Suffolk New York Masonry Services Contract — Self-Employed is a legally binding agreement made between a skilled masonry contractor and a client in Suffolk County, New York. This contract outlines the terms and conditions under which the masonry services will be provided by the self-employed contractor. In Suffolk County, there are various types of masonry services contracts that self-employed contractors specialize in, such as: 1. Bricklaying Services: This type of contract focuses on brick-related masonry work, including brick wall construction, brick repairs, chimneys, fireplaces, and brick paving. 2. Stonework Services: Stonework contracts involve the use of natural stone materials for building structures like walls, patios, walkways, retaining walls, or decorative features. 3. Concrete Services: These contracts revolve around concrete masonry work, such as pouring and finishing concrete slabs, constructing concrete driveways, sidewalks, foundations, or basement floors. 4. Tile Installation Services: This type of contract is centered around masonry work involving the installation and repair of various types of tiles, including ceramic, porcelain, mosaic, or stone tiles, in kitchens, bathrooms, or other areas requiring tiling. 5. Masonry Restoration Services: This contract specializes in the restoration and preservation of historical masonry structures, including cleaning, repointing, waterproofing, and overall structural repairs. The Suffolk New York Masonry Services Contract — Self-Employed typically includes the following key elements: 1. Parties Involved: The contract identifies both the masonry contractor, who is self-employed, and the client seeking masonry services. Their names, contact details, and addresses are mentioned. 2. Scope of Work: The contract specifies the specific masonry services being provided, like bricklaying, stonework, concrete work, tile installation, or restoration, along with detailed descriptions and designs, if applicable. 3. Timeline and Deadlines: This section outlines the start date and estimated completion date of the project, as well as any milestones or deadlines for certain aspects of the work. 4. Payment Terms: The contract indicates the agreed-upon fee or the method of calculating the contractor's compensation, such as hourly rates, fixed project rates, or material plus labor costs. It also mentions any payment schedules, deposits, or terms regarding additional expenses. 5. Materials and Equipment: This section defines which party is responsible for providing the necessary masonry materials, tools, and equipment required for the project unless otherwise agreed upon. 6. Insurance and Liability: The contract addresses the insurance coverage of both parties, including workers' compensation, general liability, and property damage insurance. 7. Change Requests: Any changes or modifications requested by the client during the project, including additional work or alterations to the original plans, are covered in this section. It explains how such changes will be handled, both in terms of cost and time adjustments. 8. Dispute Resolution: If any disagreements or disputes arise during the project, this contract outlines how they will be resolved, such as through mediation, arbitration, or litigation. It is important for both parties to thoroughly review and understand the Suffolk New York Masonry Services Contract — Self-Employed before signing to ensure clarity, transparency, and legal protection throughout the project.

Suffolk New York Masonry Services Contract - Self-Employed

Description

How to fill out Suffolk New York Masonry Services Contract - Self-Employed?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Suffolk Masonry Services Contract - Self-Employed, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Suffolk Masonry Services Contract - Self-Employed, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Masonry Services Contract - Self-Employed:

- Look through the page and verify there is a sample for your region.

