A Fairfax Virginia Tax Work Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions of a tax-related work arrangement between a self-employed individual and a client in the Fairfax, Virginia area. This agreement establishes the rights and responsibilities of both parties involved in the tax-related services provided. Keywords: Fairfax Virginia, tax work agreement, self-employed, independent contractor, legally binding, terms and conditions, tax-related services. There are various types of Fairfax Virginia Tax Work Agreements — Self-Employed Independent Contractor that can be tailored to suit different circumstances. These may include: 1. Tax Preparation Agreement: This type of agreement is commonly used when a self-employed independent contractor offers tax preparation services for individuals or businesses in Fairfax, Virginia. It specifies the scope of work, fees, deadlines, and confidentiality requirements. 2. Tax Consulting Agreement: This agreement is designed for self-employed independent contractors who provide tax consulting services to clients in Fairfax, Virginia. It outlines the consultant's responsibilities, deliverables, consultation periods, and compensation structure. 3. Tax Audit Representation Agreement: This type of agreement is used when a self-employed independent contractor offers representation services during tax audits in Fairfax, Virginia. It details the contractor's obligations, representation limits, fees, and the process for disputing audit findings. 4. Tax Planning Agreement: This agreement is utilized by self-employed independent contractors who provide tax planning advice and strategies to clients in Fairfax, Virginia. It highlights the contractor's role, confidentiality obligations, payment terms, and the expected outcomes of the tax planning services. 5. IRS Compliance Agreement: This agreement is specifically designed for self-employed independent contractors who focus on ensuring IRS compliance for their clients in Fairfax, Virginia. It outlines the contractor's responsibilities to assist clients in meeting their tax obligations, as well as any penalties or liabilities associated with non-compliance. Regardless of the specific type of Fairfax Virginia Tax Work Agreement — Self-Employed Independent Contractor, it is crucial to include essential elements such as project details, compensation terms, dispute resolution mechanisms, confidentiality clauses, non-disclosure agreements, and termination conditions. It is recommended to seek legal advice to ensure the agreement complies with federal and state laws while protecting the rights and interests of both parties involved.

Fairfax Virginia Tax Work Agreement - Self-Employed Independent Contractor

Description

How to fill out Fairfax Virginia Tax Work Agreement - Self-Employed Independent Contractor?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Fairfax Tax Work Agreement - Self-Employed Independent Contractor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Fairfax Tax Work Agreement - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fairfax Tax Work Agreement - Self-Employed Independent Contractor:

