King Washington Financial Services Agent Agreement — Self-Employed Independent Contractor is a legally binding document that establishes the terms and conditions between King Washington Financial Services and individuals who wish to work as agents or independent contractors. This agreement outlines the specific roles, responsibilities, and rights of both parties involved in the financial services industry. As a self-employed independent contractor, agents partnering with King Washington Financial Services gain the freedom to work on their own terms, deciding their working hours and business strategies. However, they are required to adhere to the policies, procedures, and standards set forth by the company. The agreement generally covers several key aspects to ensure clarity and a mutually beneficial working relationship. The Agent Agreement identifies the nature of the relationship between the agent and King Washington Financial Services, emphasizing it as an independent contractor arrangement rather than an employer-employee relationship. Agents maintain their autonomy and are responsible for their expenses, taxes, and compliance with applicable laws and regulations. The agent's responsibilities typically include prospecting and acquiring clients, providing financial advice and services, promoting and selling financial products or services offered by King Washington Financial Services, and maintaining accurate records. They may also be required to participate in ongoing training programs and stay updated with industry trends and regulations. King Washington Financial Services provides support to their agents through administrative assistance, training materials, marketing resources, and access to their product portfolio. Compensation terms, commission structures, and bonuses are typically outlined in the agreement, ensuring transparency and fair payment for services rendered. Depending on the specific type of financial services offered by King Washington Financial Services, variations of the Agent Agreement may exist. Examples include agreements specific to insurance agents, investment advisors, mortgage brokers, or retirement planning specialists. These specialized agreements cater to the unique requirements and regulations governing each area of financial services. In conclusion, the King Washington Financial Services Agent Agreement — Self-Employed Independent Contractor provides an opportunity for individuals interested in the financial services industry to work as independent contractors while leveraging the resources and support of a reputable financial services company. It sets the foundation for a collaborative partnership that allows agents to build their businesses and provide valuable financial solutions to clients.

King Washington Financial Services Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out King Washington Financial Services Agent Agreement - Self-Employed Independent Contractor?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the King Financial Services Agent Agreement - Self-Employed Independent Contractor, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the King Financial Services Agent Agreement - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make a few more steps to get the King Financial Services Agent Agreement - Self-Employed Independent Contractor:

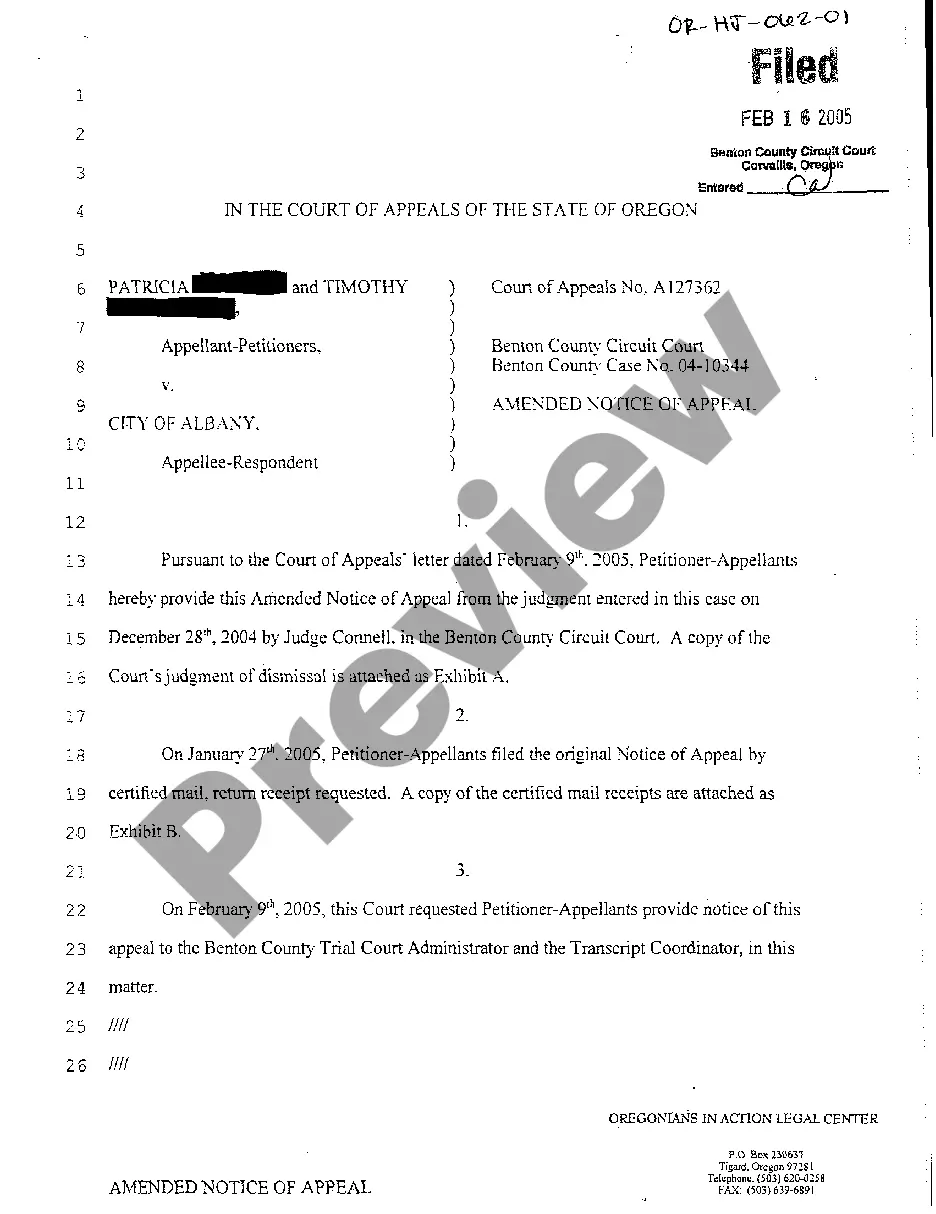

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!