King Washington Fire Protection Service Contract - Self-Employed

Description

How to fill out King Washington Fire Protection Service Contract - Self-Employed?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like King Fire Protection Service Contract - Self-Employed is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the King Fire Protection Service Contract - Self-Employed. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

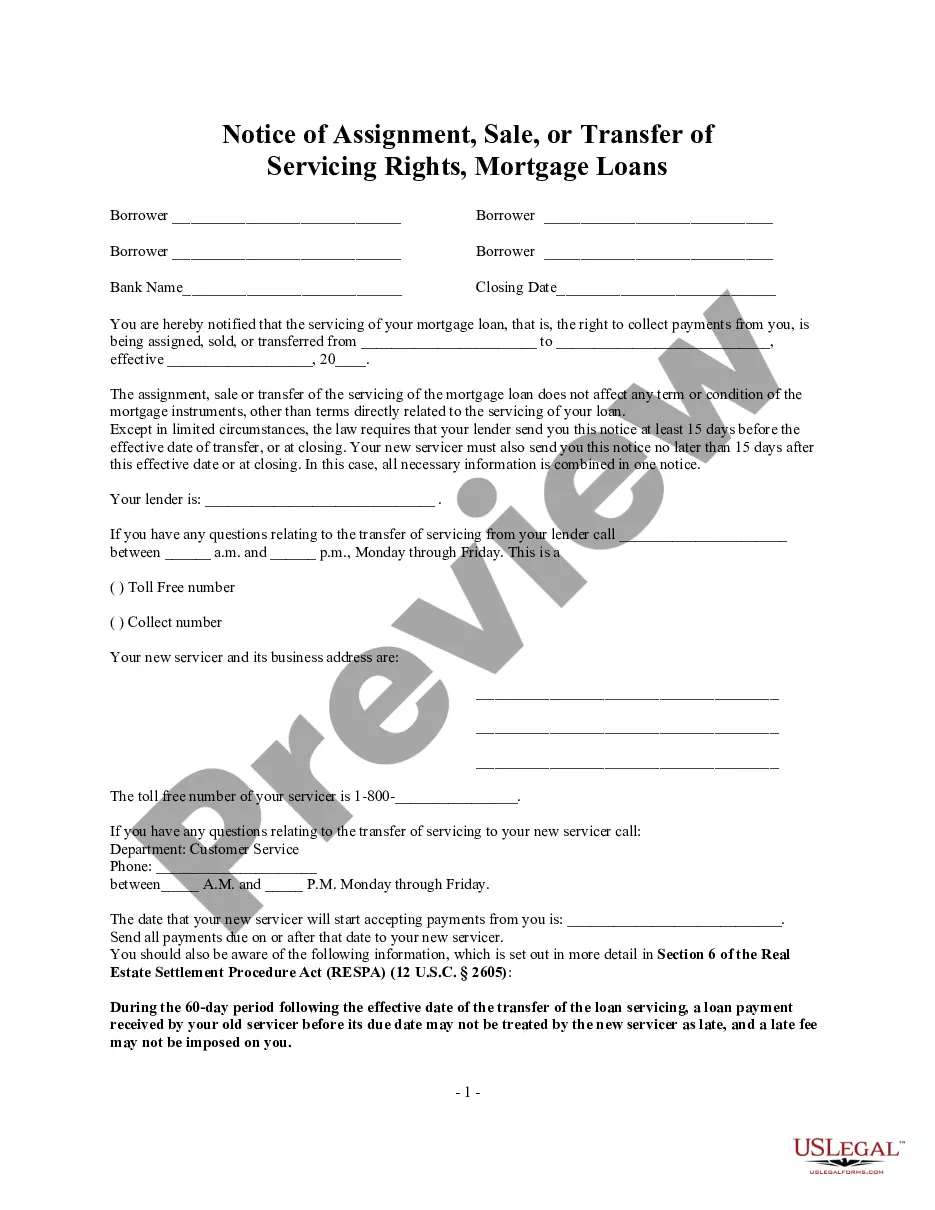

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the King Fire Protection Service Contract - Self-Employed in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

What tax forms are needed for an independent contractor to be hired? IRS Tax Form W-9. A W-9 form is used by a company to request a contractor's taxpayer identification number (TIN).IRS Tax Form 1099-NEC.IRS Tax Form 1096.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Even if the contractor doesn't show up for work, you have to document the termination by sending a written notice specifying the reason for termination without defaming the contractor. Also, in cases where a bank or escrow company is involved in the project, make sure to inform it of the termination.

Perlman When dealing with independent contractors, companies shouldn't discipline them the same way they would an employee. Instead, the remedy for an independent contractor not complying with company expectations is to terminate or consider terminating the contract.

Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

The short answer is no. You can't fire a contractor like you would an employee because they are self-employed, not your employee. But you can terminate your relationship if the worker fails to deliver according to the terms of your contractif you have one.

Instead, ending a contractor relationship involves terminating the professional services agreement and statement of work between your company and the contractor. For this reason, as long as you have correctly classified your independent contractor, labor laws do not apply to your relationship with this individual.

Obtain a business license at your city or county clerk's office, and inquire about additional permits. Contact your state Department of Revenue to determine if your service business must pay sales taxes. Determine your firefighting services and markets. Select a strategy that drives your business operations.

To ensure you're protected from start to finish, always follow these protocols before you hire. Get Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.