The Dallas Texas Educator Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between an educator and an educational institution or organization in Dallas, Texas. This agreement is specifically designed for educators who work as self-employed independent contractors, providing services such as tutoring, teaching, or consulting. The Dallas Texas Educator Agreement — Self-Employed Independent Contractor covers various important aspects of the working relationship between the educator and the educational institution. It outlines the responsibilities and obligations of both parties, ensuring clarity and preventing any misunderstanding. The agreement typically includes the following key elements: 1. Scope of Services: This section specifies the nature of the services to be provided by the educator, whether it is teaching specific subjects, providing tutoring assistance, conducting workshops or seminars, or any other educational-related services. 2. Compensation: The agreement defines the compensation structure, including the payment terms, rates, and any additional reimbursements or benefits the educator may be entitled to. It may also outline any penalties or deductions in case of non-compliance with the agreement. 3. Working Schedule: This section details the working hours, days of the week, and duration of the contract. It may also outline any specific time frames or deadlines for completing projects or delivering services. 4. Intellectual Property: In some cases, the agreement may address intellectual property rights, specifying who retains ownership of any materials, curriculum, or educational resources developed during the term of the agreement. 5. Termination: This clause outlines the conditions under which either party can terminate the agreement, including notice periods, reasons for termination, and any applicable penalties or consequences. While there may not be specific types of Dallas Texas Educator Agreement — Self-Employed Independent Contractor, variations can exist depending on factors such as the educational institution, specific subject, or the length of the contract. However, regardless of the specific details, the basic framework of the agreement remains consistent, focusing on protecting both parties' rights and establishing clear expectations. In conclusion, the Dallas Texas Educator Agreement — Self-Employed Independent Contractor is a crucial document for educators and educational institutions in Dallas, Texas. It ensures a mutual understanding of the working relationship, defines the terms and conditions, and protects the rights and obligations of both parties involved.

Dallas Texas Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Dallas Texas Educator Agreement - Self-Employed Independent Contractor?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Dallas Educator Agreement - Self-Employed Independent Contractor, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Therefore, if you need the current version of the Dallas Educator Agreement - Self-Employed Independent Contractor, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Dallas Educator Agreement - Self-Employed Independent Contractor:

- Glance through the page and verify there is a sample for your region.

