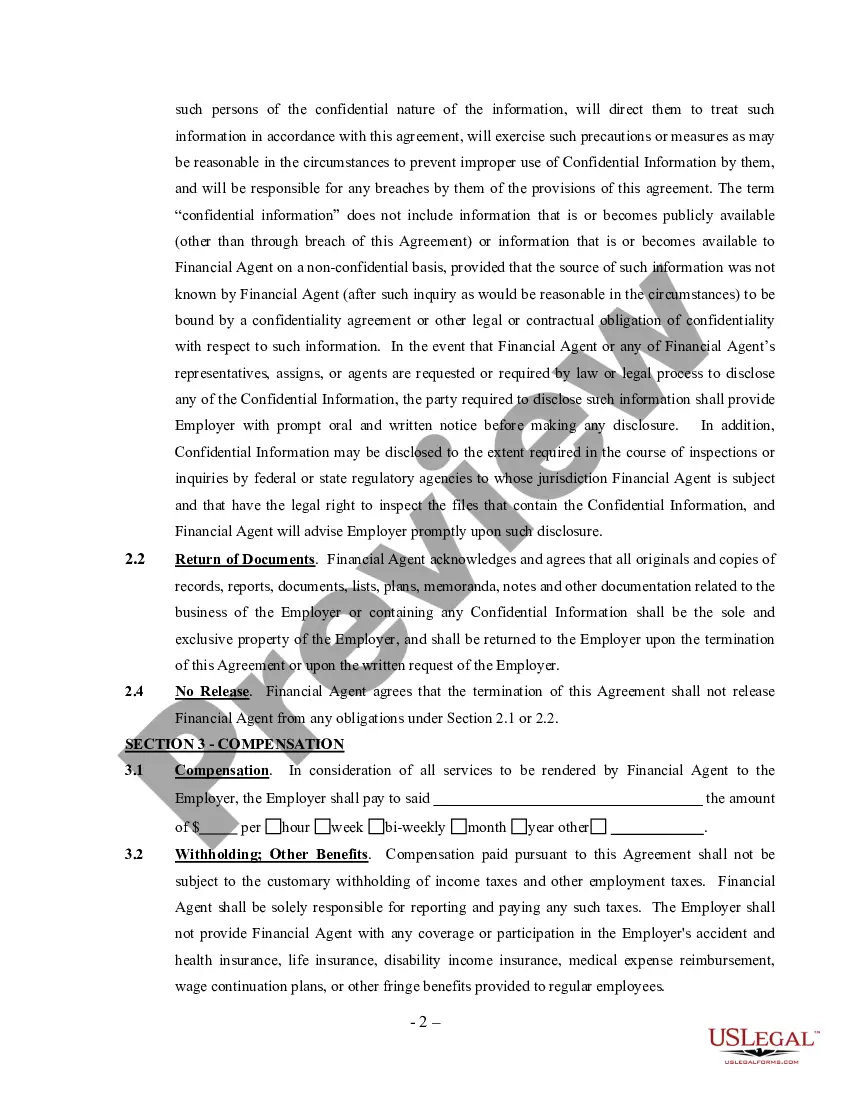

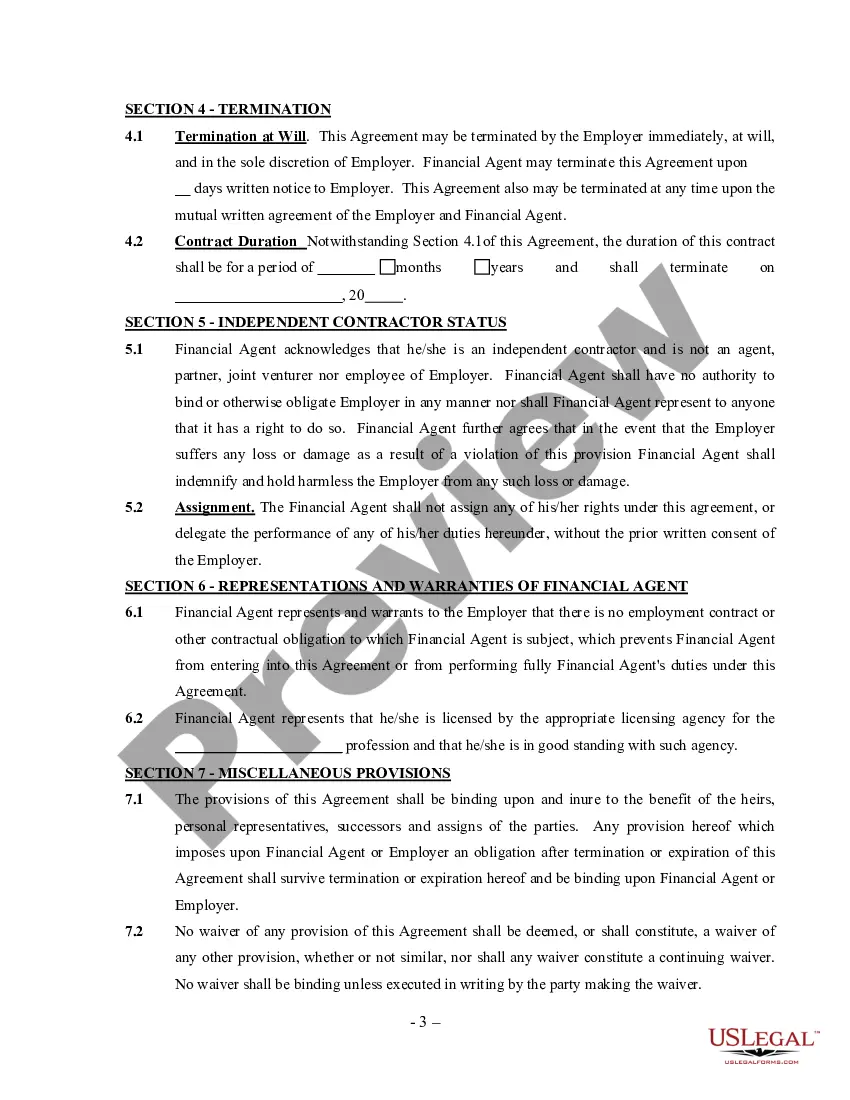

Cuyahoga Ohio Financial Services Agent Agreement — Self-Employed Independent Contractor is a legal contract designed for individuals in the financial services industry who wish to work as independent contractors in the Cuyahoga area of Ohio. This agreement outlines the terms and conditions under which the agent will provide their services to clients and the responsibilities they hold as a self-employed professional. Key terms and clauses included in the Cuyahoga Ohio Financial Services Agent Agreement — Self-Employed Independent Contractor may cover aspects such as: 1. Services Provided: This section defines the scope of the services that the financial agent will offer to clients. It may include services like investment planning, retirement planning, tax preparation, wealth management, or insurance brokerage. 2. Client Relationship: The agreement may specify that the agent-client relationship is solely between the agent and their clients, clarifying that the agent is not an employee or representative of any specific financial institution. 3. Compensation and Commission: Details regarding the agent's compensation structure are typically outlined in this section. This may include the commission structure, payment terms, and possible performance-based incentives. 4. Compliance with Regulations: Financial agents are required to adhere to various laws and regulations governing the financial services industry. The agreement may specify that the agent must comply with all applicable federal, state, and local laws, as well as industry-specific regulations. 5. Non-Disclosure and Confidentiality: Given the sensitive nature of financial information, this section highlights the agent's obligation to maintain client confidentiality and protect their data from unauthorized access or disclosure. 