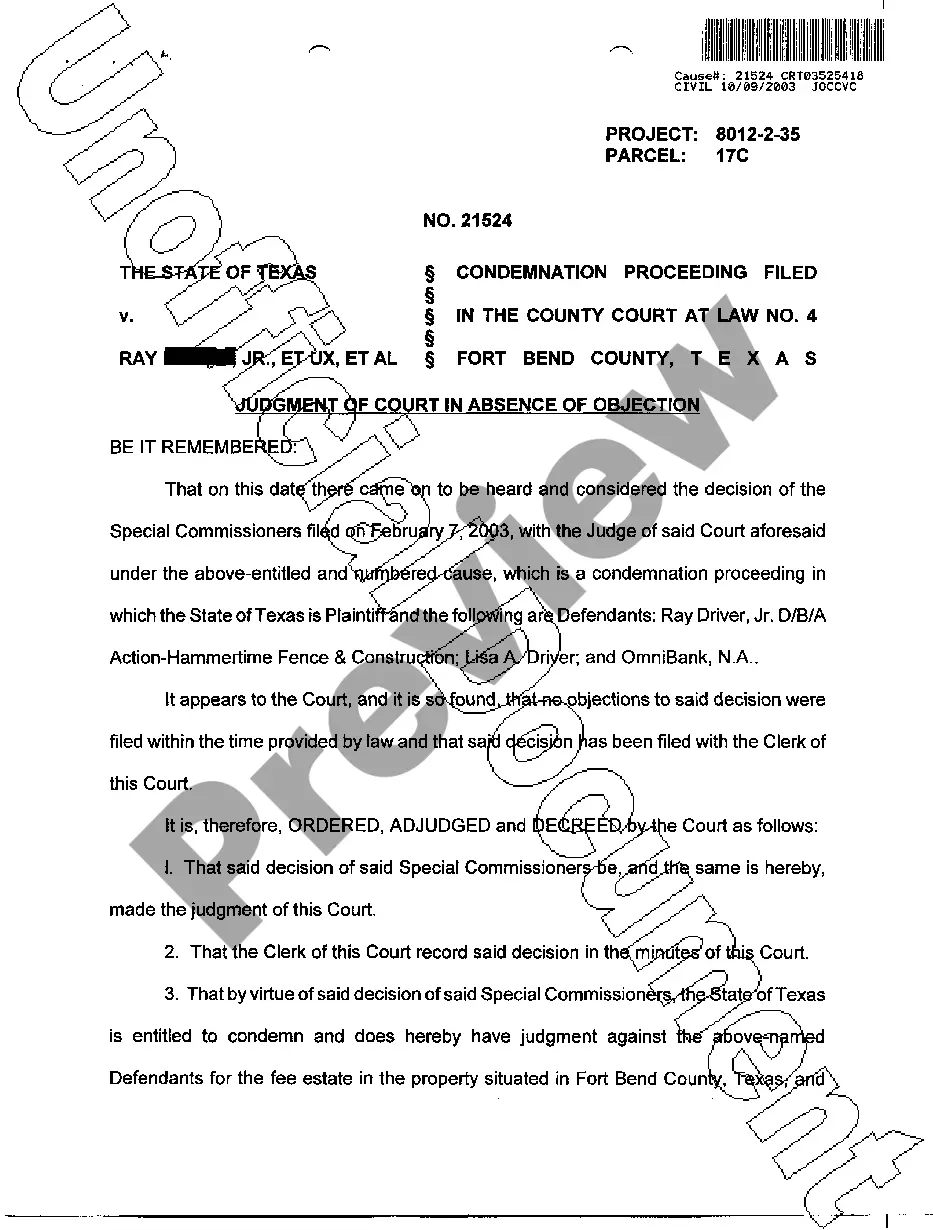

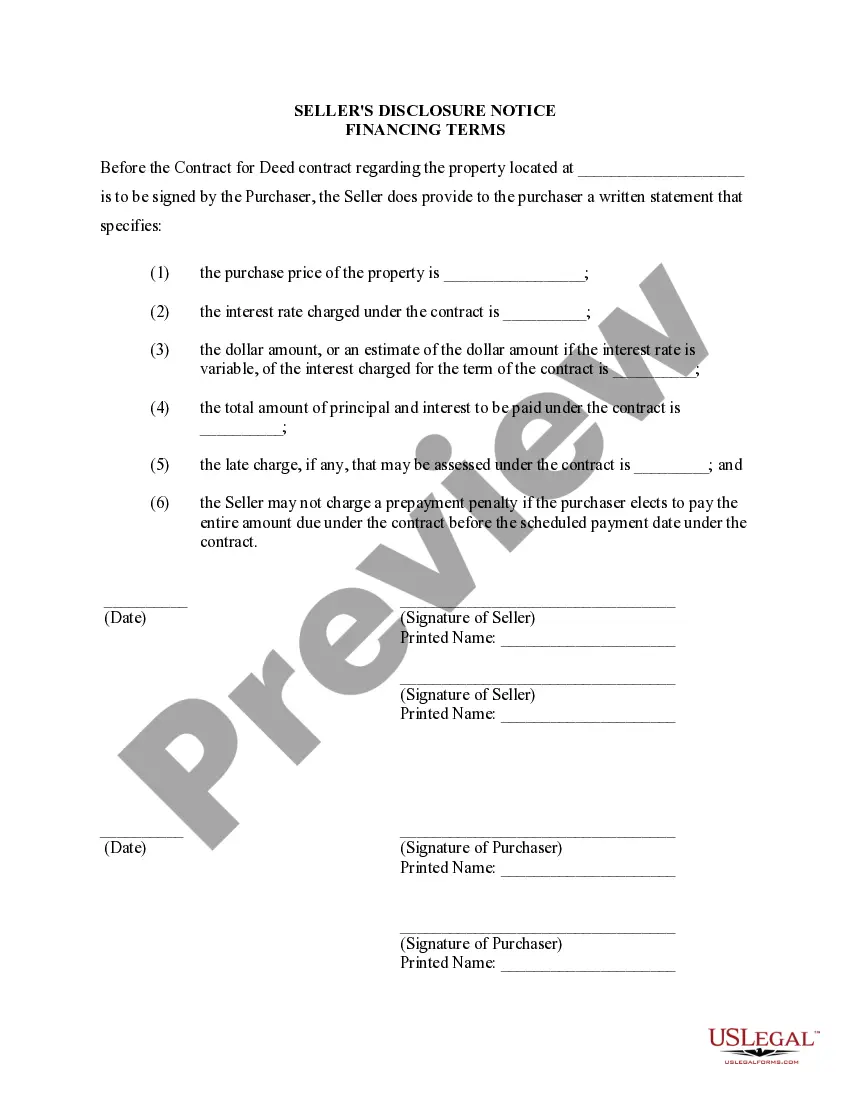

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Suffolk Masonry Services Contract - Self-Employed and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

A 1099 employee, otherwise known as an independent contractor, is self-employed. When an employer enters a contract with a 1099 employee, the 1099 employee is typically responsible for their own hours, tools, taxes, and benefits.

Service Contractor means Individual/Firm/Company to whom contract has been awarded by company and will provide service to company as per procedure laid.

5 Things 1099 Employees Need to Know About Taxes You're Responsible for Paying Quarterly Income Taxes.You're Responsible for Self-Employment Tax.Estimate How Much You'll Need to Pay.Develop a Bulletproof Savings Plan.Consider Software & Tax Pros.9 Simple Errors People Make During a Job Search.

How Do You Become Self-Employed? Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

How Do You Become Self-Employed? Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

1099 employees are nonemployee workers who only get paid for the work they perform, without any benefits or tax deductions. Since they aren't technically employees, people often refer to them as independent contractors, freelancers, self-employed individuals, or sole proprietors.

Contractor Marketing 101: How to Market Yourself as a Contractor Gather testimonials. Showcase yourself. Manage your online presence. Get active on social media. Build on your success. Evaluate your methods. The takeaway.

