Wake North Carolina Auditor Agreement — Self-Employed Independent Contractor is a legal document that establishes the terms and conditions between an auditor and their clients in the state of North Carolina. This agreement outlines the nature of the engagement, responsibilities, compensation, and other critical aspects of the working relationship. The Wake North Carolina Auditor Agreement is specifically designed for individuals who work as self-employed independent contractors in the field of auditing. It is essential for maintaining clarity and protecting the rights and interests of both parties involved. Key keywords related to this agreement may include: 1. Wake North Carolina: Refers to the location or jurisdiction specific to the agreement, stating that it is governed by the laws and regulations of the state of North Carolina. 2. Auditor Agreement: The agreement refers to the contract between the auditor and the client, establishing the terms of their professional relationship. 3. Self-Employed: Indicates that the auditor works as an independent contractor, responsible for their own taxes, insurance, and other business-related obligations. 4. Independent Contractor: Refers to the individual or business entity that agrees to provide audit services to the client on a contract basis, outside a traditional employer-employee relationship. Types of Wake North Carolina Auditor Agreements — Self-Employed Independent Contractor may vary based on various factors, such as: 1. Scope of Services: Different agreements may outline the specific services the auditor will provide, such as financial statement auditing, internal control evaluation, or compliance assessments. 2. Duration: The agreement may specify the duration of the engagement, whether it is a one-time audit, an ongoing contractual arrangement, or a project-based agreement. 3. Compensation: The agreement may detail how the auditor will be remunerated for their services, including the billing rate, frequency of payment, and any additional expenses or reimbursements. 4. Confidentiality and Non-Disclosure: Some agreements may have specific clauses to ensure the protection of sensitive information and trade secrets shared between the auditor and the client. 5. Termination Clause: An agreement may include provisions that outline the conditions under which either party can terminate the agreement, such as breach of contract, non-performance, or changes in circumstances. In conclusion, the Wake North Carolina Auditor Agreement — Self-Employed Independent Contractor is a comprehensive legal document that governs the working relationship between auditors and their clients in North Carolina. It provides clarity on the terms, obligations, and expectations for both parties involved, ensuring a mutually beneficial professional engagement.

Wake North Carolina Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Wake North Carolina Auditor Agreement - Self-Employed Independent Contractor?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Wake Auditor Agreement - Self-Employed Independent Contractor, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Therefore, if you need the current version of the Wake Auditor Agreement - Self-Employed Independent Contractor, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wake Auditor Agreement - Self-Employed Independent Contractor:

- Look through the page and verify there is a sample for your area.

