The Contra Costa California Auditor Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between an independent contractor and the County of Contra Costa, California, for auditing services. This agreement is essential for freelancers and self-employed individuals looking to provide their expertise and services in the field of auditing within the Contra Costa County. The agreement establishes the relationship between the independent contractor and the County of Contra Costa, ensuring rights, responsibilities, and obligations of both parties. It covers various aspects, such as the scope of work, payment terms, confidentiality, intellectual property, and dispute resolution. Contra Costa County recognizes the importance of hiring qualified auditors to ensure the accuracy and transparency of financial records. By entering into this agreement, the independent contractor agrees to carry out auditing activities in compliance with all applicable laws, regulations, and industry standards. There may be different types of Contra Costa California Auditor Agreements — Self-Employed Independent Contractor, tailored to the specific needs of different auditing projects or departments within the County. Some possible variations and subcategories of these agreements may include: 1. Financial Auditor Agreement: This agreement focuses on auditing financial records, including balance sheets, income statements, and cash flow statements. It may involve reviewing financial transactions, assessing internal controls, and providing recommendations for improvement. 2. Compliance Auditor Agreement: This type of agreement may be required for auditors specializing in ensuring compliance with specific regulations or policies. It may include evaluating adherence to legal requirements, industry standards, or internal policies. 3. Performance Auditor Agreement: This agreement may be necessary for auditors examining the efficiency and effectiveness of operations within the County. It may involve assessing program performance, identifying areas for improvement, and suggesting strategies to enhance productivity. 4. IT Auditor Agreement: IT auditors focus on evaluating the effectiveness of information technology systems and controls. This agreement may outline the responsibilities related to assessing software, hardware, data security, and IT infrastructure. 5. Internal Controls Auditor Agreement: This agreement may be relevant for auditors specializing in internal controls assessment. It may involve reviewing policies, procedures, and mechanisms in place to prevent fraud, error, or misuse of resources. In summary, the Contra Costa California Auditor Agreement — Self-Employed Independent Contractor is a comprehensive legal document that establishes the terms and conditions between auditors and the County of Contra Costa. It ensures transparency, accuracy, and legality in auditing services and may encompass various types, such as Financial Auditor Agreement, Compliance Auditor Agreement, Performance Auditor Agreement, IT Auditor Agreement, and Internal Controls Auditor Agreement.

Contra Costa California Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Contra Costa California Auditor Agreement - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business purpose utilized in your county, including the Contra Costa Auditor Agreement - Self-Employed Independent Contractor.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Contra Costa Auditor Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Contra Costa Auditor Agreement - Self-Employed Independent Contractor:

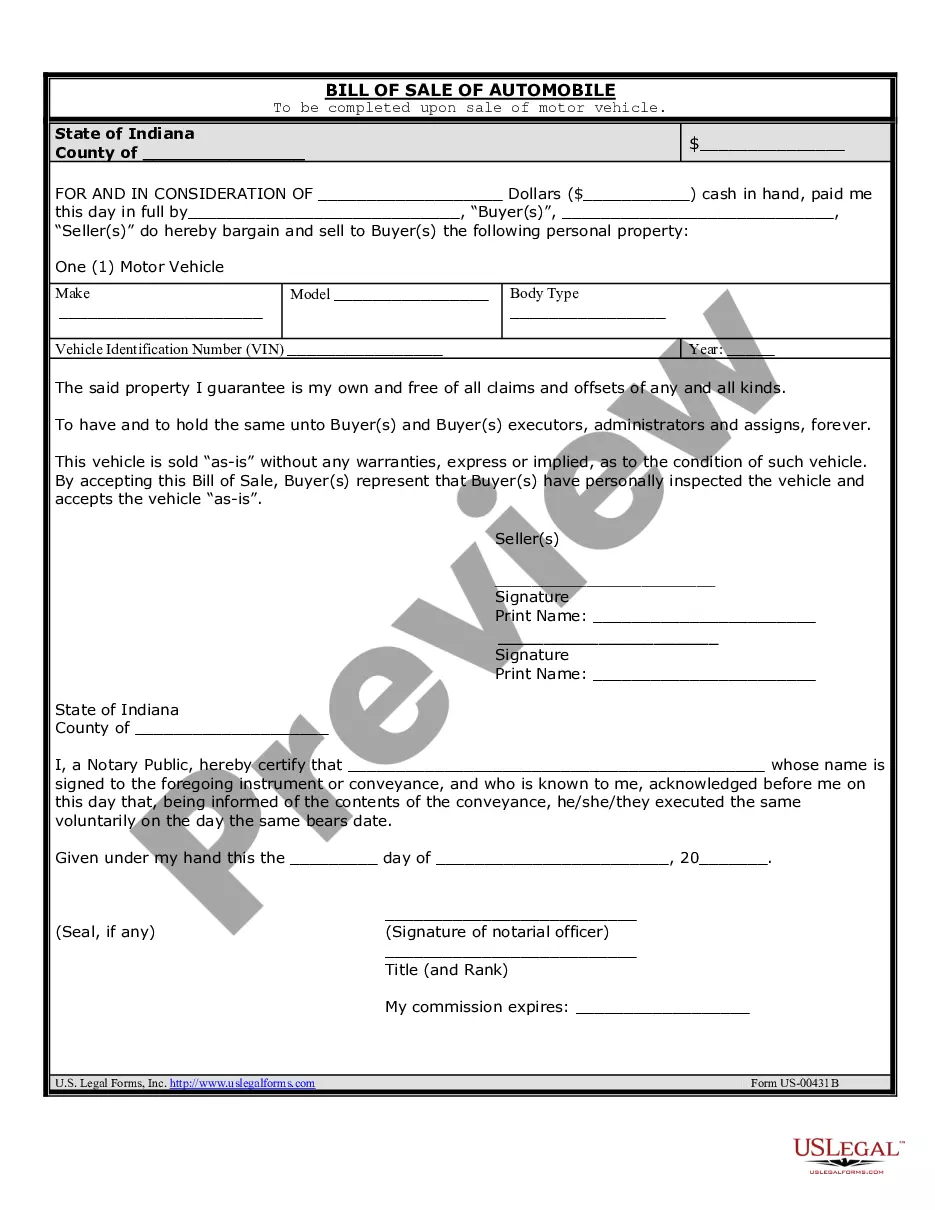

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Contra Costa Auditor Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!