Franklin Ohio Auditor Agreement — Self-Employed Independent Contractor Introduction: The Franklin Ohio Auditor Agreement is a legally binding document that outlines the terms and conditions between a self-employed independent contractor and the municipality of Franklin, Ohio. This agreement establishes the rights and responsibilities of both parties, ensuring a fair and transparent working relationship. Keywords: Franklin Ohio Auditor Agreement, Self-Employed Independent Contractor, municipality, terms and conditions, rights and responsibilities, working relationship. 1. Purpose: The purpose of the Franklin Ohio Auditor Agreement — Self-Employed Independent Contractor is to define the scope of work and the specific services to be provided by the contractor to the municipality. It ensures that both parties have a clear understanding of their obligations. Keywords: purpose, scope of work, specific services, contractor, municipality, obligations. 2. Contractor Requirements: The agreement will outline the necessary qualifications and credentials that a self-employed independent contractor must possess in order to be eligible for providing auditing services in Franklin, Ohio. This may include relevant certifications or licenses. Keywords: contractor requirements, qualifications, credentials, auditing services, Franklin Ohio. 3. Duration: The agreement will specify the duration of the contract, including the start and end dates. It may also include provisions for renewal or termination, depending on the needs of the municipality. Keywords: duration, contract, start and end dates, renewal, termination, municipality. 4. Compensation: The compensation section of the agreement will outline the payment terms for the contractor's services. This may include details such as hourly rates, project-based fees, or other agreed-upon compensation models. It will also address the timeline of payment and any applicable taxes or deductions. Keywords: compensation, payment terms, hourly rates, project-based fees, timeline of payment, taxes, deductions. 5. Confidentiality and Non-Disclosure: To protect the interests of the municipality, the agreement will likely include provisions for confidentiality and non-disclosure. This ensures that any sensitive information or data discovered during the auditing process remains confidential and is not disclosed to third parties without proper authorization. Keywords: confidentiality, non-disclosure, sensitive information, data, auditing process. Types of Franklin Ohio Auditor Agreement — Self-Employed Independent Contractor: 1. Financial Auditor Agreement: This type of agreement specifically focuses on auditing financial statements and ensuring compliance with financial regulations. 2. Operational Auditor Agreement: This agreement is tailored towards auditing the operational processes of a municipality, such as efficiency, effectiveness, and risk management. 3. Performance Auditor Agreement: Performance auditing focuses on assessing the performance of specific programs or activities within the municipality to identify areas for improvement. 4. Compliance Auditor Agreement: This type of agreement is concerned with evaluating the municipality's adherence to applicable laws, regulations, and policies. Keywords: financial auditor agreement, operational auditor agreement, performance auditor agreement, compliance auditor agreement. Conclusion: The Franklin Ohio Auditor Agreement — Self-Employed Independent Contractor is a comprehensive document that protects the rights and outlines the responsibilities of both the contractor and the municipality. By defining the scope of work, compensation, confidentiality, and other essential aspects, this agreement ensures a smooth and professional working relationship between both parties. Keywords: comprehensive document, protect rights, responsibilities, scope of work, compensation, confidentiality, working relationship.

Franklin Ohio Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Franklin Ohio Auditor Agreement - Self-Employed Independent Contractor?

