Travis Texas Industrial Contractor Agreement — Self-Employed is a legally binding document that outlines the terms and conditions between a contractor and an industrial company based in Travis County, Texas. This agreement serves as a safeguard for both parties involved, ensuring clear expectations and a solid foundation for their working relationship. The Travis Texas Industrial Contractor Agreement — Self-Employed is designed specifically for independent contractors who specialize in industrial services. It provides a framework to regulate important aspects of the contracting arrangement, such as project scope, compensation, deliverables, and duration of the agreement. Here are some relevant keywords related to the Travis Texas Industrial Contractor Agreement — Self-Employed: 1. Travis County, Texas: The agreement is geographically associated with Travis County, Texas, which holds significance as the location where the industrial services will be provided. 2. Industrial Contractor: The agreement is tailored for contractors who offer specialized services in the industrial sector. This may include construction, manufacturing, maintenance, or any other industry-related activities. 3. Self-Employed: The agreement applies to individuals who operate as independent contractors, allowing them to work on a self-employed basis rather than being an employee of the industrial company. 4. Terms and Conditions: The agreement clearly defines the terms and conditions under which the contractor will provide their services, ensuring both parties are aware of their rights and obligations. 5. Project Scope: The agreement outlines the specific tasks, responsibilities, and objectives that the contractor will be accountable for throughout the duration of the project. 6. Compensation: This section details how the contractor will be remunerated for their services, covering aspects such as hourly rates, fixed fees, payment schedule, and any additional expenses. 7. Deliverables: The agreement specifies the expected deliverables and milestones that the contractor must meet during the project. It ensures that both parties have a clear understanding of the desired outcomes. 8. Duration of Agreement: This section defines the start and end date of the agreement, establishing the timeframe within which the contractor will provide their services. There may be various types of Travis Texas Industrial Contractor Agreement — Self-Employed, each customized to suit different industrial sectors. For instance, there could be agreements specifically designed for construction contractors, maintenance contractors, or equipment installation contractors. These specialized agreements would address the unique requirements and challenges associated with each respective area of expertise. Ultimately, the Travis Texas Industrial Contractor Agreement — Self-Employed serves as a comprehensive legal document that protects the rights and interests of both the contractor and the industrial company. By clearly defining expectations and obligations, this agreement ensures a smooth and mutually beneficial working relationship.

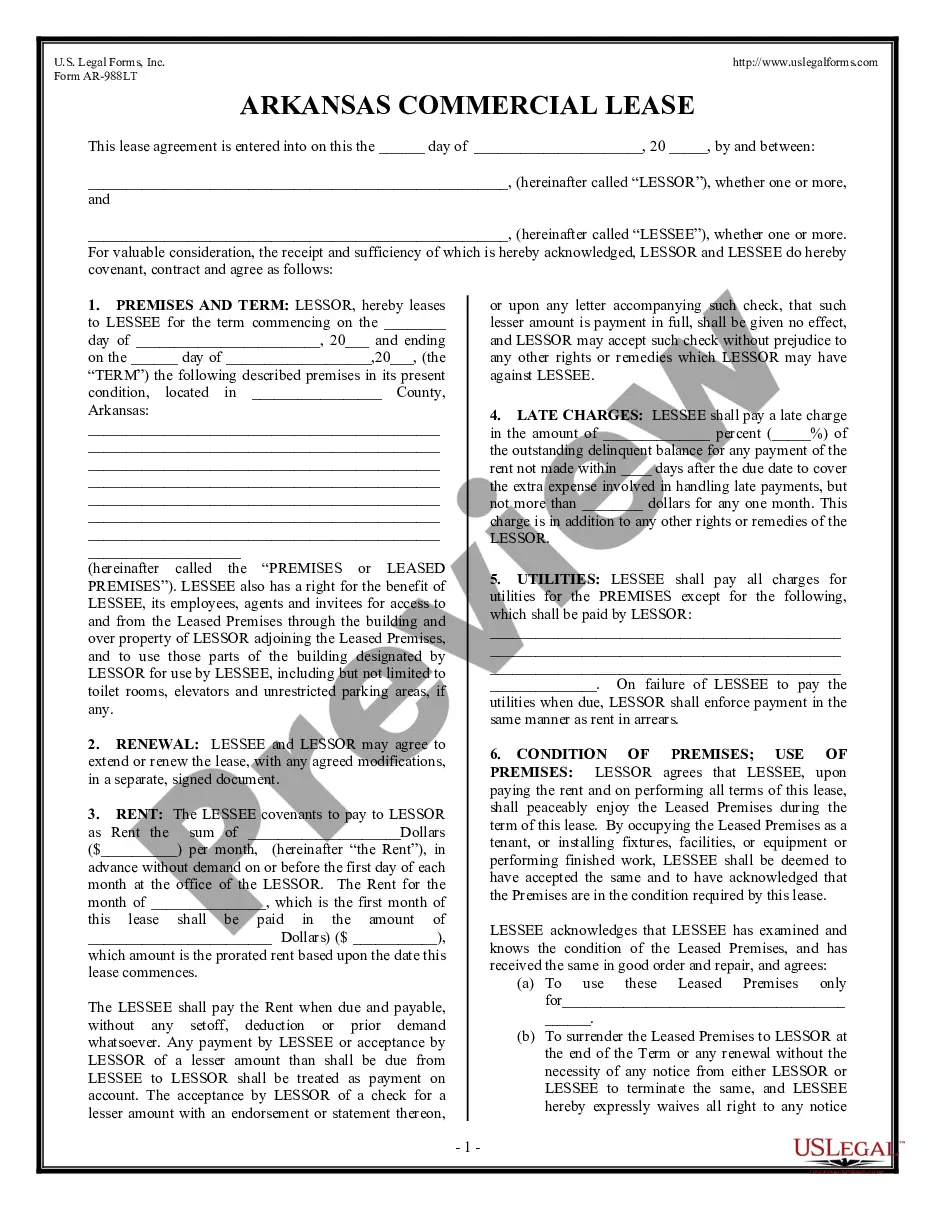

Travis Texas Industrial Contractor Agreement - Self-Employed

Description

How to fill out Travis Texas Industrial Contractor Agreement - Self-Employed?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Travis Industrial Contractor Agreement - Self-Employed, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the recent version of the Travis Industrial Contractor Agreement - Self-Employed, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Travis Industrial Contractor Agreement - Self-Employed:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Travis Industrial Contractor Agreement - Self-Employed and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Ten Tips for Making Solid Business Agreements and Contracts Get it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How Do You Become Self-Employed? Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

As a contractor, this is most likely you. This means that you run your own business as an individual and you are self-employed. Being a sole trader gives you both complete control and responsibility. Your business assets and liabilities are not separate from your personal ones.

The contract itself must include the following: Offer. Acceptance. Consideration. Parties who have the legal capacity. Lawful subject matter. Mutual agreement among both parties. Mutual understanding of the obligation.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

How to write an employment contract Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.