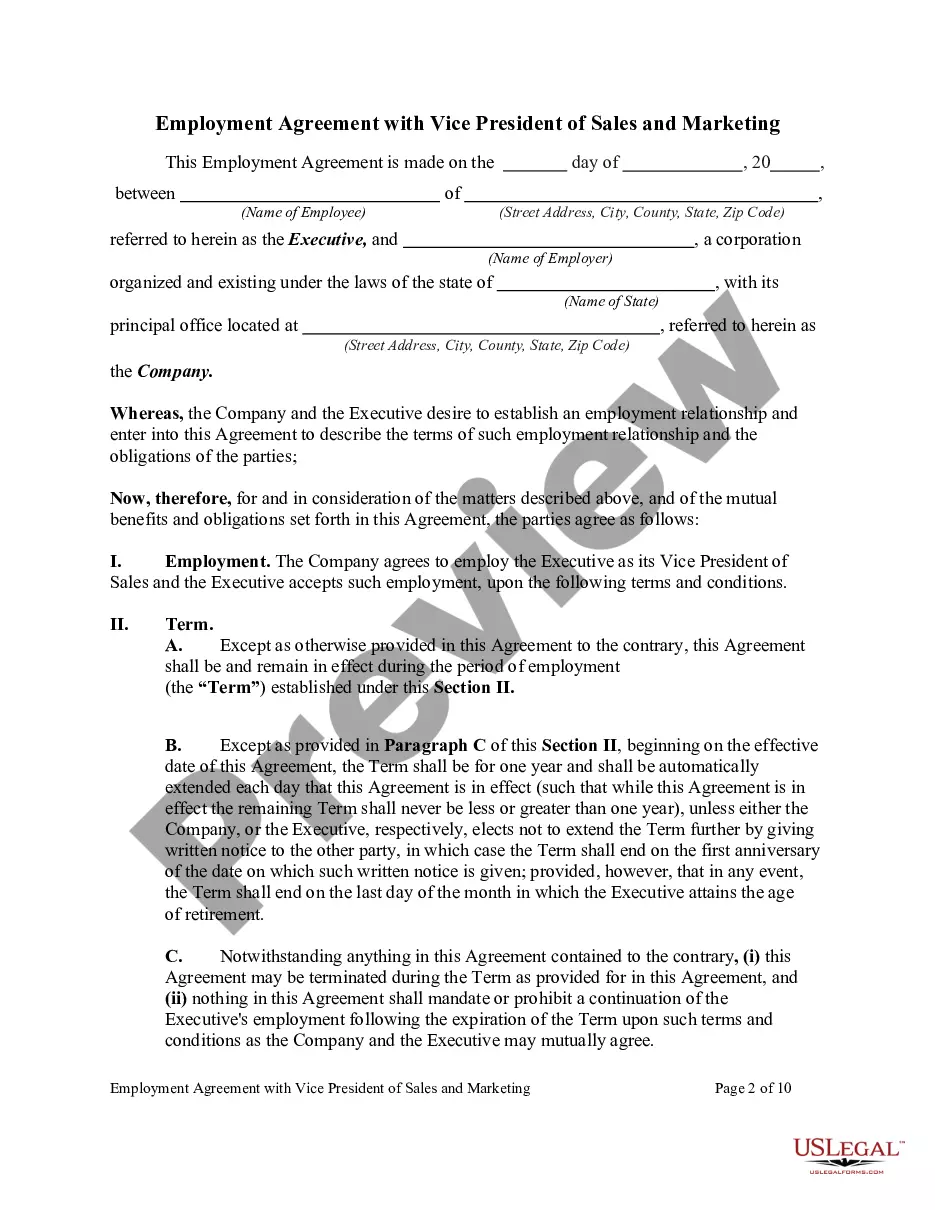

The Wake North Carolina Financial Services Agent Agreement — Self-Employed Independent Contractor is a legally binding contract that outlines the terms and conditions between a financial services agent and the agency they work for in Wake, North Carolina. This agreement serves as a framework for establishing the working relationship and responsibilities of the agent as a self-employed independent contractor. Key components of this agreement include: 1. Scope of Work: The agreement clearly defines the specific financial services that the agent will provide, such as investment advice, insurance sales, or tax planning. It outlines the agent's obligations and sets expectations for the quality and timeliness of their work. 2. Compensation and Commission Structure: The agreement details how the agent will be compensated for their services. This may include a base salary, commission on sales, or a combination of both. The commission structure is outlined, specifying the percentage or amount the agent will receive for each successful transaction. 3. Non-Compete and Non-Disclosure: To protect the agency's proprietary information, the agreement typically includes non-compete and non-disclosure clauses. These clauses prohibit the agent from sharing or using confidential information for personal gain during and after their contract term. 4. Termination and Renewal: The agreement outlines the terms for terminating the contract by either party. It may stipulate the required notice period and conditions for termination. Additionally, the agreement may include provisions for contract renewal, specifying whether it will automatically renew or require negotiation for a new term. 5. Compliance and Regulation: Financial services agents are often subject to regulatory requirements and compliance obligations. This agreement may include provisions requiring the agent to adhere to applicable laws, regulations, and ethical standards. It may also outline any licenses or certifications that the agent must maintain. Different types of Wake North Carolina Financial Services Agent Agreement — Self-Employed Independent Contractor might include variations depending on the specific agency or financial services being provided. For example, there could be agreements tailored for insurance agents, investment advisors, or tax consultants. Each agreement would outline the unique terms and conditions relevant to that particular type of financial service.

Wake North Carolina Financial Services Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Wake North Carolina Financial Services Agent Agreement - Self-Employed Independent Contractor?

Do you need to quickly draft a legally-binding Wake Financial Services Agent Agreement - Self-Employed Independent Contractor or probably any other document to handle your personal or corporate matters? You can select one of the two options: contact a legal advisor to draft a valid paper for you or create it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific document templates, including Wake Financial Services Agent Agreement - Self-Employed Independent Contractor and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, carefully verify if the Wake Financial Services Agent Agreement - Self-Employed Independent Contractor is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the document isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Wake Financial Services Agent Agreement - Self-Employed Independent Contractor template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the paperwork we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!