Collin Texas Industrial Contractor Agreement - Self-Employed

Description

How to fill out Industrial Contractor Agreement - Self-Employed?

Drafting legal paperwork can be laborious. Furthermore, if you opt to hire a lawyer to create a business agreement, documentation for asset transfer, prenuptial contract, dissolution papers, or the Collin Industrial Contractor Agreement - Self-Employed, it might set you back a significant amount. So, what is the most sensible method to conserve both time and expense while generating authentic documents in full adherence to your state and municipal laws.

US Legal Forms is a fantastic option, whether you're looking for templates for personal or commercial purposes.

- US Legal Forms constitutes the biggest online assortment of state-specific legal forms, offering users access to current and professionally vetted documents for any scenario all gathered in one location.

- Thus, if you need the latest iteration of the Collin Industrial Contractor Agreement - Self-Employed, you can easily find it on our site.

- Acquiring the documents takes minimal time.

- Those who already possess an account should verify their subscription is active, Log In, and choose the template with the Download button.

- If you haven't signed up yet, here's how to obtain the Collin Industrial Contractor Agreement - Self-Employed.

- Browse through the site and confirm there is a template for your area.

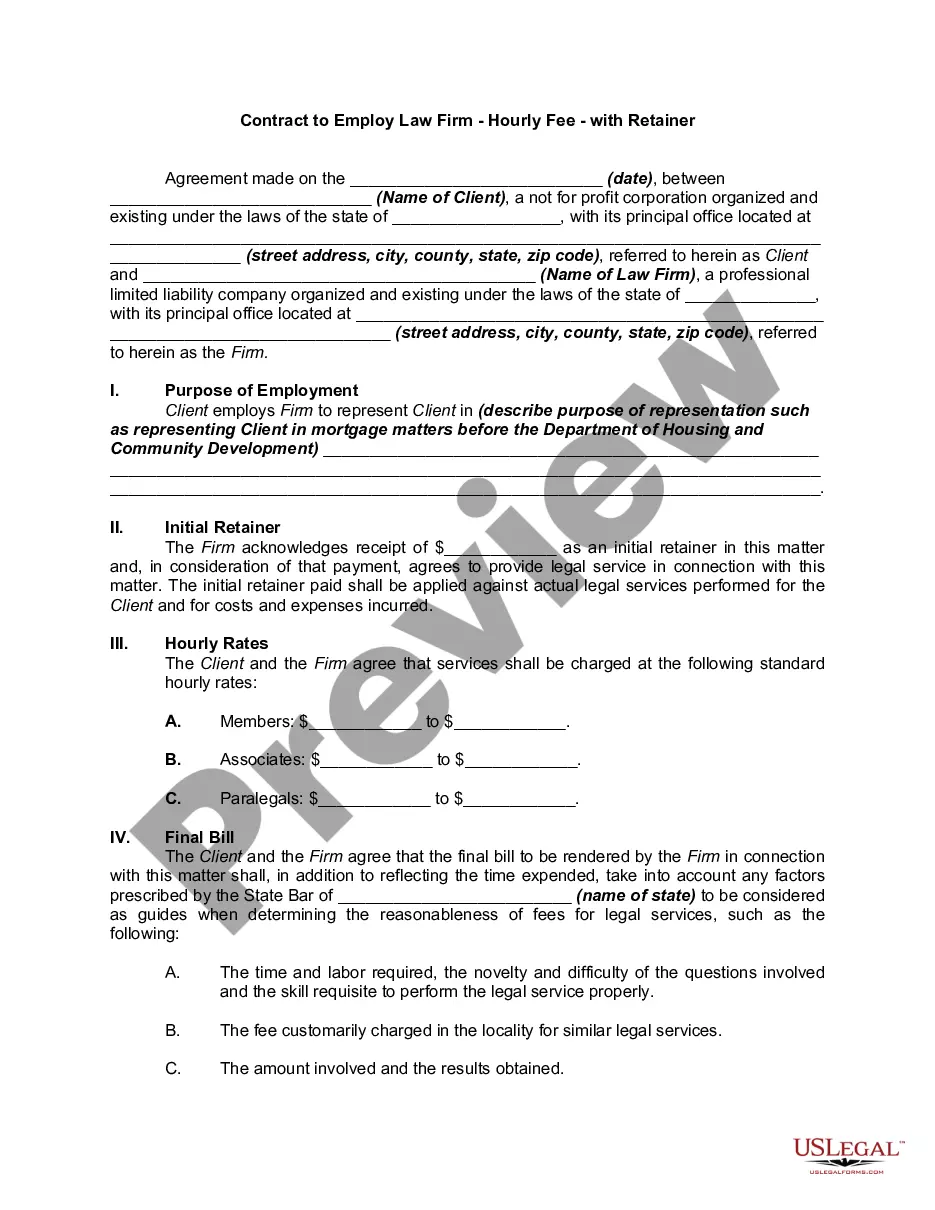

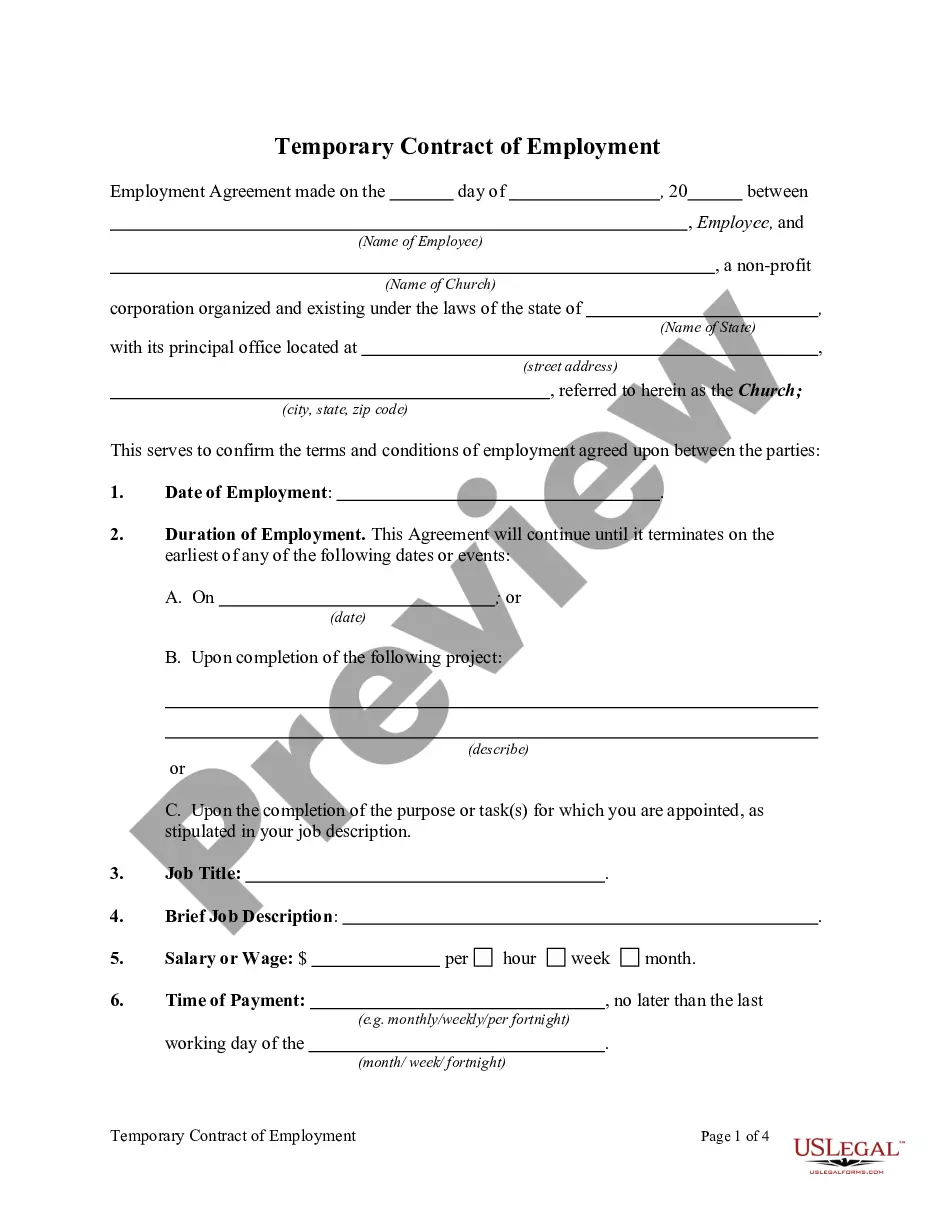

- Review the form description and utilize the Preview option, if available, to ensure it's the template you seek.

- Don’t fret if the form doesn’t meet your needs - look for the suitable one in the header.

- Press Buy Now once you discover the required sample and select the most appropriate subscription.

- Log in or create an account to acquire your subscription.

- Make a payment using a credit card or via PayPal.

- Select the document format for your Collin Industrial Contractor Agreement - Self-Employed and download it.

- When completed, you can print it out and fill it in manually or transfer the samples to an online editor for quicker and more convenient completion.

- US Legal Forms enables you to utilize all the documents you’ve ever obtained multiple times - you can locate your templates in the My documents tab in your account. Give it a go now!

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

What Should Be in a Construction Contract? Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.

How Do You Become Self-Employed? Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

The simple answer is YES. You can write your own contracts. There is no requirement that they must be written by a lawyer. There is no requirement that they have to be a certain form or font.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

So let's look at those three contract types in a bit more detail. Fixed price contracts. With a fixed price contract the buyer (that's you) doesn't take on much risk.Cost-reimbursable contracts. With a cost-reimbursable contract you pay the vendor for the actual cost of the work.Time and materials contracts.