Cuyahoga Ohio Mortgage Loan Officer Agreement — Self-Employed Independent Contractor is a legal document that establishes the relationship between a mortgage loan officer and a lender operating in Cuyahoga County, Ohio. This agreement outlines the terms and conditions under which the loan officer will provide services as a self-employed independent contractor for the lender in facilitating mortgage loans within the Cuyahoga County jurisdiction. The Mortgage Loan Officer Agreement governs various aspects of the working relationship, including compensation, responsibilities, and compliance requirements. It is designed to protect the interests of both parties and ensure a clear understanding of the expectations and obligations involved. Key components typically addressed in the agreement include: 1. Roles and Responsibilities: The agreement defines the scope of the loan officer's duties and responsibilities, which may include, but are not limited to, client acquisition, loan origination, managing client relationships, and ensuring compliance with relevant laws and regulations. 2. Compensation Structure: The agreement outlines how the loan officer will be compensated for their services, such as through commissions, fees, or a combination of both, specifying the applicable rates or formulas for calculating compensation. It may also include provisions for expense reimbursement, if applicable. 3. Compliance Requirements: Given the regulated nature of the mortgage industry, the agreement includes provisions outlining the loan officer's obligation to comply with federal, state, and local laws governing mortgage lending, as well as any specific lender policies or procedures. 4. Non-Disclosure and Confidentiality: To protect sensitive information, the agreement may contain clauses prohibiting the loan officer from disclosing any confidential or proprietary information obtained during the course of their work, both during and after the term of the agreement. 5. Termination and Renewal: The agreement typically includes provisions outlining the conditions under which either party may terminate the agreement, such as breach of contract or non-performance. It may also specify any automatic renewal provisions or notice requirements. Different types of Cuyahoga Ohio Mortgage Loan Officer Agreement — Self-Employed Independent Contractor can include specific variations to accommodate the unique needs of different lenders or loan officers. Some may has additional clauses relating to marketing responsibilities, managing leads, or utilizing specific software or systems. In conclusion, the Cuyahoga Ohio Mortgage Loan Officer Agreement — Self-Employed Independent Contractor is a crucial legal document that defines the working relationship between a mortgage loan officer and a lender operating in Cuyahoga County, Ohio. By establishing clear terms and expectations, this agreement ensures a mutual understanding of the roles, compensation, compliance requirements, and confidentiality obligations involved in the loan officer's self-employed independent contractor arrangement.

Cuyahoga Ohio Mortgage Loan Officer Agreement - Self-Employed Independent Contractor

Description

How to fill out Cuyahoga Ohio Mortgage Loan Officer Agreement - Self-Employed Independent Contractor?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life sphere, finding a Cuyahoga Mortgage Loan Officer Agreement - Self-Employed Independent Contractor meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. In addition to the Cuyahoga Mortgage Loan Officer Agreement - Self-Employed Independent Contractor, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Cuyahoga Mortgage Loan Officer Agreement - Self-Employed Independent Contractor:

- Examine the content of the page you’re on.

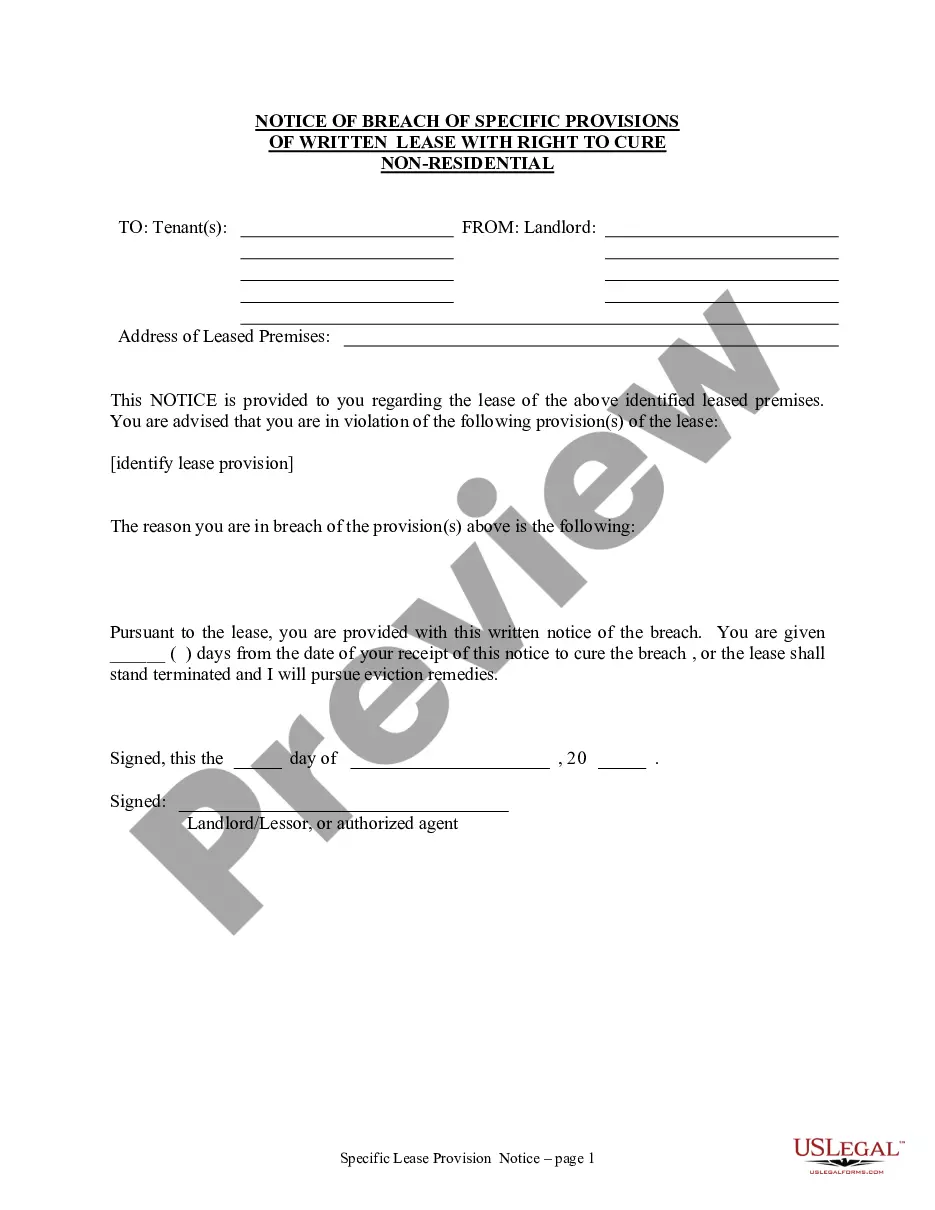

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Cuyahoga Mortgage Loan Officer Agreement - Self-Employed Independent Contractor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!