Maricopa Arizona Auditor Agreement — Self-Employed Independent Contractor: Understanding the Terms and Types Introduction: Maricopa, Arizona is known for its business-friendly environment, attracting a significant number of self-employed independent contractors, including auditors. To establish clear expectations, protect the rights of both parties, and outline the terms of engagement, a comprehensive Maricopa Arizona Auditor Agreement is necessary. In this article, we will delve into the details of what this agreement entails, covering its key components and various types that may exist. Key Components of Maricopa Arizona Auditor Agreement — Self-Employed Independent Contractor: 1. Intent and Scope: This section highlights the mutual agreement between the auditor and the client, clearly specifying the intent of engaging the services of an independent contractor for audit-related tasks. 2. Duration and Termination: Here, the start and end dates of the contract are specified, along with provisions for termination by either party under certain circumstances. 3. Compensation: The agreement outlines the compensation structure, payment terms, and any additional expenses that may be reimbursed to the auditor. 4. Duties and Responsibilities: This section details the specific tasks and deliverables expected from the auditor, ensuring clarity on the scope of work. 5. Independent Contractor Status: It is crucial to establish that the auditor is an independent contractor and not an employee, defining the rights, responsibilities, and liabilities that come with this status. 6. Confidentiality and Non-Disclosure: This component highlights the importance of maintaining the confidentiality of sensitive information and proprietary data, both during and after the engagement. 7. Intellectual Property Rights: If applicable, this part outlines the ownership and usage rights of any intellectual property created during the course of the audit. 8. Indemnification: This clause ensures that the auditor has appropriate liability insurance and indemnifies the client against any claims or losses arising from their actions or omissions. Types of Maricopa Arizona Auditor Agreement — Self-Employed Independent Contractor: 1. Financial Auditor Agreement: This type focuses on auditing financial statements, reviewing internal controls, and providing recommendations for improvement in financial processes. 2. Compliance Auditor Agreement: Suitable for organizations requiring an independent review of their adherence to specific regulations or industry standards, such as HIPAA or SOX compliance. 3. Operational Auditor Agreement: This type concentrates on evaluating the efficiency and effectiveness of an organization's operational processes, aiming to identify areas for improvement and cost-saving measures. 4. IT Auditor Agreement: Designed for firms seeking an audit of their information technology systems, data security protocols, and infrastructure, ensuring compliance with industry best practices. Conclusion: The Maricopa Arizona Auditor Agreement — Self-Employed Independent Contractor is essential for establishing a clear and mutually beneficial relationship between auditors and their clients. It covers various key components, including intent, duration, compensation, duties, and confidentiality. Additionally, different types of agreements exist to cater to the specific audit requirements of businesses, such as financial, compliance, operational, and IT audits.

Maricopa Arizona Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Maricopa Arizona Auditor Agreement - Self-Employed Independent Contractor?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a Maricopa Auditor Agreement - Self-Employed Independent Contractor meeting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the Maricopa Auditor Agreement - Self-Employed Independent Contractor, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Maricopa Auditor Agreement - Self-Employed Independent Contractor:

- Examine the content of the page you’re on.

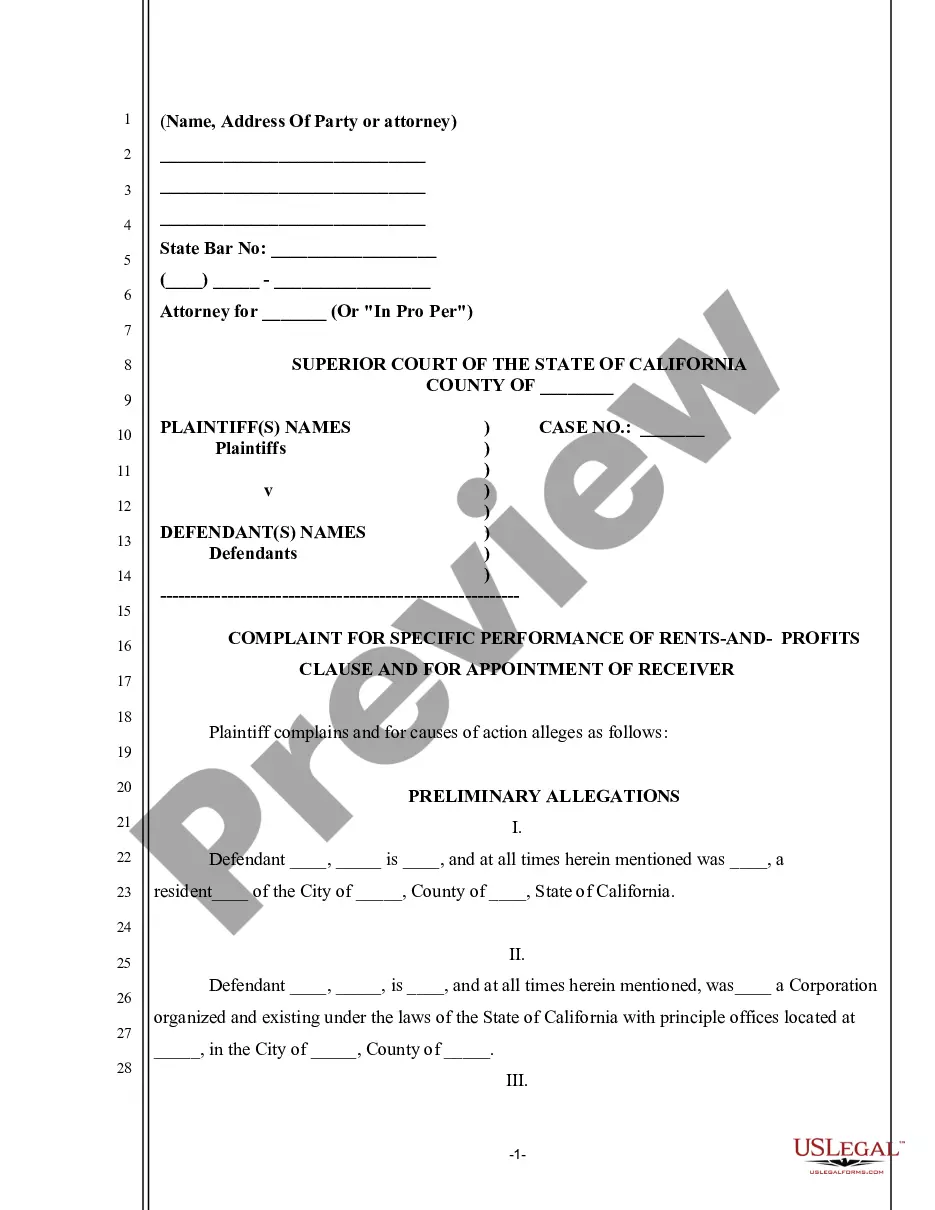

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Maricopa Auditor Agreement - Self-Employed Independent Contractor.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!