Chicago Illinois Tutoring Agreement — Self-Employed Independent Contractor A Chicago Illinois Tutoring Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between a tutor and a student seeking academic assistance in the city of Chicago, Illinois. This agreement ensures that both parties are aware of their rights and responsibilities, leading to a transparent and efficient working relationship. The agreement serves as a contract between the tutor and the student, establishing the framework for their collaboration. It covers essential aspects such as payment, scheduling, cancellation policies, and expectations for both parties involved. This agreement plays a vital role in protecting the interests of both the tutor and the student, ensuring a fair and professional working environment. Different types of Chicago Illinois Tutoring Agreement — Self-Employed Independent Contractor may include: 1. Academic Tutoring Agreement: This type of agreement focuses on providing assistance in specific academic subjects such as mathematics, science, language arts, or social sciences. It outlines the scope of tutoring services, including the specific subjects to be covered and any additional resources needed. 2. Test Preparation Tutoring Agreement: This type of agreement is intended to prepare students for standardized tests such as the SAT, ACT, GRE, or GMAT. It includes details about the test(s) the tutor will focus on, the study materials to be used, and the anticipated duration of the tutoring sessions. 3. Language Tutoring Agreement: Language tutoring agreements concentrate on improving language skills, including spoken and written fluency, pronunciation, grammar, and vocabulary. These agreements may cater to individuals seeking to learn a foreign language or improve their proficiency in their native language. 4. Specialized Tutoring Agreement: Specialized tutoring agreements target specific areas of expertise, such as music, art, sports, or computer programming. These agreements require tutors with specialized knowledge and skills in their respective fields to provide tailored instruction to students. Keywords: Chicago Illinois Tutoring Agreement, Self-Employed Independent Contractor, tutor, student, academic assistance, payment, scheduling, cancellation policies, expectations, academic tutoring, test preparation tutoring, language tutoring, specialized tutoring.

Varsity Tutors Independent Contractor Agreement

Description tutor independent contractor agreement varsity tutors

How to fill out Chicago Illinois Tutoring Agreement - Self-Employed Independent Contractor?

