San Diego California Foundation Contractor Agreement - Self-Employed

Description

How to fill out Foundation Contractor Agreement - Self-Employed?

Drafting paperwork for business or personal requirements is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it is crucial to consider all federal and state laws relevant to the specific region.

Nevertheless, minor counties and even municipalities have legislative rules that must also be taken into account.

Join the platform and effortlessly acquire verified legal documents for any circumstance with just a few clicks!

- These factors contribute to the pressure and duration it takes to produce a San Diego Foundation Contractor Agreement - Self-Employed without expert assistance.

- It's simple to bypass expenses related to attorneys drafting your papers and create a binding San Diego Foundation Contractor Agreement - Self-Employed independently, utilizing the US Legal Forms online catalog.

- It is the premier online repository of state-specific legal forms that are professionally reviewed, ensuring their reliability when selecting a template for your county.

- Prior subscribers merely need to Log In to their accounts to retrieve the necessary document.

- If you do not yet possess a subscription, follow the detailed instructions below to acquire the San Diego Foundation Contractor Agreement - Self-Employed.

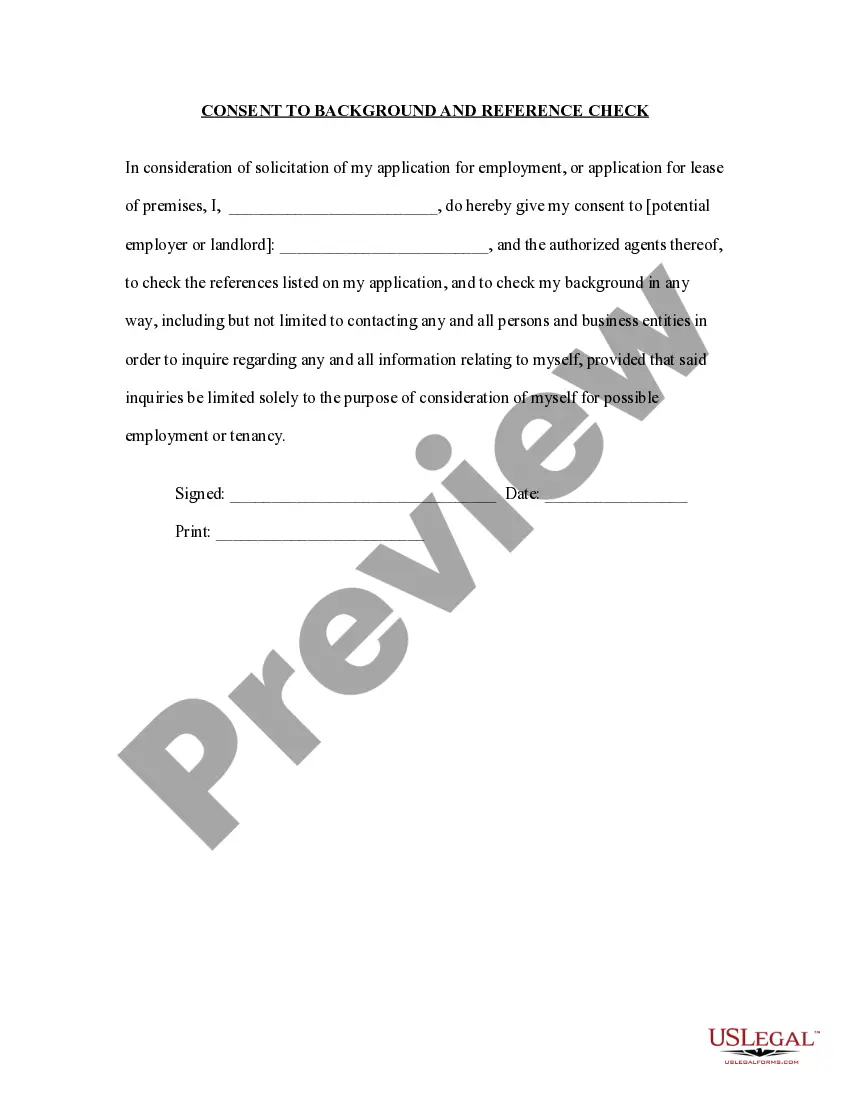

- Inspect the webpage you have accessed and confirm it contains the document you seek.

- To do so, utilize the form description and preview if these features are present.

Form popularity

FAQ

Generally, to be legally valid, most contracts must contain two elements: All parties must agree about an offer made by one party and accepted by the other. Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

An independent contractor (1099) offer letter is between a client (employer) that hires a contractor to perform a service for payment. The scope of work should be included in the offer letter along with the rates for providing the service.

A California Independent Contractor Agreement is a contract between an independent contractor and a client where the client hires an individual or an organization in the state of California.

There are a number of advantages to being a contractor. Contract work provides greater independence and, for many people, a greater perceived level of job security than traditional employment. Less commuting, fewer meetings, less office politics ? and you can work the hours that suit you and your lifestyle best.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

You are typically considered an independent contractor if: you determine what work you perform, where you perform it and how it's performed; you decide whether you want to subcontract the work to other independent contractors; and. you have the opportunity to make a profit (or loss) in your own personal capacity.

A person is required to come into an agreement (known as Independent Contractor Agreement and/or ICA) if he is appointed as an independent contractor with the company, being the other party. This ICA recognises the rights, duties, obligations, services of the contractor, etc.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Filing taxes as an independent contractor in Canada As an independent contractor, you include all of your revenue as income on your personal tax return every April. However, as indicated above, you claim independent contractor tax deductions to reduce your taxable income and your tax bill!