Travis Texas Fence Contractor Agreement — Self-Employed is a legally binding contract that governs the relationship between a self-employed fence contractor and their clients in Travis County, Texas. This agreement outlines the terms and conditions under which the fence contractor will provide services such as installing, repairing, or maintaining fences for residential or commercial properties in Travis County. The Travis Texas Fence Contractor Agreement — Self-Employed includes important provisions that protect both parties involved. These provisions cover various aspects, including but not limited to: 1. Scope of Work: The agreement specifies the specific types of fencing services the contractor will provide, such as wooden fence installation, chain-link fence repair, or vinyl fence maintenance. 2. Compensation: The contract details the agreed-upon payment structure, including the contractor's hourly rate, fixed project fees, or any other mutually agreed-upon compensation method. 3. Duration of Agreement: The agreement defines the start and end dates, outlining whether it is valid for a fixed period or until the completion of the services. 4. Materials and Equipment: If the contractor is responsible for providing the necessary materials and equipment, the agreement should specify the types and quality of materials, as well as any additional charges for their usage. 5. Liability and Insurance: This section outlines the contractor's liability for damages or injuries that may occur during the provision of services, as well as the insurance coverage required for the contractor to undertake the work. 6. Termination: The agreement outlines the grounds for termination by either party, whether due to non-performance, breach of contract, or other valid reasons. It's important to note that variations of the Travis Texas Fence Contractor Agreement — Self-Employed may exist, tailored to specific subcategories of fence contractors, such as agricultural fence installation or industrial fence repair. These variations may include additional clauses or specifications relevant to the specific type of fencing work being performed. In conclusion, the Travis Texas Fence Contractor Agreement — Self-Employed is a comprehensive contract that safeguards the interests of both the fence contractor and their clients. This legally binding document ensures clear communication, defines the rights, responsibilities, and expectations of all parties involved, and establishes a framework for a successful and mutually beneficial working relationship.

Travis Texas Fence Contractor Agreement - Self-Employed

Description

How to fill out Travis Texas Fence Contractor Agreement - Self-Employed?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Travis Fence Contractor Agreement - Self-Employed is fast and simple.

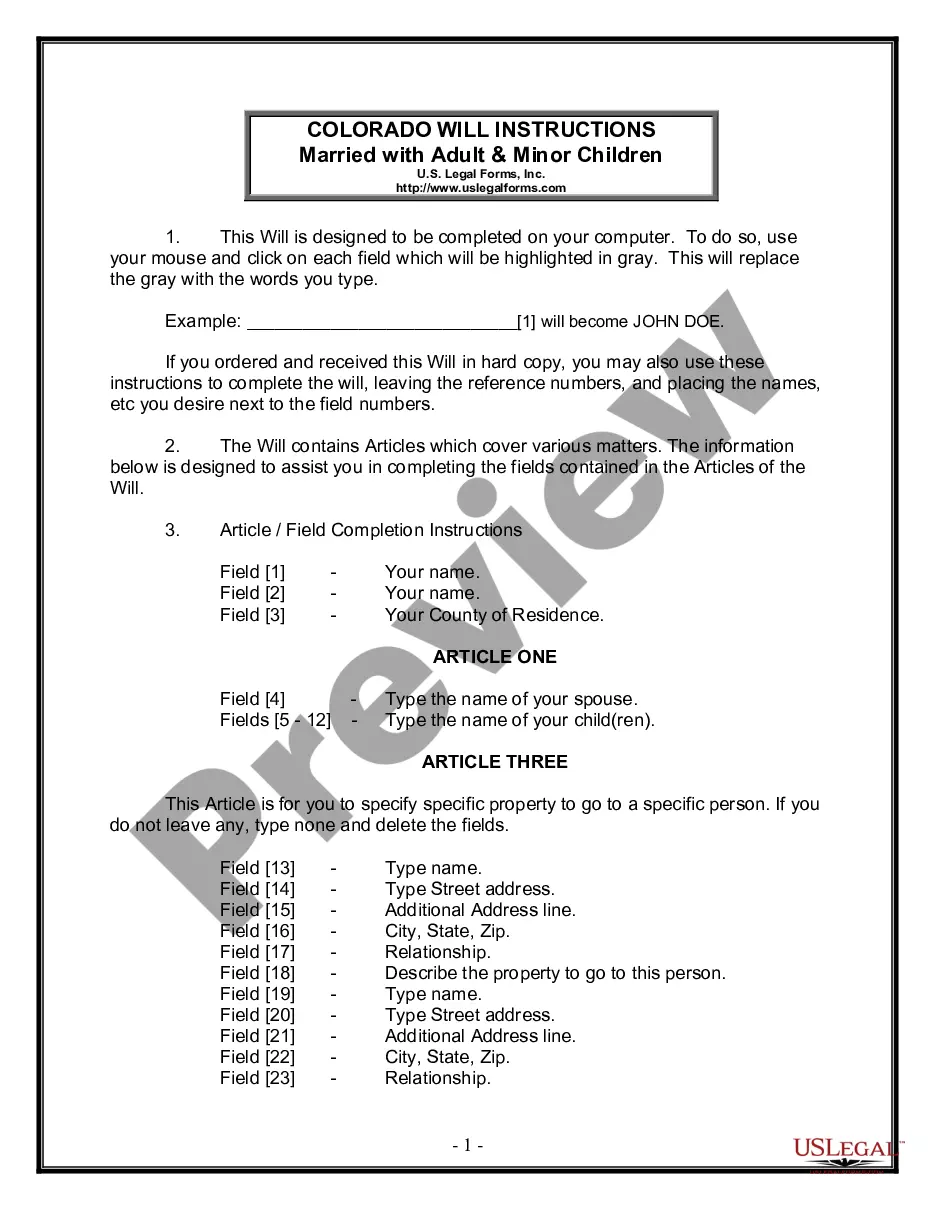

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Travis Fence Contractor Agreement - Self-Employed. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Travis Fence Contractor Agreement - Self-Employed in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Contractors run their own business and sell their services to others, unlike employees who work in someone else's business. Contractors sometimes called independent contractors, sub-contractors or subbies generally use their own processes, tools and methods to complete the work.

The main difference between a sole proprietor and an independent contractor is the way compensation is reported. A sole proprietor must track their own business expenses, while an independent contractor will receive a 1099 form that outlines the income earned during the previous calendar year.

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

An employee works in your business and is part of your business. A contractor is running their own business.

In the eyes of the law, a worker is either an independent contractor or an employee. However, an independent contractor is not a type of business entity. Business entity types include partnerships, sole proprietorships, corporations, and LLCs.

Both independent contractors and sole proprietors are self-employed business owners. They both keep track of business income and expenses; they both file income taxes using Schedule C (unless a different business type is chosen), and both pay self-employment taxes on their business income..

Write the contract in six steps Start with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

As a contractor, you can be an individual (sole trader) or working in your own company, partnership, or trust. You might even call yourself an independent contractor, sub-contractor or a 'subbie'. Contractors have different tax and super obligations to employees.

There are a number of advantages to being a contractor. Contract work provides greater independence and, for many people, a greater perceived level of job security than traditional employment. Less commuting, fewer meetings, less office politics and you can work the hours that suit you and your lifestyle best.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.