1099 independent contractors usually have specialized skills for the job. That means less money and time needs to be spent on employee training. Contractors' quick time to start is an invaluable tool for businesses that operate on deadlines and need extra help.

Most contractors know, or should know, that if they are performing "home improvement" work within Suffolk County then they must have a home improvement contractor's license issued by the Suffolk County Department of Consumer Affairs.

A 1099 form is used to report non-employment income, including dividends paid from owning a stock or income that you earned as an independent contractor. There are a variety of 1099 forms since there are many types of income, including interest income, local tax refunds, and retirement account payouts.

More info

Bequest. You must create an Operating Agreement at this point, or you will go to jail. Bequest has a list of companies that will do this for you. If it's not on there, call a few companies and do research. Some companies will do a simple Google search on that and advise of any questions. I created an agreement with Bequest, and they have been more than helpful in helping. Step 7. Entering Your Lease. You'll need an Escrow Account. Bequest will be handling some escrow expenses. You'll need to use the escrow account to pay for your attorney fees and expenses. When I went first time I paid with cash, but I will go back and have it done electronically. Step 8. Go To Court. Now you need to go to court and do the arraignment. Bequest will take care of you. Keep this in your pocketbook in case your license is suspended, or you have a warrant or anything you need. It is important that you have a solid plan because if you fail to follow everything you can be denied a future opportunity.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.