6. Termination: This section details the conditions under which the agreement can be terminated by either party, such as breach of contract, failure to fulfill obligations, or at the request of the agent or client. Different types or variations of the Cuyahoga Ohio Financial Services Agent Agreement — Self-Employed Independent Contractor may exist depending on specific requirements or nuances within the financial services industry. Some potential variations could include agreements tailored for: 1. Insurance Agents: This version of the agreement may focus specifically on insurance-related services, covering aspects such as policies, premiums, claims, and regulatory compliance within the insurance industry. 2. Investment Advisors: For individuals offering investment advisory services, this variation may include additional provisions related to securities laws, registration requirements, investment strategies, and risk disclosures. 3. Tax Consultants: This type of agreement may be specific to tax consulting services, addressing topics such as tax preparation, filing, audits, and compliance with changing tax regulations. It is important to note that the content of the Cuyahoga Ohio Financial Services Agent Agreement — Self-Employed Independent Contractor should be customized to meet the unique needs and legal requirements of both the financial agent and their clients. Engaging legal professionals or consultants knowledgeable in the financial services industry can help ensure the agreement is comprehensive, accurate, and compliant with relevant laws and regulations.

Cuyahoga Ohio Financial Services Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Cuyahoga Ohio Financial Services Agent Agreement - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your county, including the Cuyahoga Financial Services Agent Agreement - Self-Employed Independent Contractor.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Cuyahoga Financial Services Agent Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Cuyahoga Financial Services Agent Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Cuyahoga Financial Services Agent Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!