The Wayne Michigan Educator Agreement — Self-Employed Independent Contractor is a legal document that establishes the terms and conditions between educators and educational institutions or organizations in Wayne, Michigan, who work as self-employed independent contractors. This agreement outlines the rights and responsibilities of both parties involved, ensuring a fair and professional working relationship. Key terms such as compensation, job duties, intellectual property, confidentiality, and termination are included in this agreement to protect the interests of both the educators and the educational institutions. By clearly defining these terms, the Wayne Michigan Educator Agreement ensures that expectations are set and understood, reducing the chances of disputes or misunderstandings. There are different types of Wayne Michigan Educator Agreements — Self-Employed Independent Contractor that may vary based on the nature of the educational services provided. These may include agreements for: 1. Private Tutoring: This agreement is tailored to educators who provide one-on-one academic support or specialized tutoring services to students outside of formal educational institutions. 2. Online Education Services: With the rise of remote learning, this agreement covers educators who offer their services through online platforms, delivering lessons or courses digitally. 3. Consulting and Training: This agreement is intended for educators who work as consultants or trainers, providing expertise in specific subjects or skills to educational institutions or organizations on a project or contract basis. 4. Artistic Instruction: This agreement is designed for educators who offer artistic instruction, such as music, dance, painting, or theater, as independent contractors to educational institutions or private clients. 5. Sports Coaching: Geared towards athletic educators, this agreement governs the terms of services provided as sports coaches, trainers, or instructors to schools, sports clubs, or individual athletes. Regardless of the specific type of agreement, the purpose of the Wayne Michigan Educator Agreement — Self-Employed Independent Contractor remains the same: to establish a legally binding and mutually beneficial relationship between educators and educational institutions in Wayne, Michigan.

Wayne Michigan Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Wayne Michigan Educator Agreement - Self-Employed Independent Contractor?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Wayne Educator Agreement - Self-Employed Independent Contractor, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Consequently, if you need the current version of the Wayne Educator Agreement - Self-Employed Independent Contractor, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wayne Educator Agreement - Self-Employed Independent Contractor:

