The Lima Arizona Visiting Professor Agreement — Self-Employed Independent Contractor is a comprehensive contract that outlines the terms and conditions under which a visiting professor operates as a self-employed independent contractor at Lima Arizona University. This agreement aims to ensure clear expectations and a mutually beneficial working relationship between the professor and the university. Key aspects covered in this agreement include: 1. Scope of services: This section defines the professor's responsibilities, which may include teaching specific courses, conducting research, participating in academic conferences, mentoring students, and other scholarly activities. 2. Duration and compensation: The agreement specifies the start and end dates of the contract, as well as the remuneration details. Payment may be provided on an hourly, per-course, or per-project basis, depending on the arrangement. 3. Intellectual property: This clause outlines the ownership and rights related to any intellectual property produced during the professor's engagement with Lima Arizona. It may address patents, copyrights, trademarks, and other forms of intellectual property. 4. Confidentiality: The agreement may include provisions to safeguard the confidentiality of information shared between the professor and the university. This could encompass research findings, student data, institutional strategies, or other sensitive information. 5. Compliance with rules and regulations: Both parties agree to adhere to applicable laws, regulations, and university policies. This ensures compliance with academic standards, ethical guidelines, and any other relevant requirements. 6. Termination: The terms of termination, including the notice period, grounds for termination, and any associated penalties or liabilities, are outlined in this section. This provides clarity regarding the conditions under which either party may end the engagement. Types of Lima Arizona Visiting Professor Agreement — Self-Employed Independent Contractor: 1. Teaching-focused agreements: These contracts primarily involve teaching responsibilities and may be temporary or part-time arrangements. They typically require the professor to deliver lectures, develop syllabi, assess students, and fulfill other related duties. 2. Research-focused agreements: These agreements primarily emphasize research activities and academic contributions. Visiting professors engaged in research-focused contracts may collaborate with other faculty members, contribute to ongoing research projects, publish scholarly articles, and participate in research-related events. 3. Combination agreements: In some cases, visiting professors may undertake a combination of teaching and research responsibilities. These contracts outline a balanced workload that encapsulates both academic instruction and scholarly activities. It is important to note that specific provisions and clauses within the Lima Arizona Visiting Professor Agreement may vary depending on the preferences and policies of Lima Arizona University and the unique requirements of the visiting professor arrangement. It is recommended that both parties review and negotiate the terms to ensure all expectations are adequately addressed.

Pima Arizona Visiting Professor Agreement - Self-Employed Independent Contractor

Description

How to fill out Pima Arizona Visiting Professor Agreement - Self-Employed Independent Contractor?

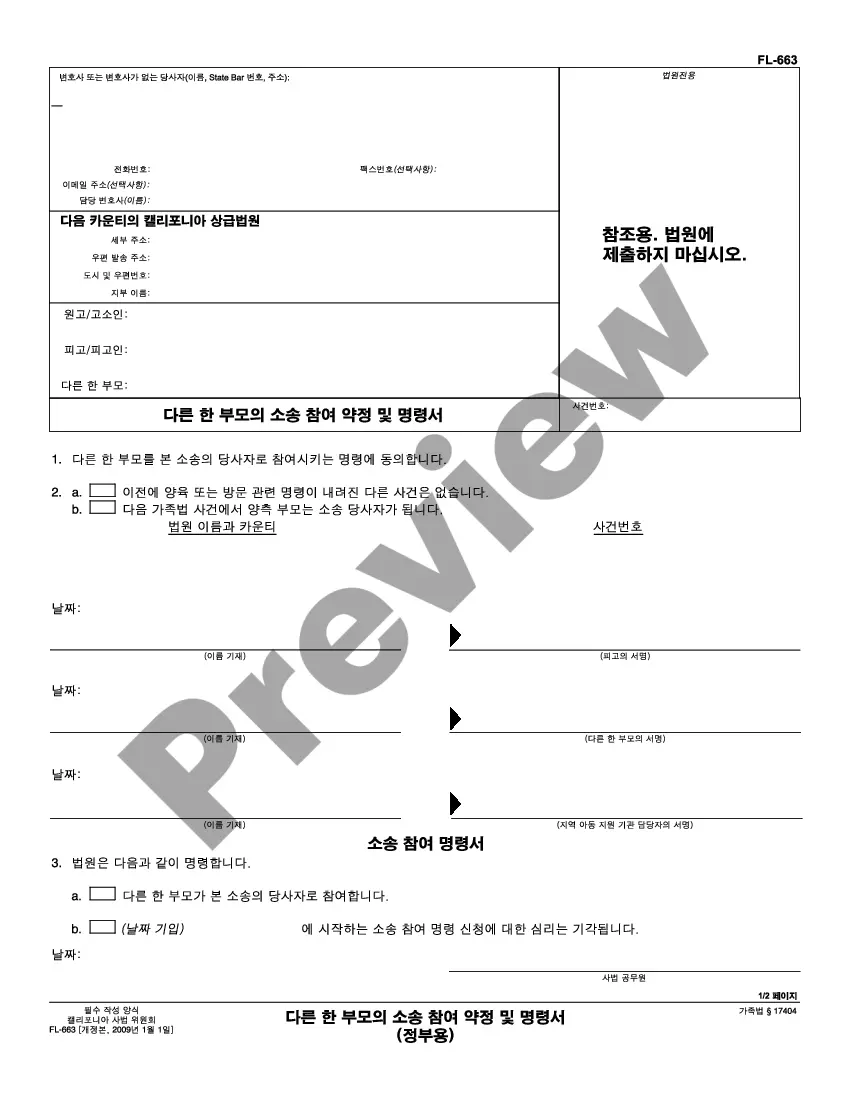

Preparing documents for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Pima Visiting Professor Agreement - Self-Employed Independent Contractor without expert assistance.