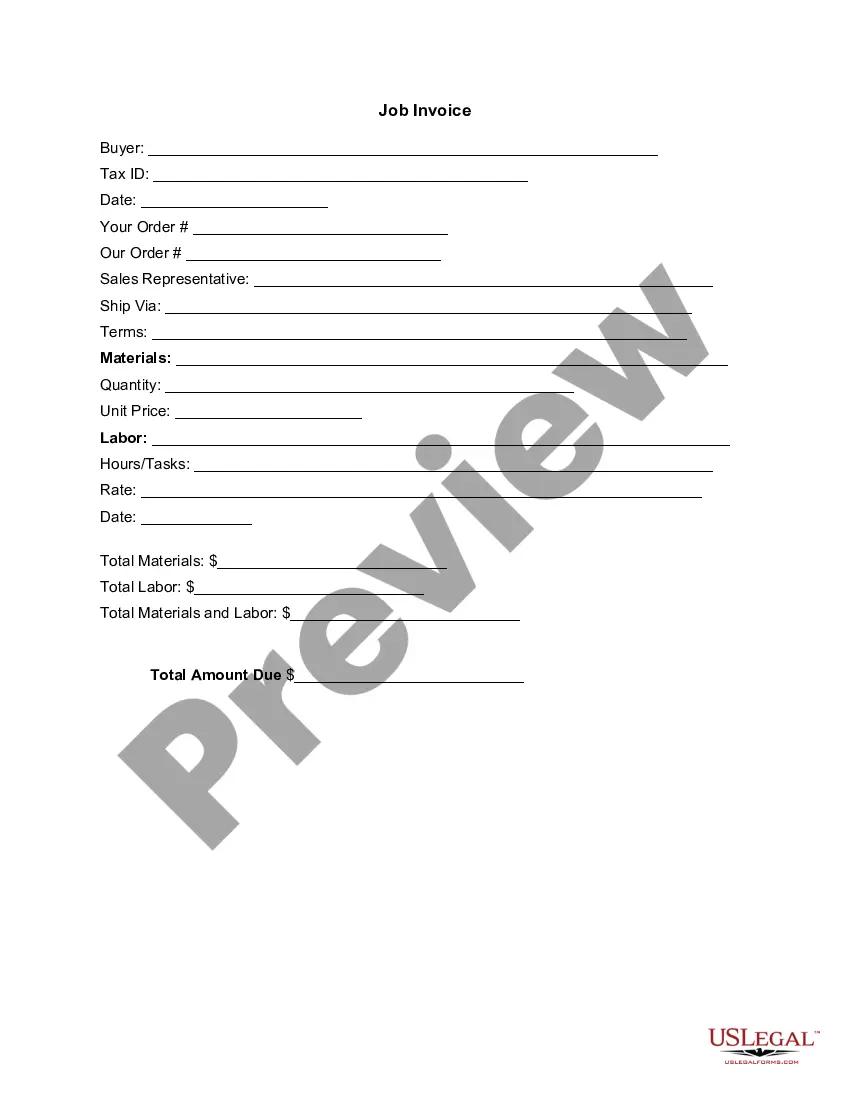

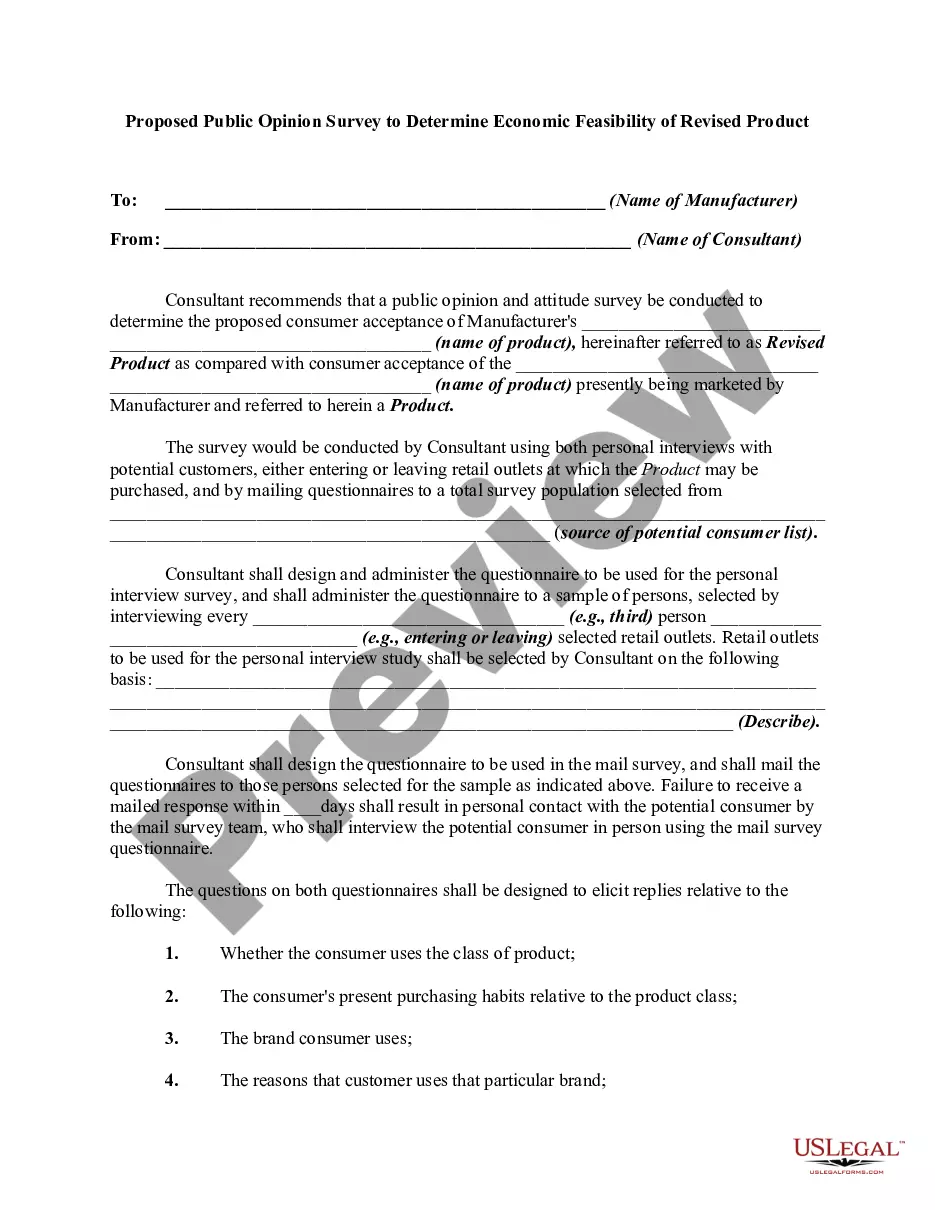

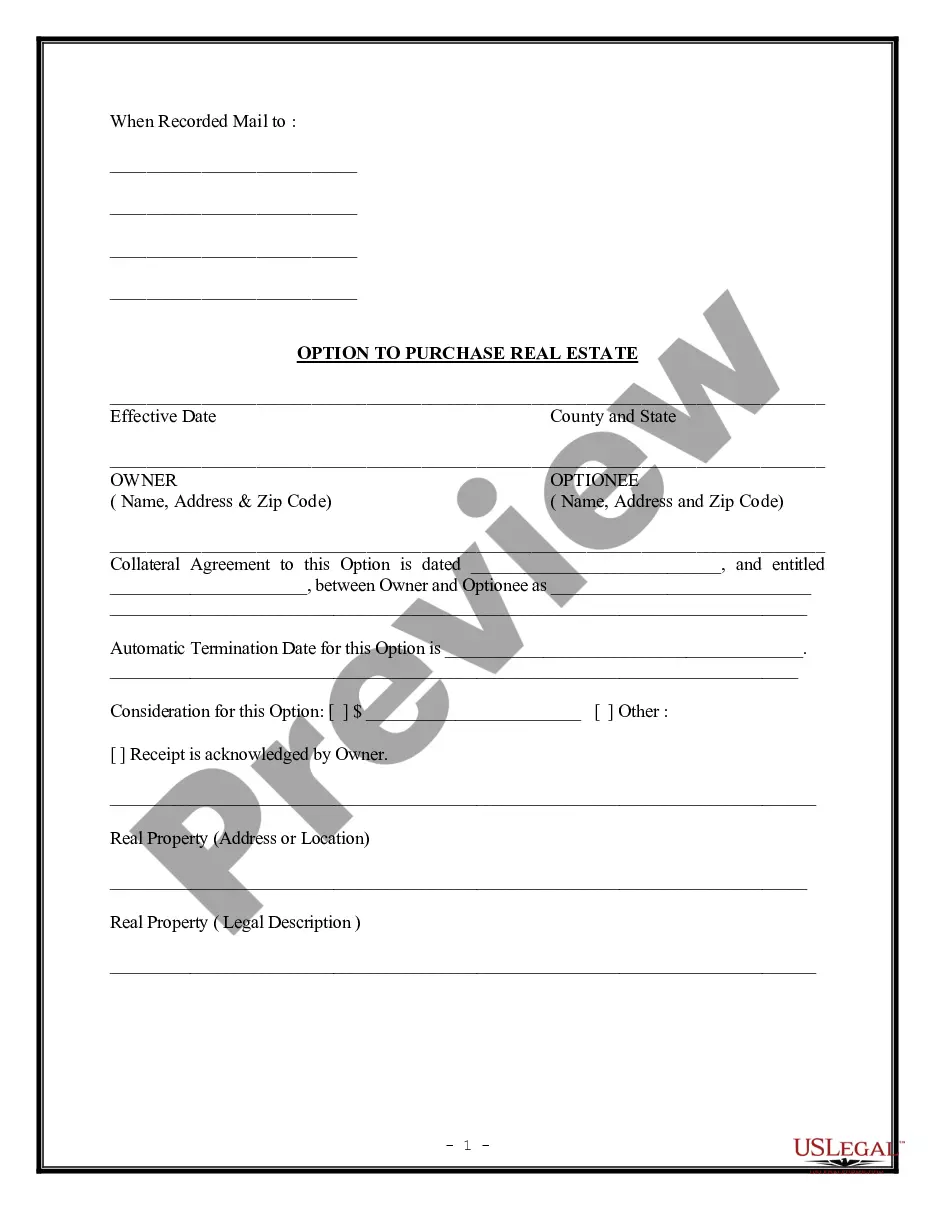

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Wake Auditor Agreement - Self-Employed Independent Contractor and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Part Time Field Inspector/Auditor. Inspectors are independent contractors and compensated per inspection.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

What to Include in a Contract The date the contract begins and when it expires. The names of all parties involved in the transaction. Any key terms and definitions. The products and services included in the transaction. Any payment amounts, project schedules, terms, and billing dates.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

What information do I need for an Independent Contractor Agreement? What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

Minimum rates of pay 2022 rights under working time and whistleblowing legislation 2022 protection from discrimination. Self-employed individuals generally only have contractual rights, but they may also be protected: from discrimination 2022 under data protection legislation as 'data subjects'.