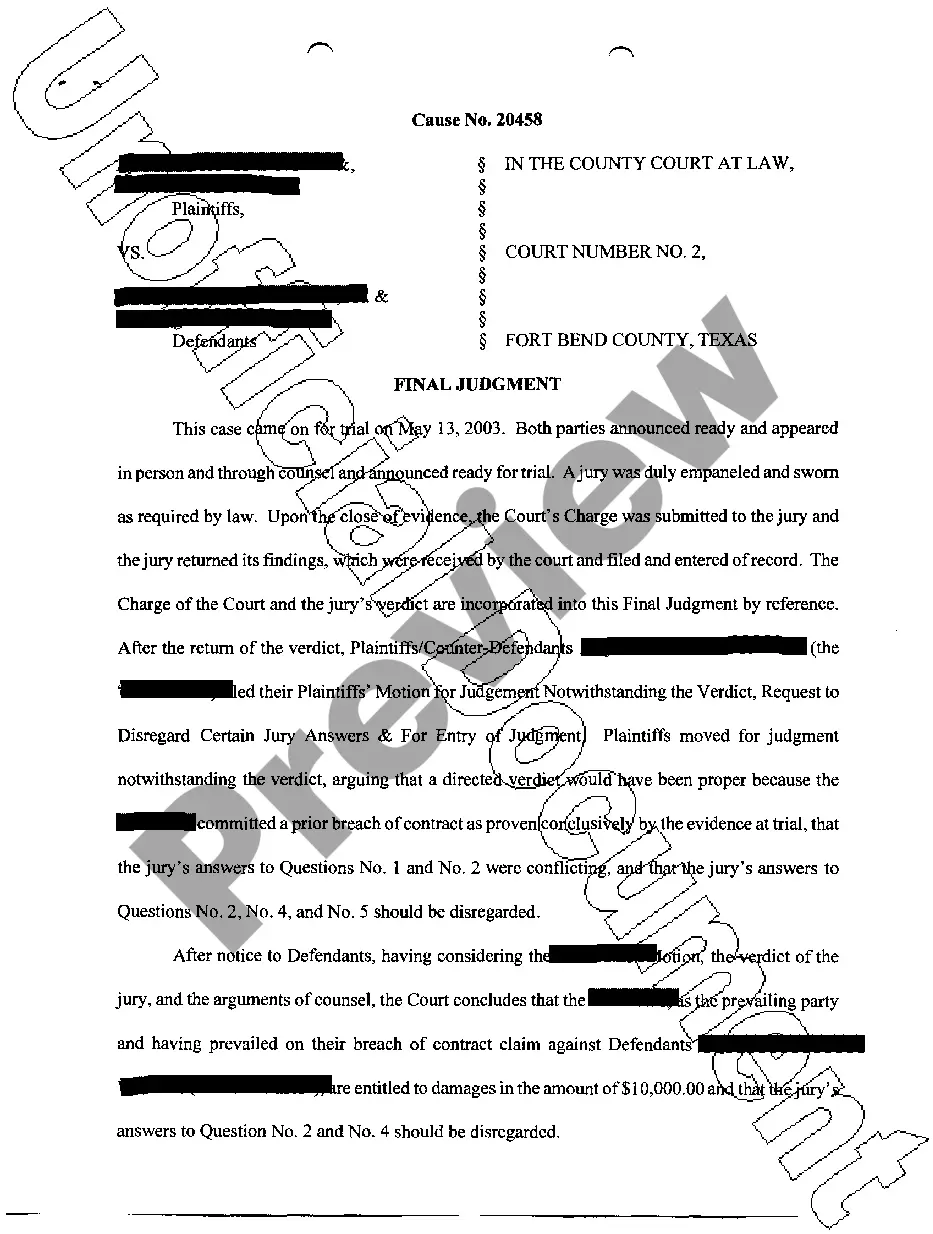

Dallas Texas Visiting Professor Agreement - Self-Employed Independent Contractor

Description

How to fill out Dallas Texas Visiting Professor Agreement - Self-Employed Independent Contractor?

Preparing papers for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Dallas Visiting Professor Agreement - Self-Employed Independent Contractor without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Dallas Visiting Professor Agreement - Self-Employed Independent Contractor on your own, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Dallas Visiting Professor Agreement - Self-Employed Independent Contractor:

- Look through the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

The Common Law Test is a guide used by the IRS to determine if a worker should be classified as an employee or an independent contractor. The standard Common Law test indicates a worker is likely an employee if the employer has control over what work is to be done and how to get it done.

What to Include in a Contract The date the contract begins and when it expires. The names of all parties involved in the transaction. Any key terms and definitions. The products and services included in the transaction. Any payment amounts, project schedules, terms, and billing dates.

A worker must also demonstrate special skills and initiative in order to be considered a contractor. A contractor makes decisions that require business skills, judgment, and initiative in addition to technical ability. Therefore, a worker performing routine tasks is unlikely to be classified as a contractor.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if: (a) the worker is free from control and direction in the performance of services; and. (b) the worker is performing work outside the usual course of the business of the hiring company; and.

What information do I need for an Independent Contractor Agreement? What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

Control of assistants. If a company hires, supervises, and pays a worker's assistants, this control indicates a possible employment relationship. If the worker retains control over hiring, supervising, and paying helpers, this arrangement suggests an independent contractor relationship.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Known as poaching, having contractors contact your own clients is a risk every business takes when bringing on contractors. Poaching can happen either while the worker is on contract with you or afterward. Either way, though, you can lose the ability to do business with that client.