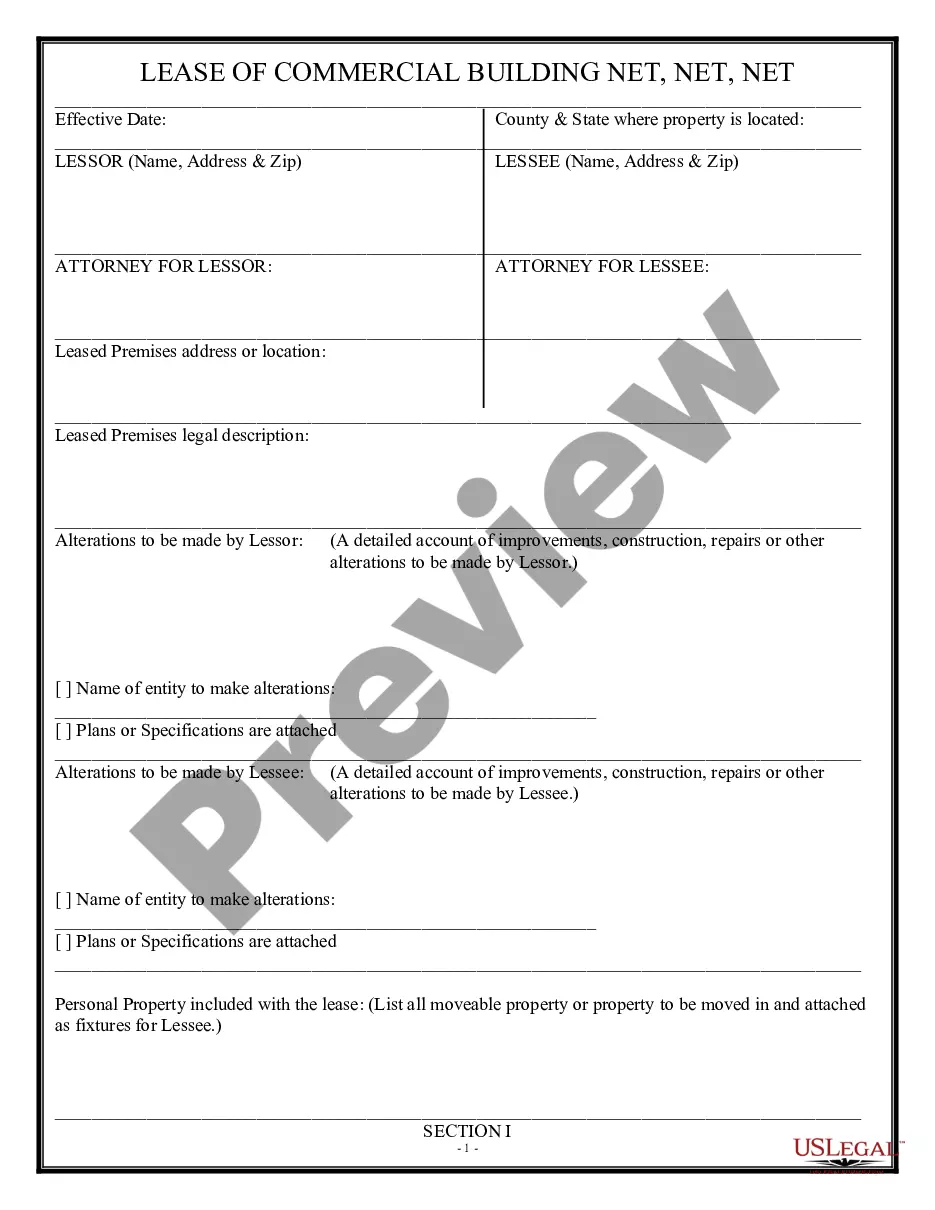

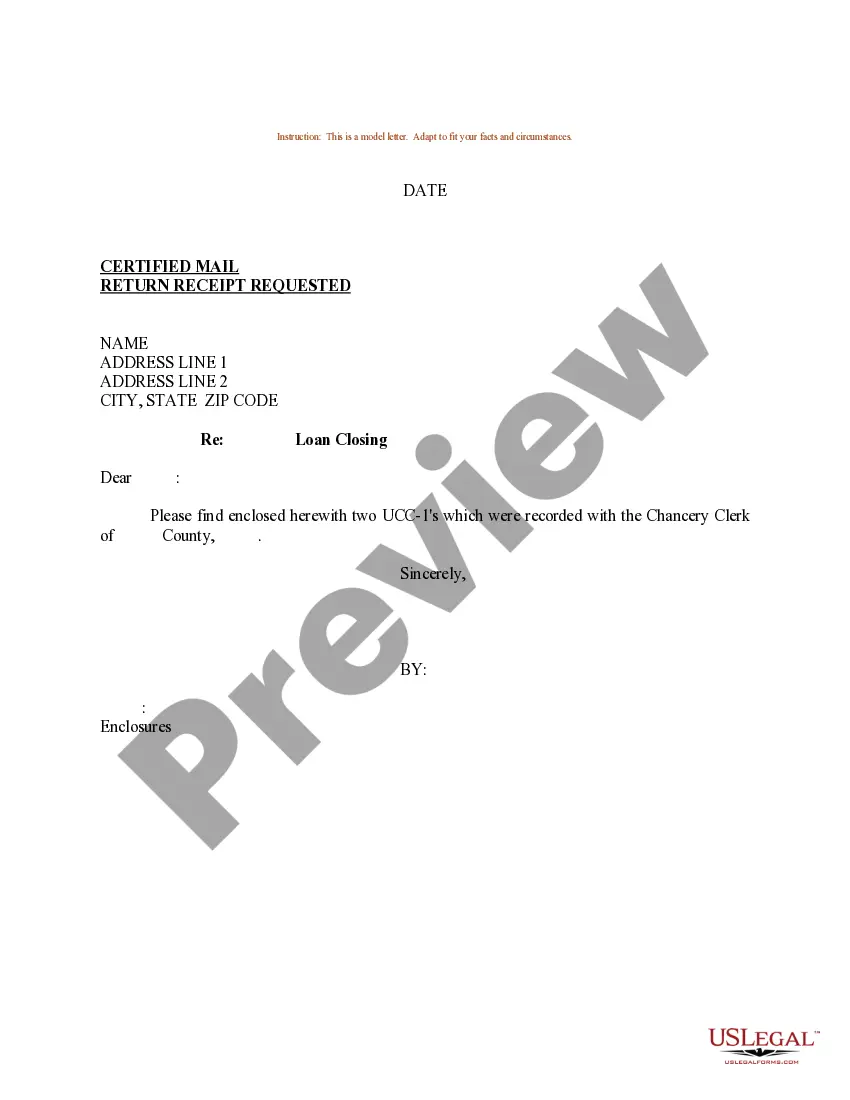

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!