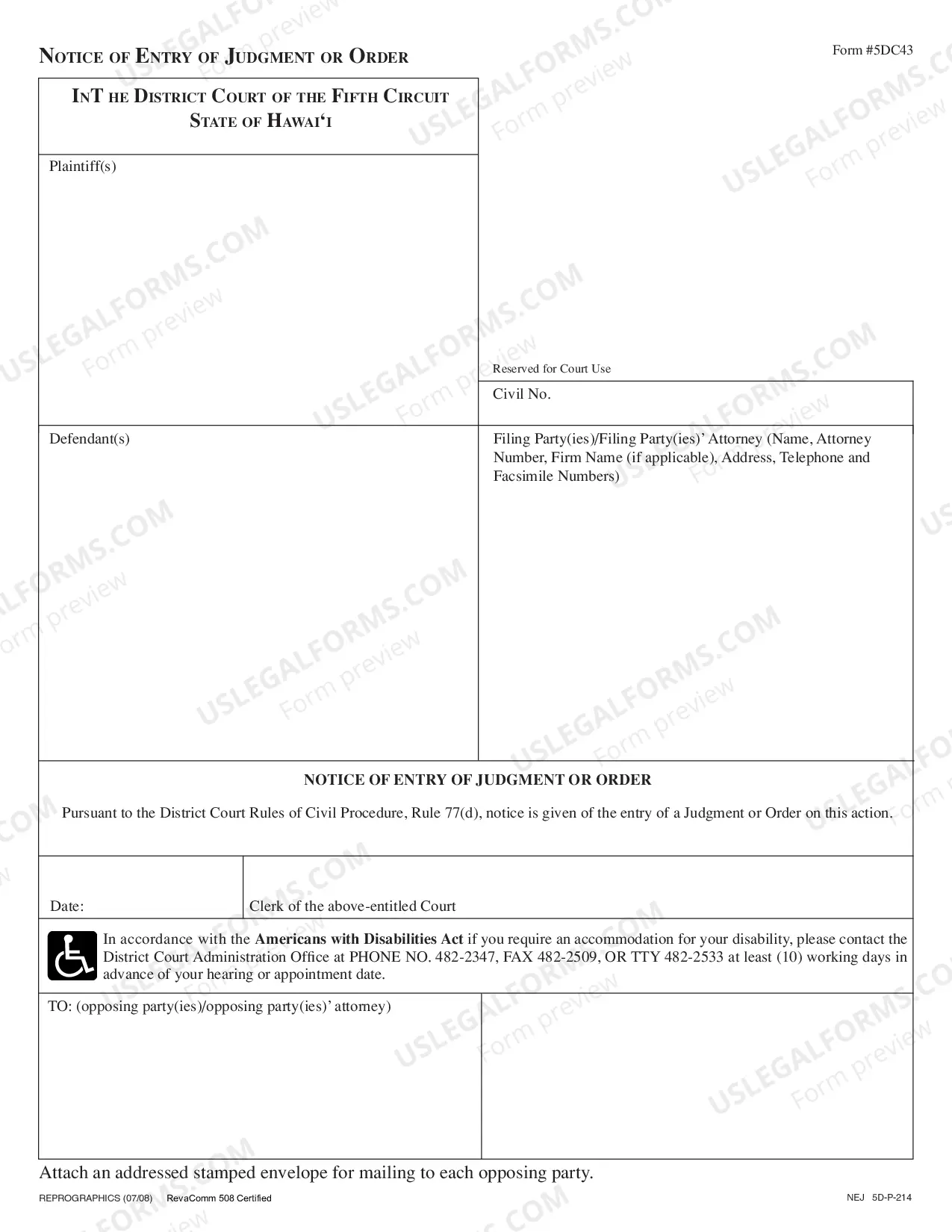

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Pima Visiting Professor Agreement - Self-Employed Independent Contractor on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Pima Visiting Professor Agreement - Self-Employed Independent Contractor:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

A worker, personal trainer, or fitness instructor can be classified as an independent contractor if: (a) the worker is free from control and direction in the performance of services; and. (b) the worker is performing work outside the usual course of the business of the hiring company; and.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Some of the common characteristics of an independent contractor include: Furnishes equipment and has control over that equipment. Submits bids for jobs, contracts, or fixes the price in advance. Has the capacity to accept or refuse an assignment or work. Pay relates more to completion of a job.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Because nearly all online English teachers are classified as Independent Contractors and therefor get no taxes taken out of our paychecks as employees would, we're in charge of making payments to the IRS ourselves, usually quarterly.

Most clubs currently classify their coaches as independent contractors and do not pay employment taxes on payments to coaches.

For colleges and universities, the general rule is that instructors, adjunct faculty, and proctors are employees. Guest speakers and performers are independent contractors.

It's rare that you will find a Pilates Studio which hires instructors as employees. For the most part, you will be working as a Pilates Instructor as an Independent Contractor. There are pros and cons to working as either an employee or an independent contractor.