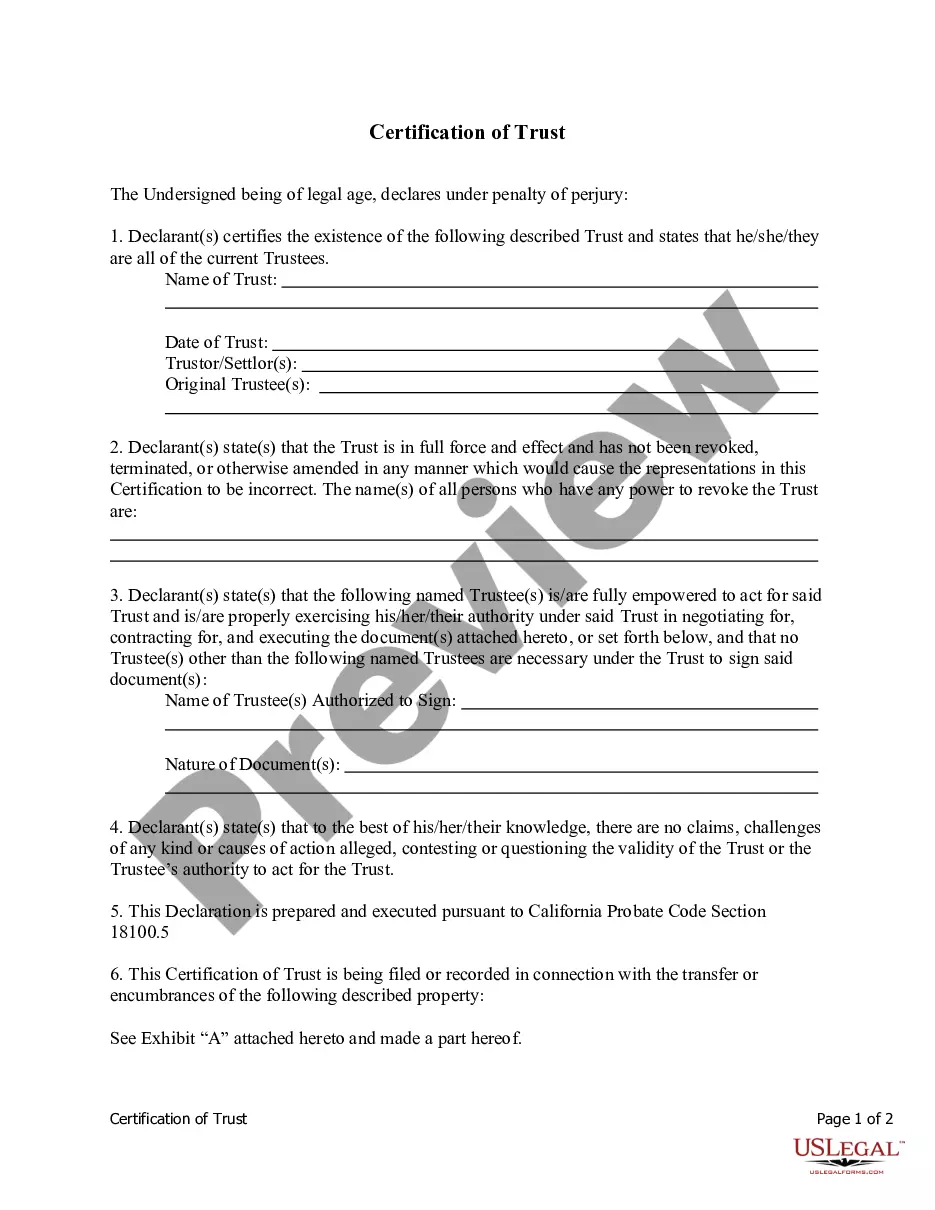

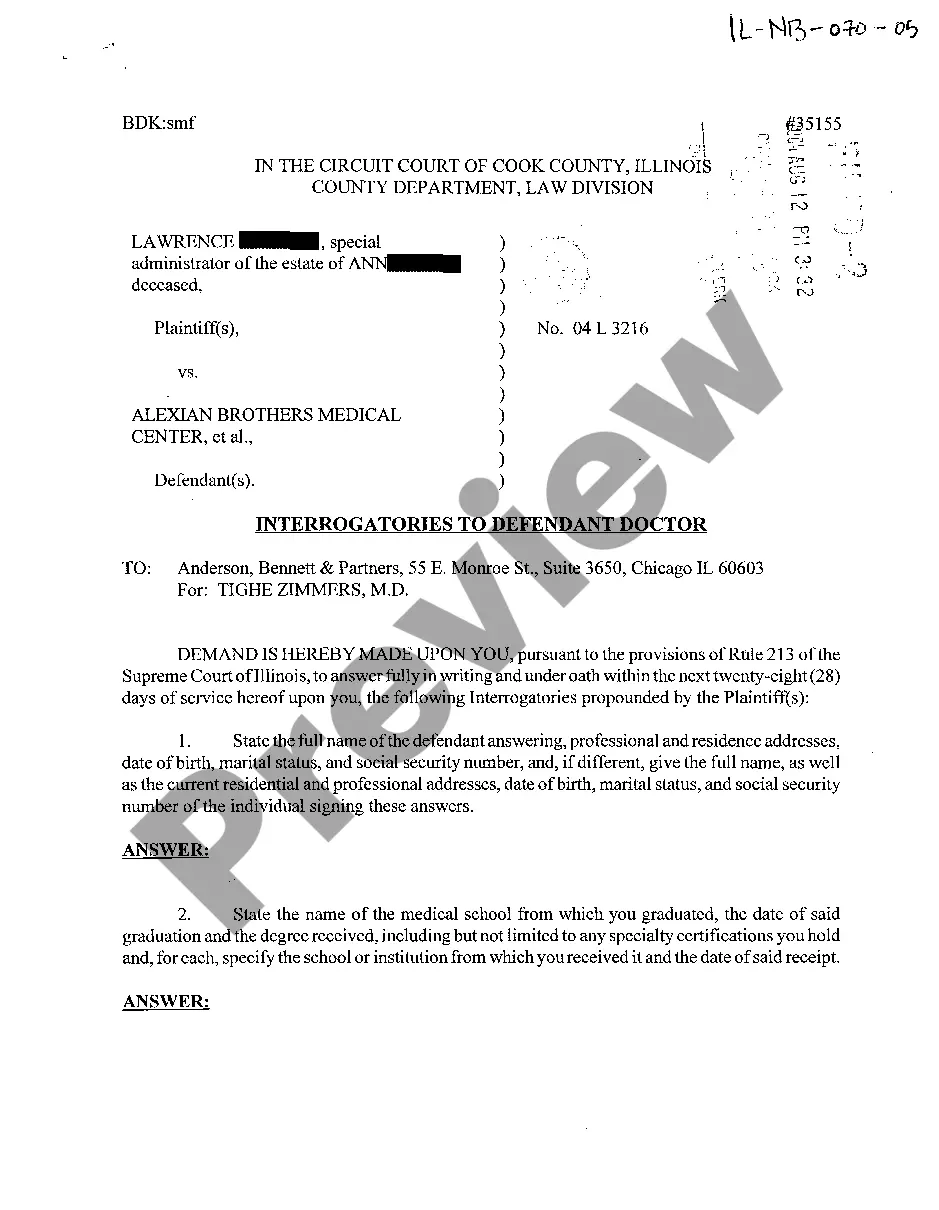

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Chicago Tutoring Agreement - Self-Employed Independent Contractor, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Therefore, if you need the latest version of the Chicago Tutoring Agreement - Self-Employed Independent Contractor, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Chicago Tutoring Agreement - Self-Employed Independent Contractor:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Chicago Tutoring Agreement - Self-Employed Independent Contractor and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

tutor independent contractor agreement Form popularity

FAQ

If you are running a tutoring business and not working under any employer, you are billed as self-employed. You may even work a full day job but still count as a self-employed tutor. According to IRS (Internal Revenue Service), you fall under the 1099 independent contractor category as a self-employed individual.

A California Independent Contractor Agreement is a contract between an independent contractor and a client where the client hires an individual or an organization in the state of California.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Filing taxes as an independent contractor in Canada As an independent contractor, you include all of your revenue as income on your personal tax return every April. However, as indicated above, you claim independent contractor tax deductions to reduce your taxable income and your tax bill!

You are typically considered an independent contractor if: you determine what work you perform, where you perform it and how it's performed; you decide whether you want to subcontract the work to other independent contractors; and. you have the opportunity to make a profit (or loss) in your own personal capacity.

Ask Clients For 1099 Forms This form is only applicable to clients who are business entities, like tutoring academies or schools, and you've collected more than $600 annually. But if your client is not a business entity, like a student or a parent, you will not need to submit the 1099-MISC.

Generally, to be legally valid, most contracts must contain two elements: All parties must agree about an offer made by one party and accepted by the other. Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

If you are working directly with students and they're paying you directly, you're self-employed. There is no ?middleman? involved in the arrangement and no one is collecting FICA payments. You are providing tutoring services directly to your students, and they are making fee payments to you, and not to a third-party.

If you're actively running your own tutoring business, and not working for an agency or other employer, you're self-employed. That's true even if you have a full-time day job. In the eyes of the Internal Revenue Service, being self-employed classifies you as a 1099 independent contractor.

As an incoming tutor, you will be classified as an Independent Contractor.? This means you will receive gross, untaxed earnings from us on a monthly basis. To set you up in our payroll system, and to ensure you get your 1099-NEC at the close of tax year, we'll need you to fill out the IRS Form W-9.