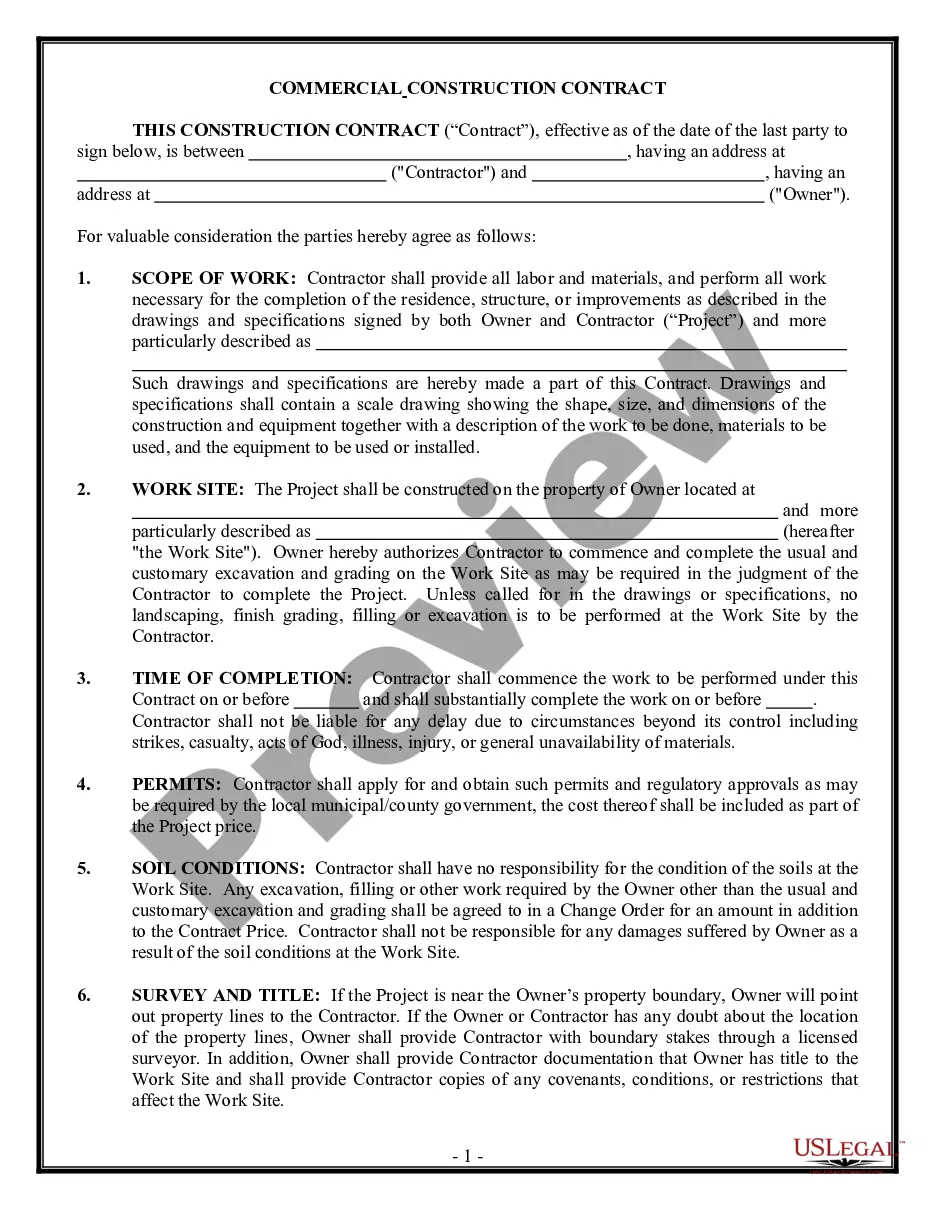

Oakland Michigan Auditor Agreement — Self-Employed Independent Contractor is a legal contract designed for individuals who work as auditors in Oakland, Michigan while being classified as independent contractors. This agreement outlines the terms and conditions of the working relationship between the auditor and their clients, ensuring a clear understanding of their rights and obligations. Key topics covered in the Oakland Michigan Auditor Agreement — Self-Employed Independent Contractor may include: 1. Agreement purpose and background: This section explains the intention of the agreement and provides a brief overview of the relationship between the auditor and the client. 2. Scope of work: This segment specifies the nature and extent of the auditing services to be provided by the self-employed independent contractor. It describes the required tasks, deliverables, and timelines for completion. 3. Compensation and payment terms: The agreement discusses the compensation structure, including how the auditor will be paid for their services and any applicable taxes or expenses. This section may also cover invoicing and payment schedules. 4. Confidentiality and non-disclosure: To protect sensitive client information, confidentiality and non-disclosure provisions are included in the agreement. Auditors must commit to maintaining the confidentiality of any proprietary or confidential data they access during their engagement. 5. Ownership of work: This clause clarifies that the work performed by the auditor is considered and remains the property of the client, thereby preventing any ownership disputes or misinterpretations. 6. Independent contractor status: This section reiterates that the auditor is being engaged as an independent contractor and is not considered an employee of the client. It establishes that the auditor is responsible for their own taxes, insurance, and benefits. Additional types of Oakland Michigan Auditor Agreements — Self-Employed Independent Contractor may include: 1. Time-based contracts: In this type of agreement, the auditor may be engaged for a specific number of hours per week or month, and compensation is based on the time spent on auditing activities. 2. Project-based contracts: These agreements are concerned with completing specific auditing projects within a predetermined timeframe. Compensation is often negotiated based on the complexity and scope of the project. 3. Retainer contracts: Retainer agreements are long-term contracts where the auditor provides ongoing auditing services to the client at a fixed monthly or annual fee. This type of agreement is beneficial for auditors seeking consistent work and a stable income stream. In conclusion, the Oakland Michigan Auditor Agreement — Self-Employed Independent Contractor is a comprehensive legal document that outlines the rights and responsibilities of auditors working on a self-employed basis in Oakland, Michigan. It ensures clarity and protection for both parties while establishing a professional and mutually beneficial relationship.

Oakland Michigan Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Oakland Michigan Auditor Agreement - Self-Employed Independent Contractor?

Are you looking to quickly draft a legally-binding Oakland Auditor Agreement - Self-Employed Independent Contractor or probably any other document to manage your personal or corporate matters? You can go with two options: contact a professional to write a valid paper for you or create it entirely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific document templates, including Oakland Auditor Agreement - Self-Employed Independent Contractor and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Oakland Auditor Agreement - Self-Employed Independent Contractor is tailored to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the search again if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Oakland Auditor Agreement - Self-Employed Independent Contractor template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the templates we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!