A Fairfax Virginia Mortgage Loan Officer Agreement is a legal document that outlines the terms and conditions between a mortgage loan officer and a company or client when operating in a self-employed capacity as an independent contractor. This agreement serves as a binding contract to ensure both parties are protected and understand their roles, responsibilities, and compensation. Keywords: — Fairfax Virginia: Refers to the specific location where the Mortgage Loan Officer Agreement is applicable, indicating that it is specific to the state of Virginia and specifically the city of Fairfax. — Mortgage Loan Officer: Denotes the profession of the individual involved in the agreement, responsible for assisting clients in obtaining mortgage loans. — Agreement: Highlights the legal nature of the document and signifies that it establishes an understanding and contract between the parties involved. — Self-Employed: Indicates that the mortgage loan officer works for themselves rather than being employed by a company, allowing for independence and control over their work. — Independent Contractor: Refers to the employment status of the mortgage loan officer, meaning that they are not considered an employee of the company they work with but rather a separate entity entering into a contractual relationship. — Detailed description: Specifies that the content provided will thoroughly describe the Fairfax Virginia Mortgage Loan Officer Agreement, leaving no important aspect untouched. Types of Fairfax Virginia Mortgage Loan Officer Agreement — Self-Employed Independent Contractor: 1. Individual Loan Officer Agreement: This agreement involves a single mortgage loan officer working independently with a company or client. 2. Team Loan Officer Agreement: When multiple loan officers work together under a team structure, this agreement outlines the terms and conditions for their collaboration with the company or client. 3. Exclusive Loan Officer Agreement: This type of agreement ensures that the independent contractor mortgage loan officer exclusively works with a particular company, prohibiting them from entering into agreements with competing entities. 4. Non-Exclusive Loan Officer Agreement: Contrasting, this agreement allows the mortgage loan officer to work with multiple companies simultaneously, providing flexibility in their client base and potential income streams. Overall, a Fairfax Virginia Mortgage Loan Officer Agreement — Self-Employed Independent Contractor is a crucial legal document that protects the interests of both parties involved in the mortgage loan process, setting clear guidelines for their professional relationship.

Fairfax Virginia Mortgage Loan Officer Agreement - Self-Employed Independent Contractor

Description

How to fill out Fairfax Virginia Mortgage Loan Officer Agreement - Self-Employed Independent Contractor?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

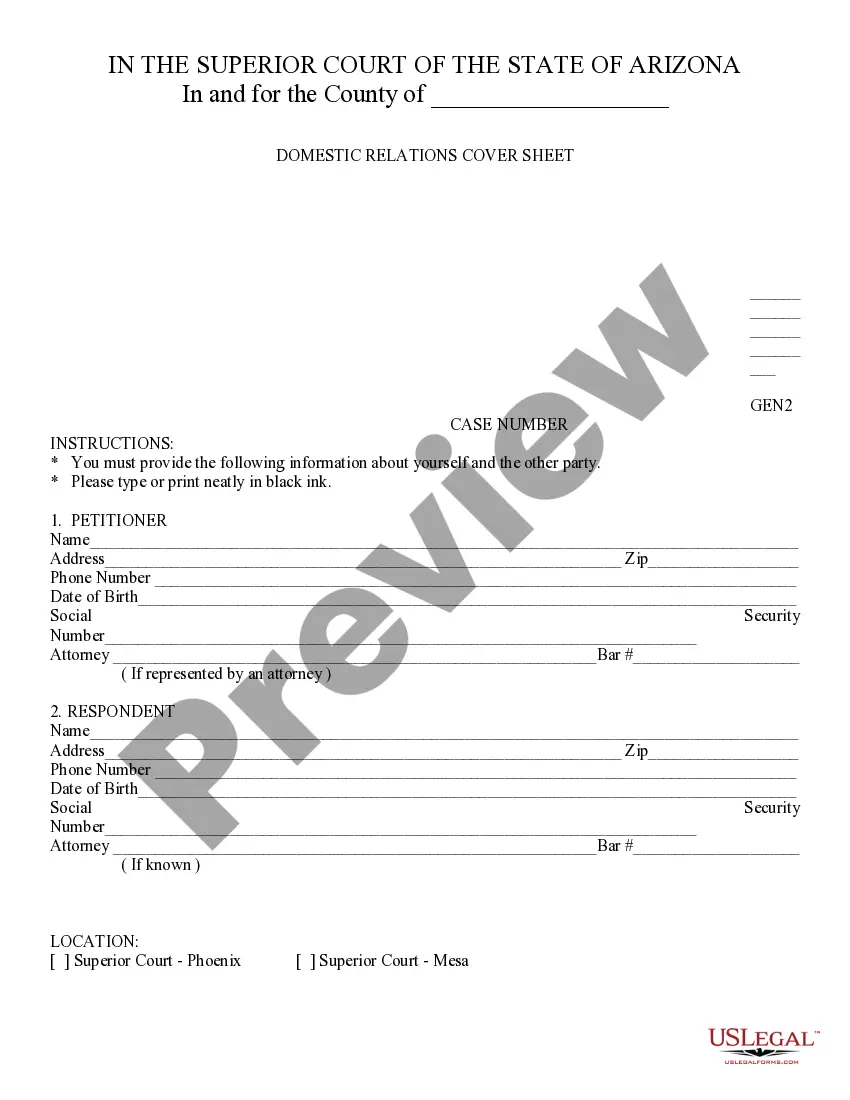

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Fairfax Mortgage Loan Officer Agreement - Self-Employed Independent Contractor.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Fairfax Mortgage Loan Officer Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Fairfax Mortgage Loan Officer Agreement - Self-Employed Independent Contractor:

- Make sure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Fairfax Mortgage Loan Officer Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Since loan originators can operate as 1099 independent contractors the NMLS has both relationship options available. See below. STATE REQUIREMENTS: State requirements vary from state to state.

To prove your income when you apply for a self-employed mortgage, you will need to provide: Two or more years' certified accounts. SA302 forms or a tax year overview (from HMRC) for the past two or three years. Evidence of upcoming contracts (if you're a contractor)

Addbacks can include any of the of the following expense items: Depreciation. Instant asset write. Interest Amortization. Non-compulsory superannuation. Non-recurring expenses. Abnormal expenses. One-off expenses. Director's fees.

Gross self-employment income means the total amount of money the trade or business produces. Gross self-employment income is computed by totaling the gross business receipts (income) for the business enterprise. Allowable costs of doing business are not deducted in determining gross self-employment income.

As a self-employed professional (especially if you're a freelancer or independent contractor), the biggest hurdle you'll cross during the mortgage process is validating your income. Your Mortgage Loan Originator (MLO) understands your income may fluctuate from month to month and year to year.

A mortgage loan originator (MLO) is a person or institution that helps a prospective borrower get the right mortgage for a real estate transaction. The MLO is the original lender for the mortgage and works with the borrower from application and approval through the closing process.

Lenders expect earnings on track with or higher than what you made on your tax returns. CPA letters. Lenders may ask your tax professional for a letter of explanation to verify your self-employment status or clarify specific details, such as your income. Documentation of business funds used for a down payment.

Commercial Mortgage Originator Originators are independent contractors working on a commission basis.

Employees (and employers) are all subject to federal and state wage hour rules. The CFPB refers to Mortgagee Letter 2006-30 and affirms it will follow HUD's rule, which is to say that Mortgage Brokers and Mortgage lenders must pay their loan officers W-2 and that 1099 is illegal under HUD/CFPB Guidelines.