Orange California Insurance Agent Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions between an insurance agent and an insurance company. This agreement serves as a binding contract that defines the relationship and responsibilities of the insurance agent as a self-employed independent contractor. The different types of Orange California Insurance Agent Agreement — Self-Employed Independent Contractor can be categorized based on the type of insurance being sold. These may include: 1. Health Insurance Agent Agreement: This agreement pertains to insurance agents specializing in health insurance policies. It outlines the agent's responsibilities, commission structure, and the terms for renewals and cancellations of policies. 2. Auto Insurance Agent Agreement: This type of agreement is specific to insurance agents focusing on auto insurance policies. It includes details about policy terms, coverage options, and commission rates for the agent. 3. Home Insurance Agent Agreement: This agreement applies to insurance agents who primarily sell homeowner's insurance policies. It covers information about exclusions, claim procedures, and the agent's obligations in relation to policyholders. 4. Life Insurance Agent Agreement: This contract is designed for insurance agents specializing in life insurance policies. It includes provisions on policy terms, beneficiary designations, commission structure, and legal requirements for selling life insurance. 5. Commercial Insurance Agent Agreement: This agreement is tailored for insurance agents specializing in commercial insurance, including coverage for businesses and commercial properties. It addresses policy exclusions, coverage limits, and commission rates for commercial insurance agents. The Orange California Insurance Agent Agreement — Self-Employed Independent Contractor typically outlines the following key aspects: 1. Parties Involved: Clearly identifies the insurance company and the self-employed independent contractor (the insurance agent). 2. Scope of Services: Defines the responsibilities and duties of the insurance agent, including sales targets, customer service, and adherence to legal and ethical standards. 3. Compensation and Commission: Specifies the commission structure, payment terms, and any additional compensation or incentives agreed upon between the insurance company and the agent. 4. Termination and Renewal: Outlines the circumstances under which the agreement may be terminated, such as breach of contract, non-performance, or mutual agreement. It also includes details on renewal terms and procedures. 5. Confidentiality and Non-Compete: Defines the confidentiality obligations of the insurance agent, including non-disclosure of proprietary information and limitations on competing with the insurance company during and after the agreement. 6. Indemnification and Liability: Clarifies the responsibilities and liabilities of both parties, including indemnification for any claims or damages arising from the agent's actions or omissions. 7. Governing Law: Specifies the governing jurisdiction and applicable laws for the agreement, typically those of Orange County, California. It is important for insurance agents in Orange California to understand the specific terms and conditions of the Insurance Agent Agreement — Self-Employed Independent Contractor applicable to their specialty. By having a comprehensive agreement in place, both the insurance company and the self-employed independent contractor can protect their rights and obligations while ensuring a mutually beneficial working relationship.

Orange California Insurance Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Orange California Insurance Agent Agreement - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business objective utilized in your region, including the Orange Insurance Agent Agreement - Self-Employed Independent Contractor.

Locating forms on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Orange Insurance Agent Agreement - Self-Employed Independent Contractor will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Orange Insurance Agent Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the correct page with your localised form.

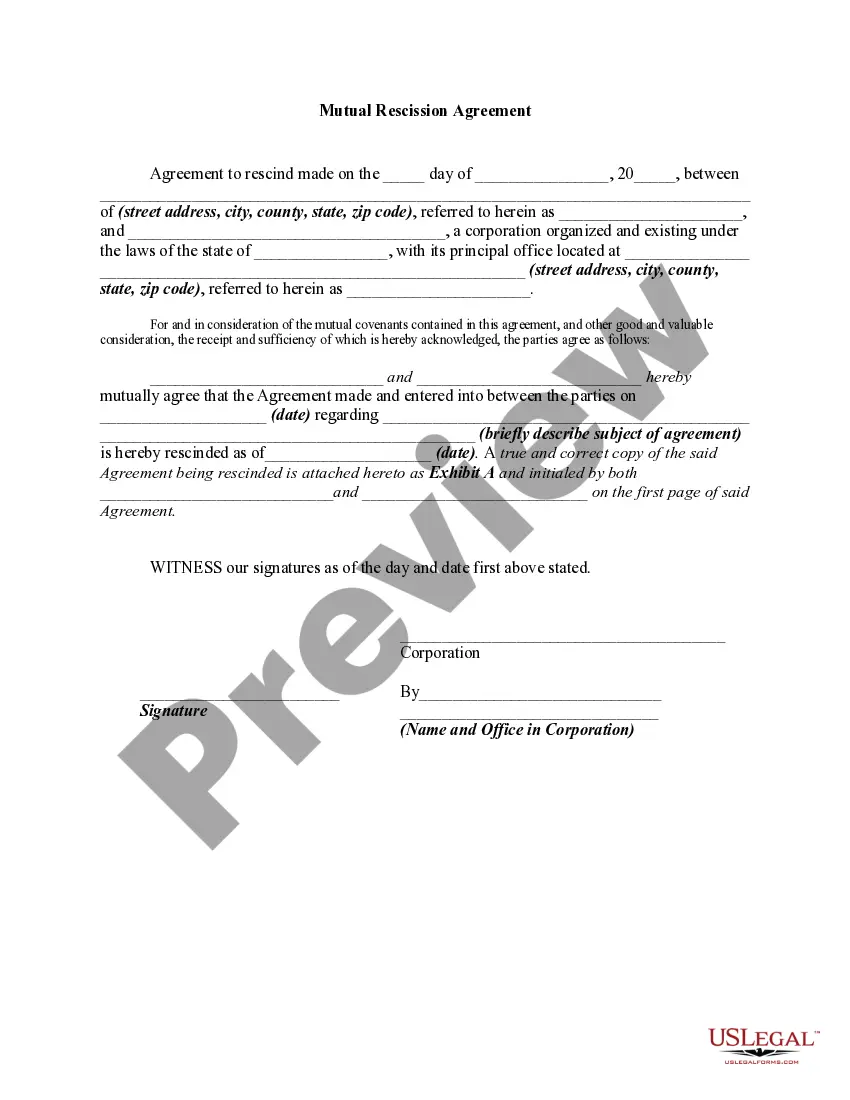

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Orange Insurance Agent Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!