Bronx New York Government Contractor Agreement — Self-Employed: The Bronx, located in New York City, has a robust government contracting industry for self-employed individuals. The Bronx government contractor agreement is a legally binding document that outlines the terms and conditions between a self-employed individual and the government entity they will be working for. This agreement is crucial to ensure both parties are on the same page and protect their rights during the duration of the contract. The Bronx government contractor agreement — self-employed, typically covers various aspects required in government contracting engagements. It establishes the scope of work, payment terms, project timelines, deliverables, and other essential details. Apart from general terms, several types of government contractor agreements can be found in the Bronx, tailoring to different self-employed professionals. These include: 1. Construction Contractor Agreement: This type of agreement is specifically designed for self-employed individuals providing construction-related services to the Bronx government. It includes provisions for permits, plans, specifications, insurance requirements, change orders, and other construction-specific considerations. 2. Consulting Contractor Agreement: Self-employed consultants in the Bronx can utilize this agreement when offering their specialized services to the government. It typically covers tasks such as research, analysis, assessment, recommendations, and project management specific to the consulting field. 3. IT Contractor Agreement: With the technology-driven nature of modern government operations, self-employed IT professionals can enter into an IT contractor agreement. It governs responsibilities related to software development, hardware installation, system maintenance, data security, and IT support. 4. Professional Services Contractor Agreement: Professionals like attorneys, accountants, engineers, and architects can establish a professional services contractor agreement. This document outlines the specific services they will provide to the government, ensuring compliance with regulations and quality standards. 5. Maintenance Contractor Agreement: This type of agreement is essential for self-employed individuals providing maintenance and repair services to Bronx government entities. It covers responsibilities related to routine inspections, repairs, replacement, and overall maintenance of various government facilities and equipment. These are just a few examples of the different types of Bronx New York government contractor agreements available to self-employed individuals. Each agreement is tailored to the specific requirements and regulations pertaining to different industries and fields within the government sector. It is important for contractors to carefully review and understand the terms and conditions of these agreements before entering into any government contracting engagements.

Bronx New York Government Contractor Agreement - Self-Employed

Description

How to fill out Bronx New York Government Contractor Agreement - Self-Employed?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business case. All files are collected by state and area of use, so picking a copy like Bronx Government Contractor Agreement - Self-Employed is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to get the Bronx Government Contractor Agreement - Self-Employed. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

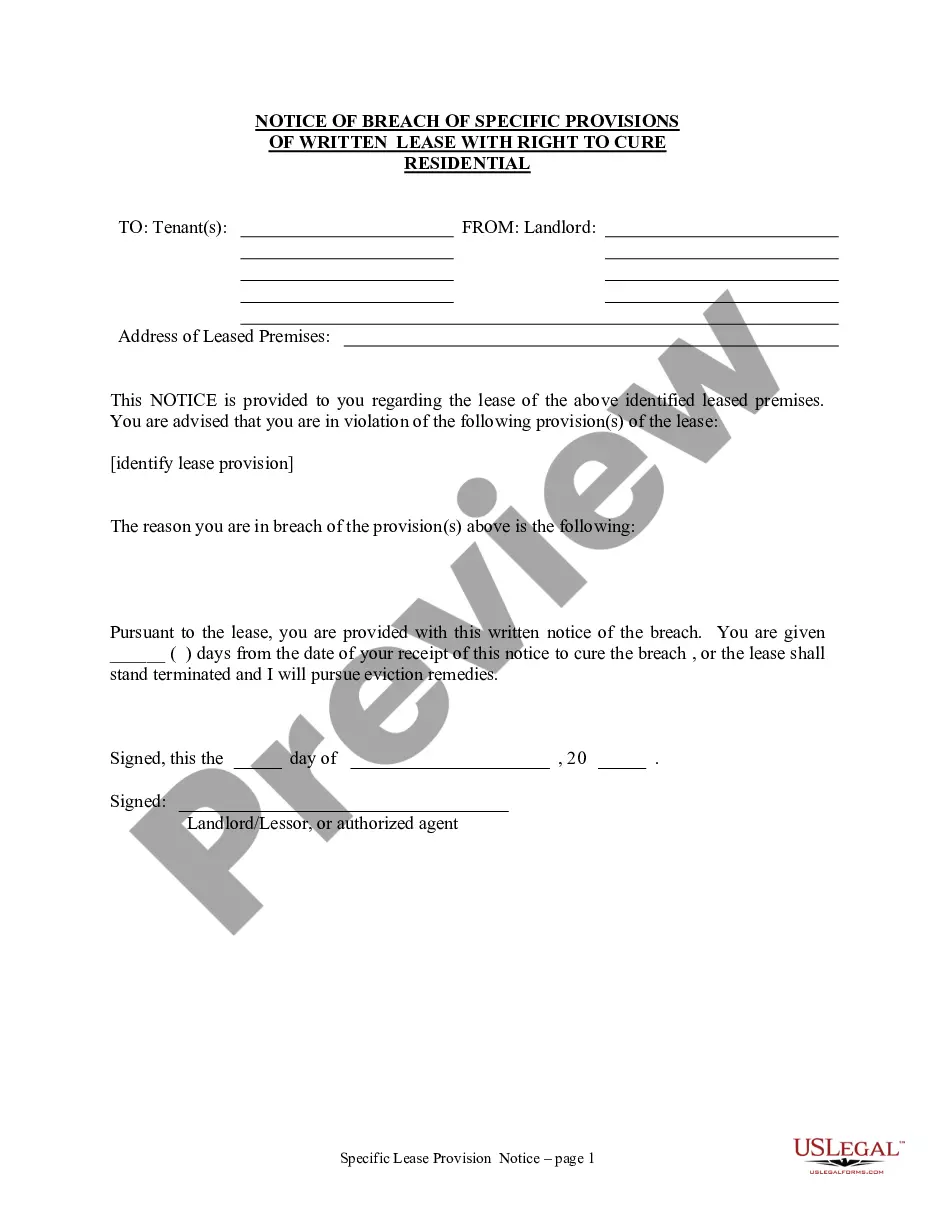

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bronx Government Contractor Agreement - Self-Employed in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

By definition, a contractor is an individual who works for someone else (individual or company) as a non-employee. It's also a way of being self-employed. However, while a contractor may be self-employed, a self-employed person might not be an independent contractor.

You may discover that by law they are considered employees and that you are liable for unemployment insurance contributions and interest. Whether the relationship is one of employer-employee will depend on several factors. These include how much supervision, direction, and control you have over the services.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

If you received a 1099 form instead of a W-2 , then the payer of your income did not consider you an employee and did not withhold federal income tax or Social Security and Medicare tax. A 1099-MISC or NEC means that you are classified as an independent contractor and independent contractors are self-employed.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The IRS says that someone is self-employed if they meet one of these conditions: Someone who carries on a trade or business as a sole proprietor or independent contractor, A member of a partnership that carries on a trade or business, or. Someone who is otherwise in business for themselves, including part-time business