas Guarantee Form is tailored to meet the specific requirements and regulations of the real estate market in Dallas and offers variations to cater to different types of transactions. These variations include: 1. Residential Guarantee Form: This form is typically used when buying or selling residential properties, such as houses, condos, or townhouses. It outlines the terms and conditions related to warranties, repairs, and other guarantees provided by the seller to protect the buyer's interests. 2. Commercial Guarantee Form: Designed for commercial real estate transactions, this variation addresses the unique aspects of buying or selling commercial properties, such as office buildings, retail spaces, or industrial facilities. It includes provisions related to environmental risks, zoning regulations, and tenant occupancy. 3. Lease Guarantee Form: This form comes into play when leasing a property in Dallas instead of buying or selling. It outlines the responsibilities of both the landlord and the tenant, including maintenance and repairs, lease payment terms, and conditions for terminating the lease agreement. 4. Construction Guarantee Form: Used primarily by contractors and builders, this variation focuses on guaranteeing the quality of construction work in Dallas. It covers aspects such as warranties for materials and workmanship, insurance requirements, and deadlines for completion. 5. Mortgage Guarantee Form: This form is utilized in mortgage transactions in Dallas, serving as a guarantee to the lender that the borrower will fulfill their repayment obligations. It outlines the terms of the mortgage, including interest rates, payment schedules, and conditions for default. Regardless of the specific variation used, the Dallas, Texas Guarantee Form is crucial for protecting the interests of all parties involved in a real estate transaction in Dallas. It provides transparency, sets clear expectations, and ensures legal compliance within the local real estate market.Dallas, Texas Guarantee Form is a legally binding contract commonly used in real estate transactions in the Dallas area. It serves as an assurance or promise made by one party to another to compensate for any potential losses or damages that may occur during the course of a transaction. The Dallas, Texas Guarantee Form is tailored to meet the specific requirements and regulations of the real estate market in Dallas and offers variations to cater to different types of transactions. These variations include: 1. Residential Guarantee Form: This form is typically used when buying or selling residential properties, such as houses, condos, or townhouses. It outlines the terms and conditions related to warranties, repairs, and other guarantees provided by the seller to protect the buyer's interests. 2. Commercial Guarantee Form: Designed for commercial real estate transactions, this variation addresses the unique aspects of buying or selling commercial properties, such as office buildings, retail spaces, or industrial facilities. It includes provisions related to environmental risks, zoning regulations, and tenant occupancy. 3. Lease Guarantee Form: This form comes into play when leasing a property in Dallas instead of buying or selling. It outlines the responsibilities of both the landlord and the tenant, including maintenance and repairs, lease payment terms, and conditions for terminating the lease agreement. 4. Construction Guarantee Form: Used primarily by contractors and builders, this variation focuses on guaranteeing the quality of construction work in Dallas. It covers aspects such as warranties for materials and workmanship, insurance requirements, and deadlines for completion. 5. Mortgage Guarantee Form: This form is utilized in mortgage transactions in Dallas, serving as a guarantee to the lender that the borrower will fulfill their repayment obligations. It outlines the terms of the mortgage, including interest rates, payment schedules, and conditions for default. Regardless of the specific variation used, the Dallas, Texas Guarantee Form is crucial for protecting the interests of all parties involved in a real estate transaction in Dallas. It provides transparency, sets clear expectations, and ensures legal compliance within the local real estate market.