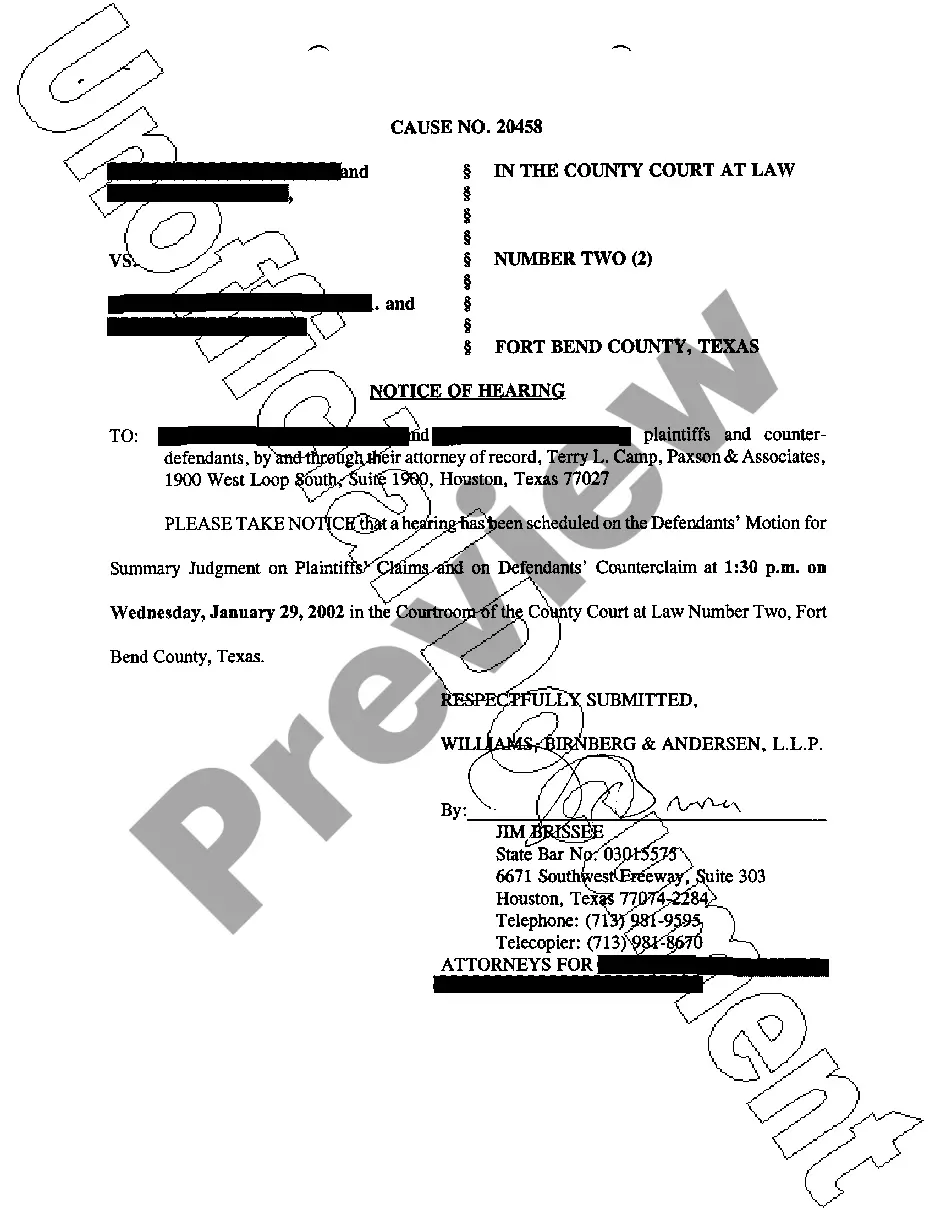

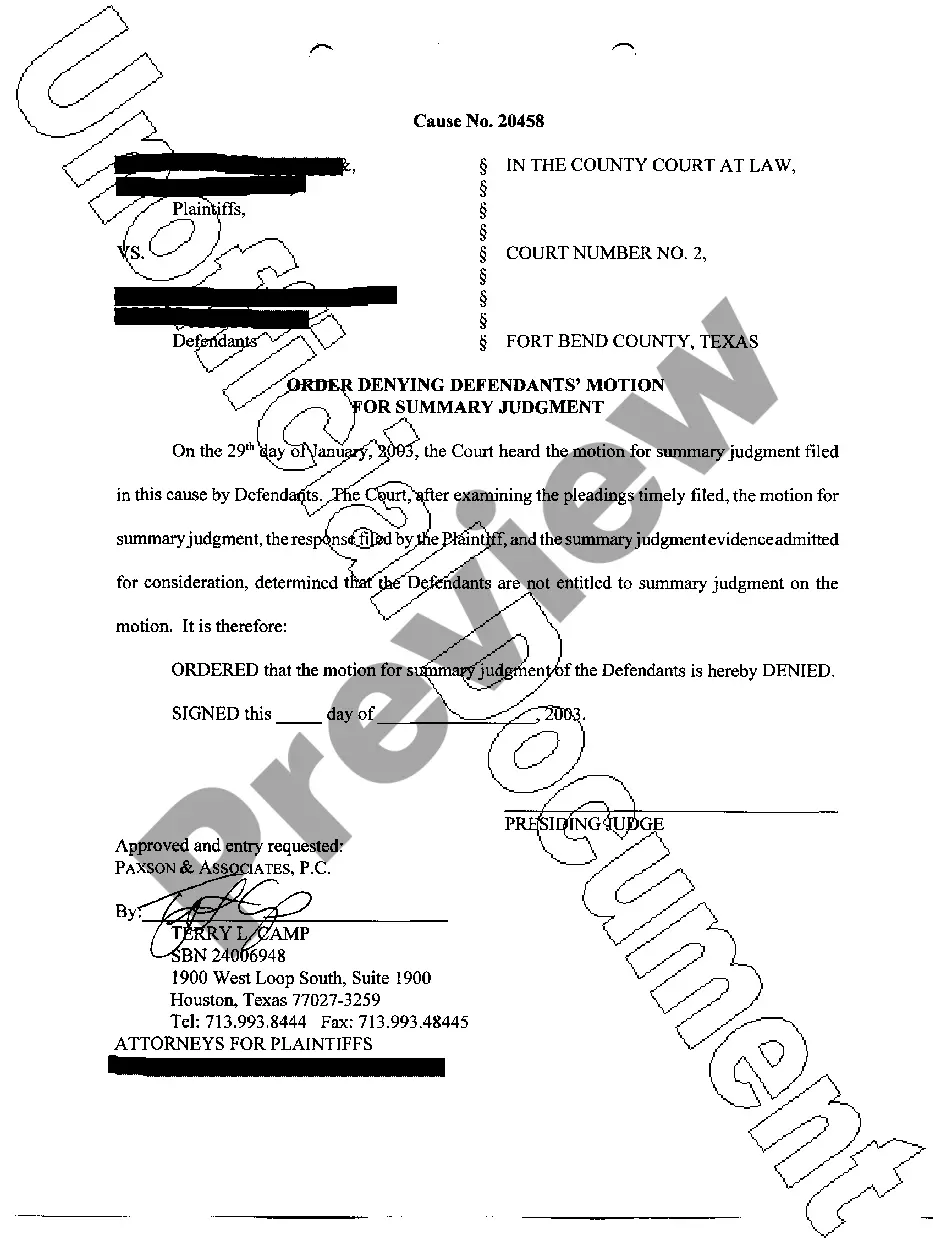

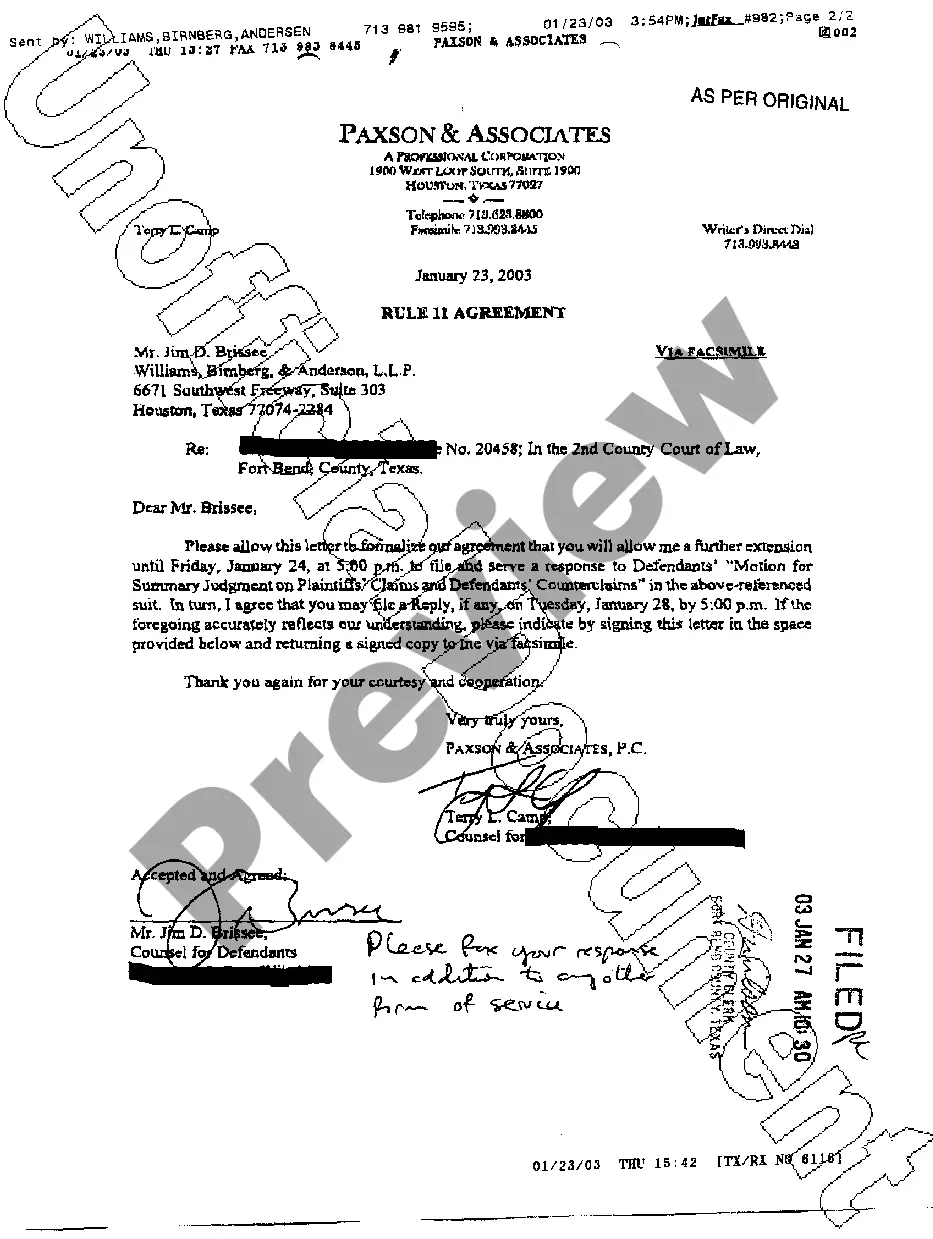

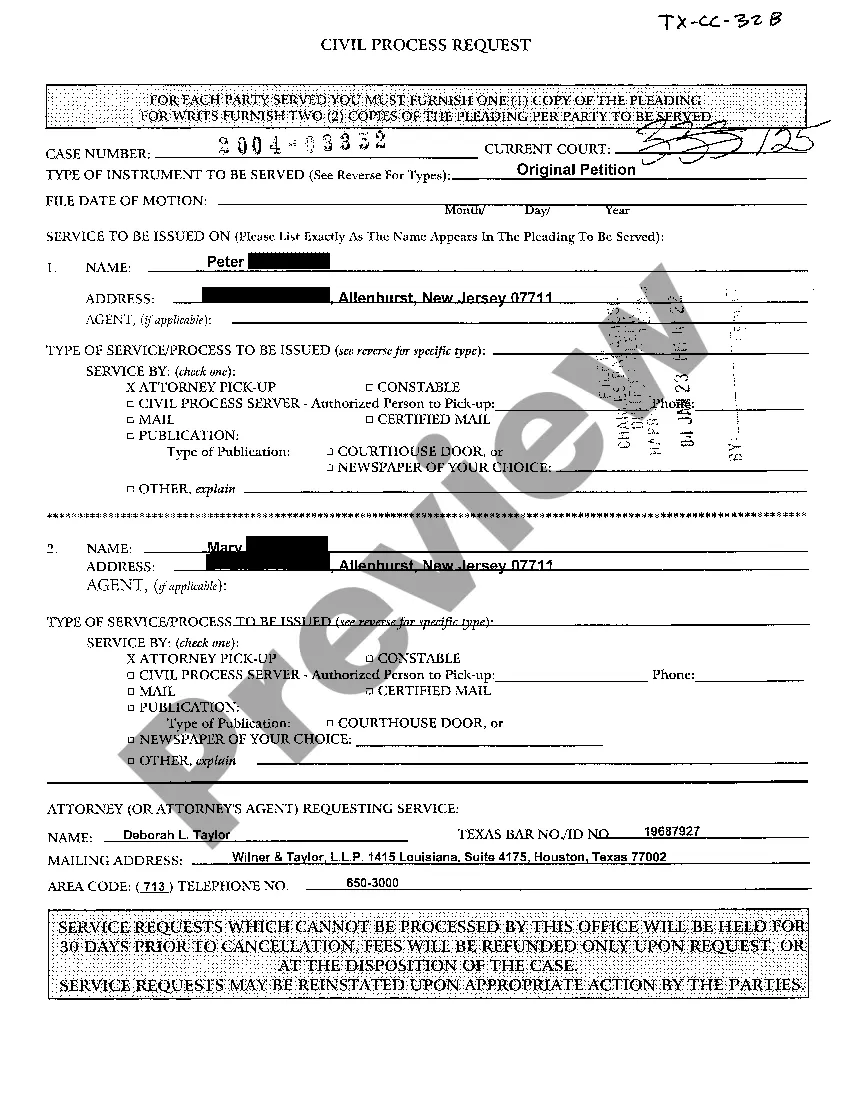

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Dallas Educator Agreement - Self-Employed Independent Contractor and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if: (a) the worker is free from control and direction in the performance of services; and. (b) the worker is performing work outside the usual course of the business of the hiring company; and.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Most clubs currently classify their coaches as independent contractors and do not pay employment taxes on payments to coaches.

Because nearly all online English teachers are classified as Independent Contractors and therefor get no taxes taken out of our paychecks as employees would, we're in charge of making payments to the IRS ourselves, usually quarterly.

What information do I need for an Independent Contractor Agreement? What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What to Include in a Contract The date the contract begins and when it expires. The names of all parties involved in the transaction. Any key terms and definitions. The products and services included in the transaction. Any payment amounts, project schedules, terms, and billing dates.

It's rare that you will find a Pilates Studio which hires instructors as employees. For the most part, you will be working as a Pilates Instructor as an Independent Contractor. There are pros and cons to working as either an employee or an independent contractor.