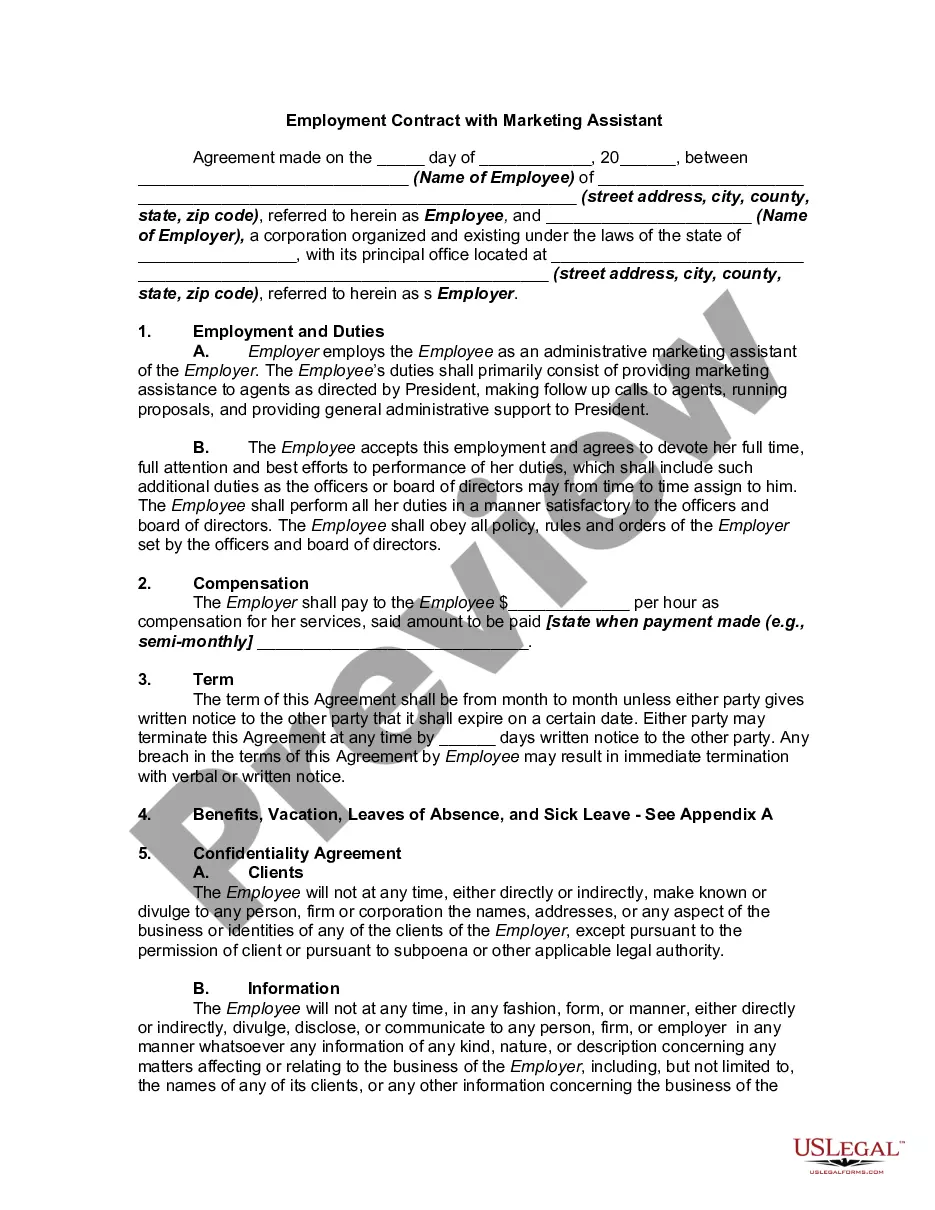

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official documentation that differs from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business objective utilized in your region, including the Franklin Auditor Agreement - Self-Employed Independent Contractor.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Franklin Auditor Agreement - Self-Employed Independent Contractor will be available for further use in the My Forms tab of your profile.

