The Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor is a legally binding contract specifically designed for individuals who operate as self-employed independent contractors in Middlesex County, Massachusetts. This agreement outlines the terms and conditions of the working arrangement between the independent contractor and their clients, as it pertains to tax obligations and responsibilities. Keywords: Middlesex Massachusetts, tax work agreement, self-employed independent contractor, contract, terms and conditions, working arrangement, tax obligations, responsibilities. There are different types of Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor, which may vary based on specific industries or services rendered. Some notable types are: 1. Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor for Freelancers: This type of agreement is tailored to freelancers who offer their expertise and services on a project basis, often working with multiple clients simultaneously. 2. Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor for Consultants: Specifically designed for consultants who provide professional advice, guidance, and expertise to businesses in Middlesex County, Massachusetts. 3. Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor for Artists: This agreement caters to individuals engaged in artistic endeavors such as musicians, painters, photographers, or performers, stipulating the terms and conditions relevant to the creative industry. 4. Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor for Technicians: This type of agreement is crafted for skilled technicians, such as IT specialists, repairmen, or equipment installers, who operate as independent contractors in Middlesex County. 5. Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor for Tradespeople: This agreement is specific to tradespeople like plumbers, electricians, carpenters, or HVAC technicians who offer specialized services as independent contractors in Middlesex County. Overall, the Middlesex Massachusetts Tax Work Agreement — Self-Employed Independent Contractor is a comprehensive contract that protects the rights and specifies the obligations of both parties involved in the self-employment arrangement. It ensures clarity regarding tax liabilities, payment terms, project scope, dispute resolution mechanisms, and other critical aspects necessary for a successful and legally compliant partnership.

Middlesex Massachusetts Tax Work Agreement - Self-Employed Independent Contractor

Description

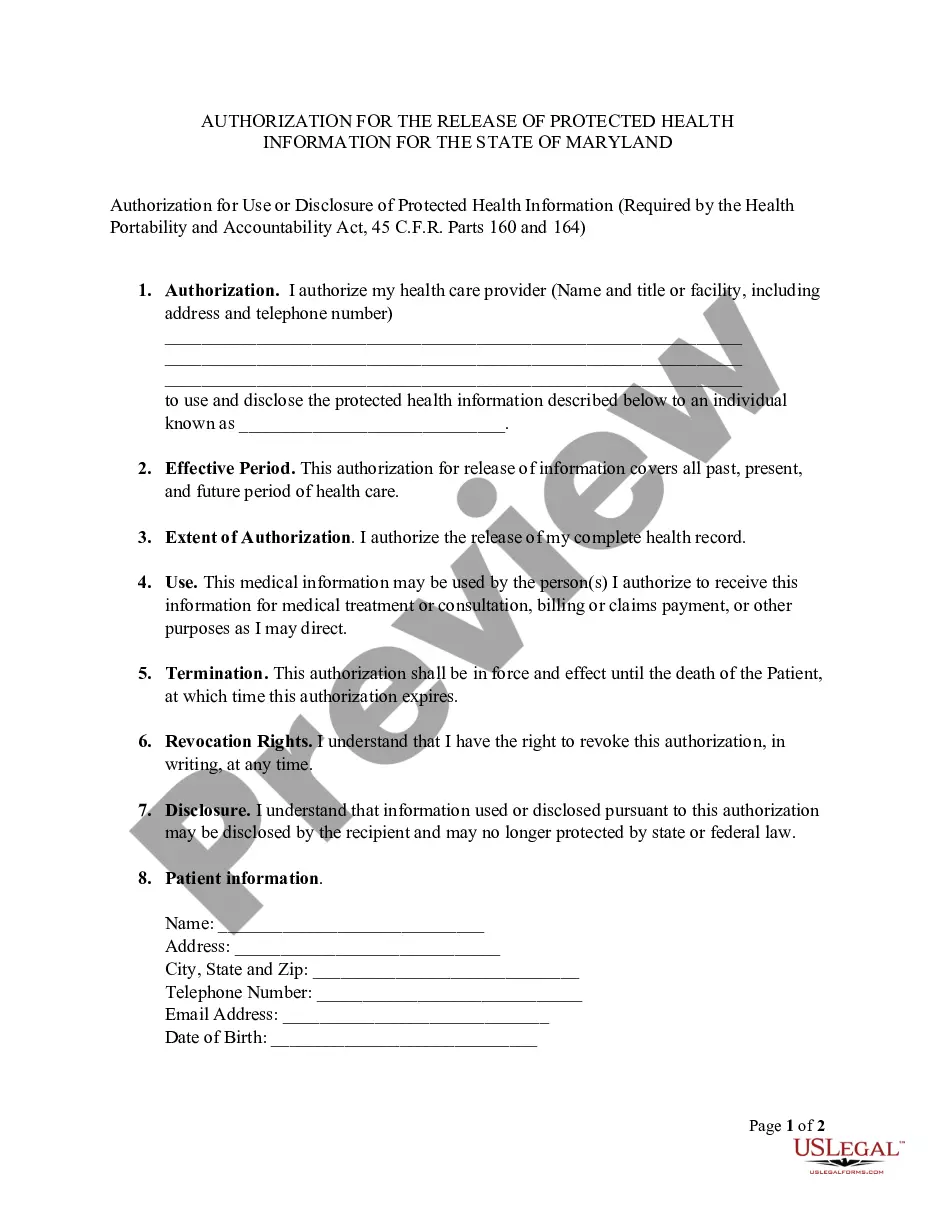

How to fill out Middlesex Massachusetts Tax Work Agreement - Self-Employed Independent Contractor?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Middlesex Tax Work Agreement - Self-Employed Independent Contractor without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Middlesex Tax Work Agreement - Self-Employed Independent Contractor on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Middlesex Tax Work Agreement - Self-Employed Independent Contractor:

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!