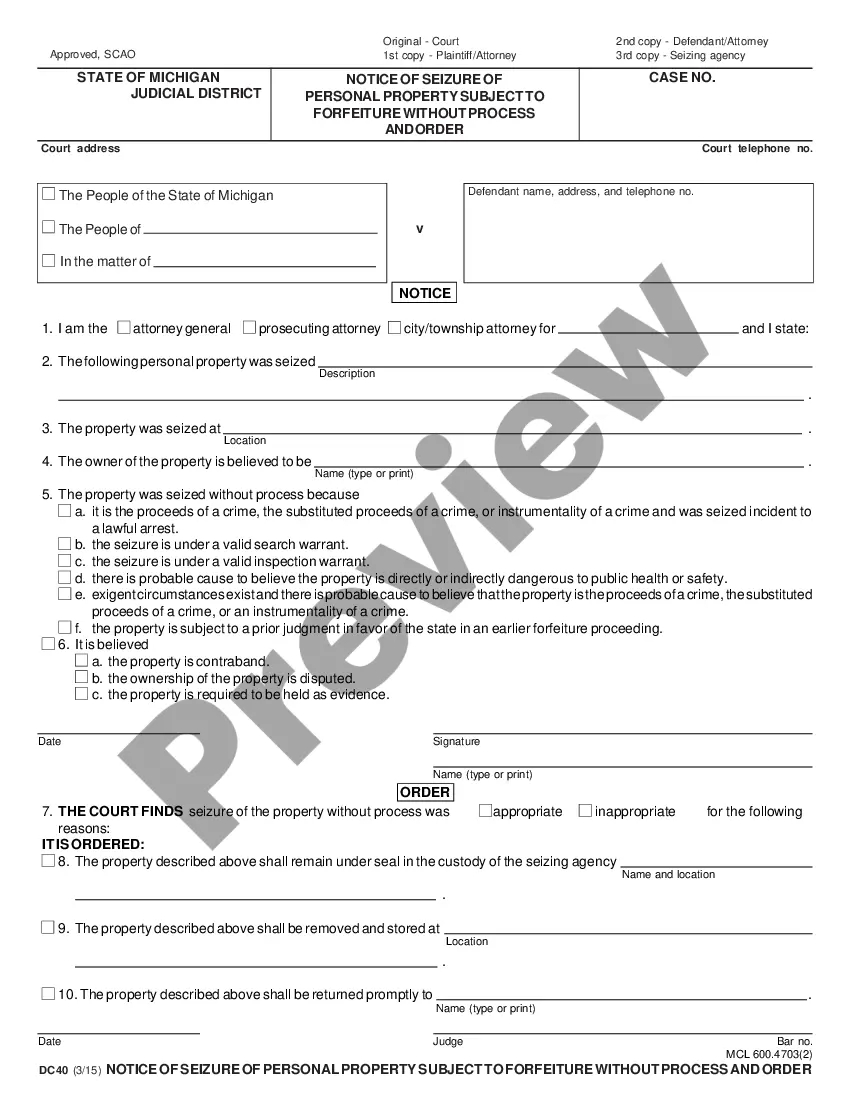

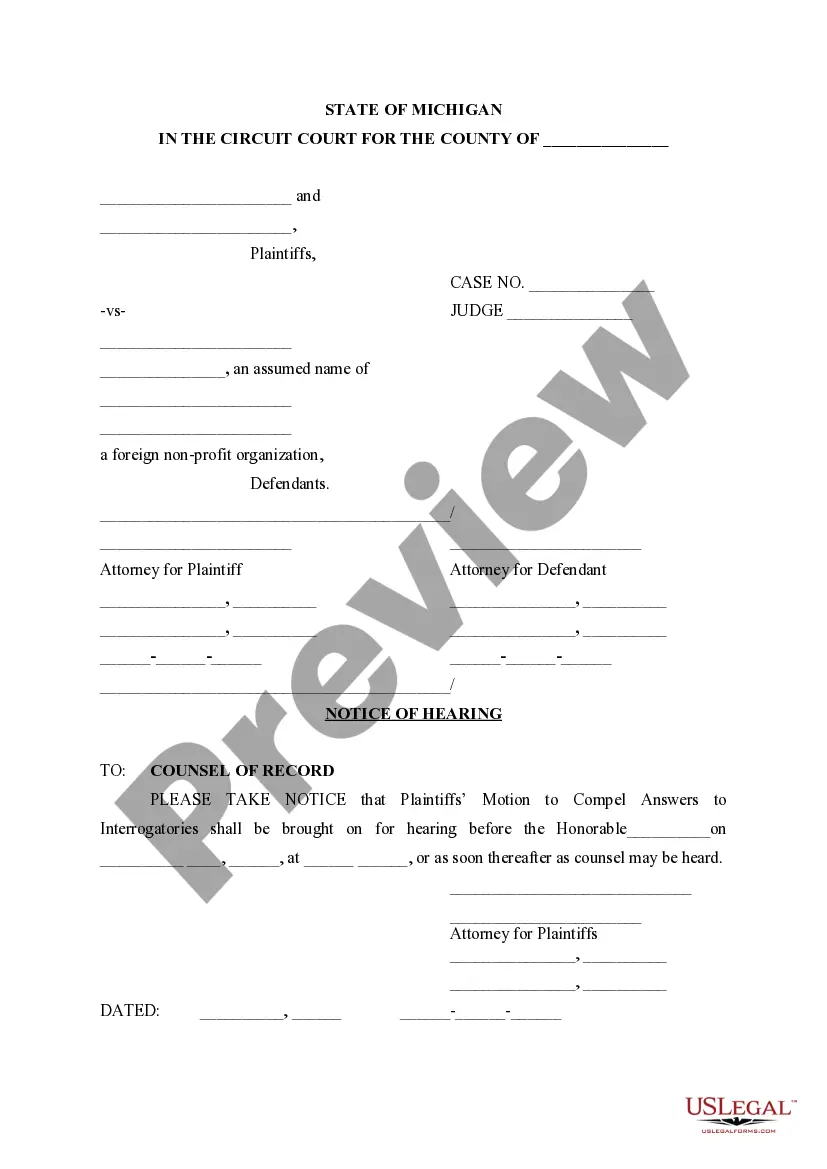

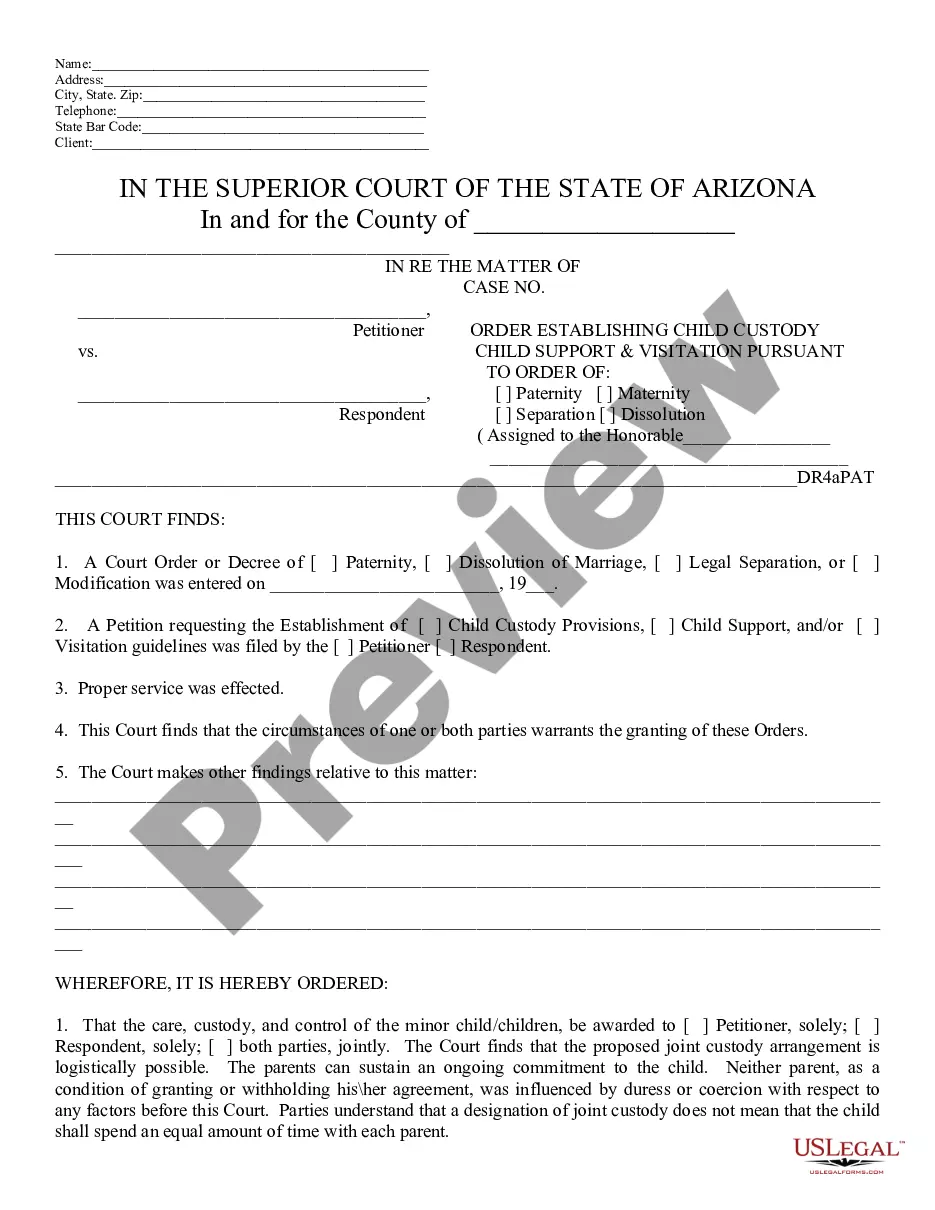

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Wayne Educator Agreement - Self-Employed Independent Contractor and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

What tax forms are needed for an independent contractor to be hired? IRS Tax Form W-9. A W-9 form is used by a company to request a contractor's taxpayer identification number (TIN).IRS Tax Form 1099-NEC.IRS Tax Form 1096.

It's rare that you will find a Pilates Studio which hires instructors as employees. For the most part, you will be working as a Pilates Instructor as an Independent Contractor. There are pros and cons to working as either an employee or an independent contractor.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if: (a) the worker is free from control and direction in the performance of services; and. (b) the worker is performing work outside the usual course of the business of the hiring company; and.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Because nearly all online English teachers are classified as Independent Contractors and therefor get no taxes taken out of our paychecks as employees would, we're in charge of making payments to the IRS ourselves, usually quarterly.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

Interesting Questions

More info

If the individual is the sole owner of the business, then the owner is responsible for all employee compensation or benefits. In addition, these employees have to be responsible for all insurance costs. If the person is an independent contractor, you'll need to continue completing the PSC, 3 pages.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.