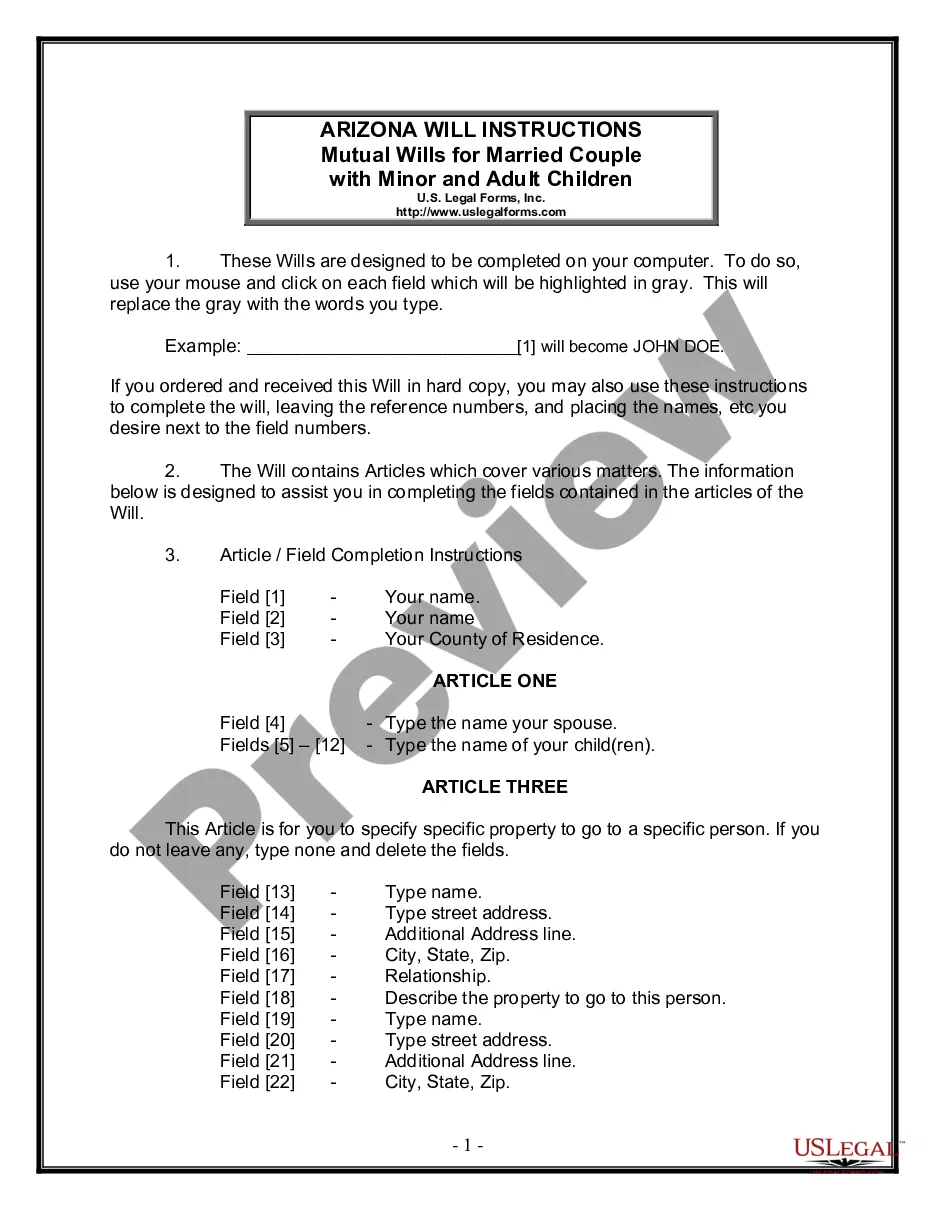

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Franklin Auditor Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the right page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Franklin Auditor Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

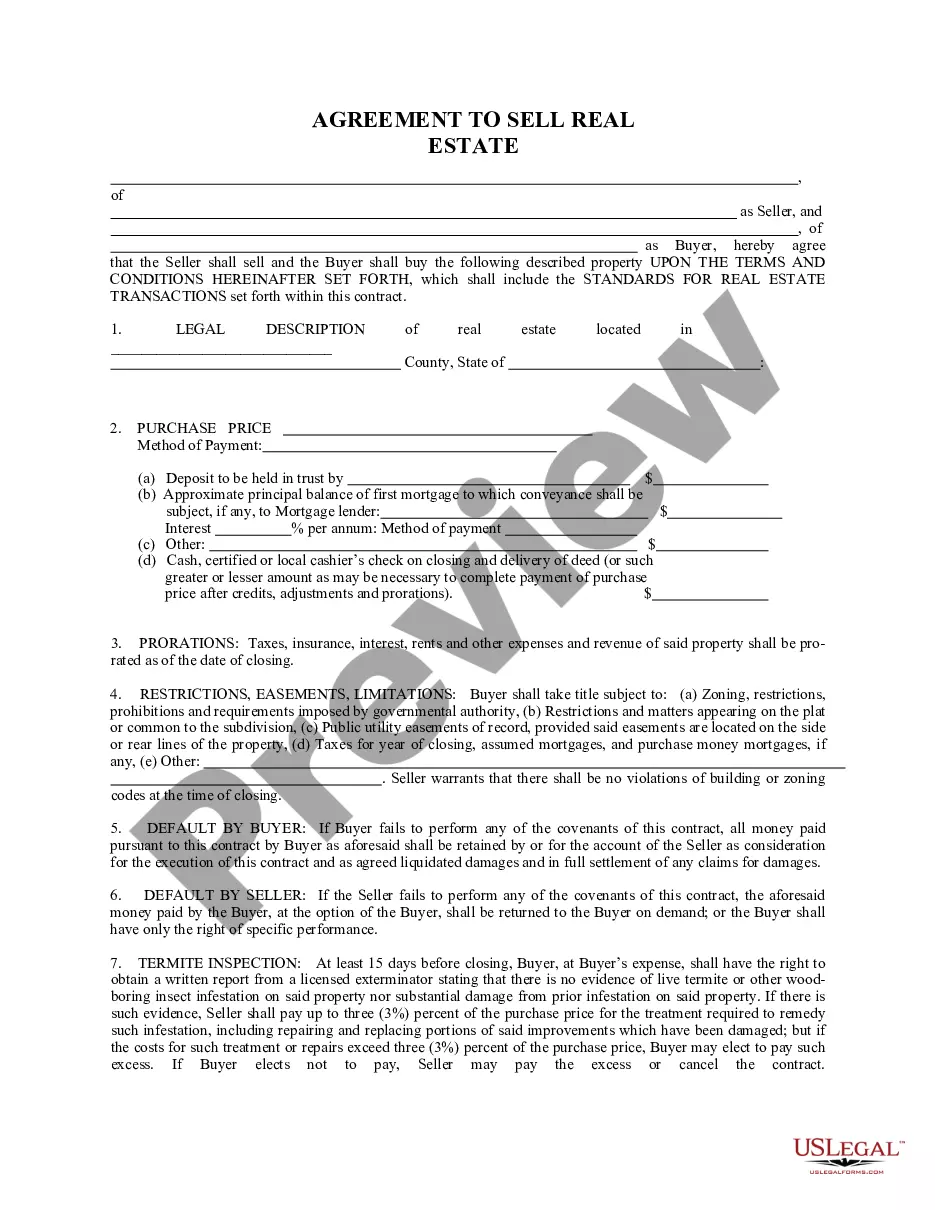

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Internal auditors are generally internal company employees while external auditors are always a third-party to the organization and their clients.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Elsewhere, an accountant may be able to work for an accounting firm and be an independent contractor depending on other factors. For a non-accounting firm such as a therapy private practice, coaching business, or small legal firm, an accountant could be an employee or an independent contractor.

Some ways to prove self-employment income include: Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Part Time Field Inspector/Auditor. Inspectors are independent contractors and compensated per inspection.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Four ways to verify your income as an independent contractor Income-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.