Oakland Michigan Tax Work Agreement — Self-Employed Independent Contractor The Oakland Michigan Tax Work Agreement — Self-Employed Independent Contractor is a legal document that outlines the tax obligations and agreements between a self-employed individual and the taxing authorities in the Oakland County, Michigan area. This agreement is specifically designed for independent contractors who operate their own businesses or work on a freelance basis in the county. Keywords: Oakland Michigan, tax work agreement, self-employed, independent contractor, tax obligations, freelancers, taxing authorities, legal document, Oakland County, Michigan. Types of Oakland Michigan Tax Work Agreement — Self-Employed Independent Contractor: 1. General Tax Work Agreement: A general tax work agreement is a comprehensive document that covers all aspects of an independent contractor's tax obligations in Oakland County, Michigan. It includes details on income reporting, deductions, estimated tax payments, and record-keeping requirements. 2. Limited Scope Tax Work Agreement: A limited scope tax work agreement focuses on specific tax aspects relevant to the self-employed individual. It may cover only certain tax deductions or requirements, depending on the contractor's business nature or industry. 3. Payroll Tax Work Agreement: Payroll tax work agreements are specifically tailored for independent contractors who have employees or subcontractors working under them. It outlines the responsibilities of the contractor for calculating, withholding, and remitting payroll taxes on behalf of their workers. 4. Sales Tax Work Agreement: For self-employed individuals involved in retail or other businesses subject to sales tax, a sales tax work agreement provides guidance on collecting, reporting, and remitting sales tax to the relevant authorities in Oakland County, Michigan. 5. Contractor-Client Tax Work Agreement: A contractor-client tax work agreement is a specialized agreement that outlines the tax responsibilities and obligations of both the independent contractor and their clients. It clarifies which party is responsible for certain tax obligations, such as filing and reporting requirements, in accordance with Oakland County, Michigan tax laws. 6. Multi-Jurisdictional Tax Work Agreement: For self-employed independent contractors who conduct business in multiple jurisdictions, such as Oakland County and other counties or states, a multi-jurisdictional tax work agreement helps determine tax obligations and reporting requirements across various locations. It is important for self-employed independent contractors in Oakland County, Michigan, to have a clear understanding of their tax obligations and to ensure compliance with local tax laws. The aforementioned types of tax work agreements provide a framework for establishing tax responsibilities and maintaining proper documentation for tax purposes in the county.

Oakland Michigan Tax Work Agreement - Self-Employed Independent Contractor

Description

How to fill out Oakland Michigan Tax Work Agreement - Self-Employed Independent Contractor?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Oakland Tax Work Agreement - Self-Employed Independent Contractor, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the latest version of the Oakland Tax Work Agreement - Self-Employed Independent Contractor, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Oakland Tax Work Agreement - Self-Employed Independent Contractor:

- Glance through the page and verify there is a sample for your area.

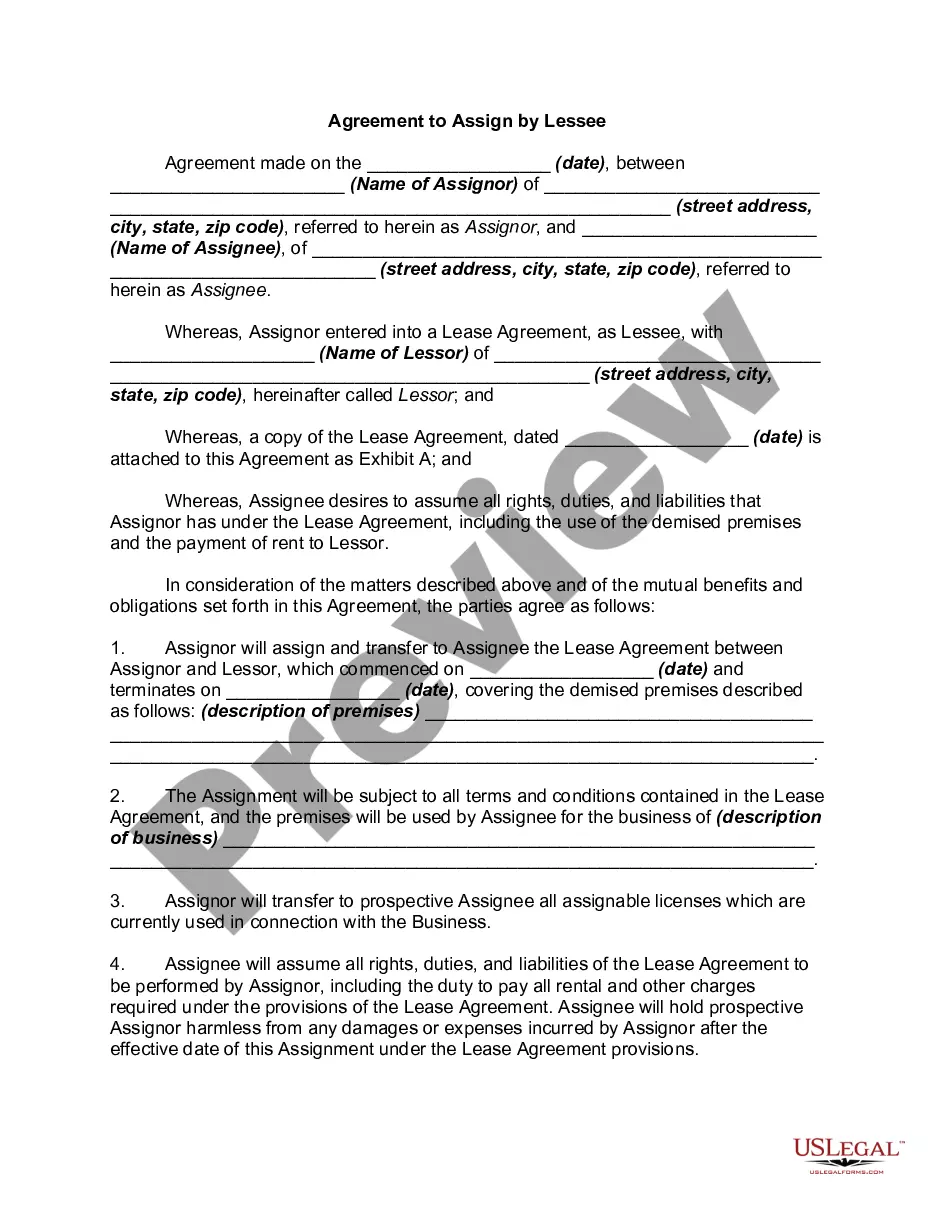

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Oakland Tax Work Agreement - Self-Employed Independent Contractor and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!