The Wake North Carolina Insurance Agent Agreement is a legal contract that outlines the terms and conditions between an insurance company and a self-employed independent contractor who will be operating as an insurance agent in the Wake area of North Carolina. This agreement serves as a comprehensive document that governs the relationship and responsibilities of both parties involved. In this agreement, the insurance agent is classified as a self-employed independent contractor rather than an employee of the insurance company. This means that the agent has the freedom to operate their business autonomously, setting their own schedule and working independently to generate sales and provide insurance services to clients in the Wake area. The Wake North Carolina Insurance Agent Agreement typically includes various clauses and provisions that define the nature of the relationship between the insurance company and the agent. These may include: 1. Commission Structure: This section outlines how the insurance agent will be compensated for their services based on the sales they generate. It may specify a commission percentage or a tiered commission structure for different types of insurance products. 2. Exclusive vs. Non-Exclusive Agreement: Some Wake North Carolina Insurance Agent Agreements may be exclusive, meaning the agent agrees to work solely for the insurance company and cannot represent any other insurance provider. Non-exclusive agreements allow the agent to work for other insurance companies simultaneously. 3. Territory and Client Base: The agreement may specify the designated territory or area in Wake, North Carolina, where the insurance agent can operate and solicit business. It may also detail if there are any restrictions on soliciting clients from other agents or the insurance company's existing client base. 4. Responsibilities and Obligations: This section outlines the expectations and obligations of both the insurance company and the agent. It may include requirements such as maintaining appropriate licensing, attending training sessions, submitting regular reports, and complying with state and federal regulations. 5. Termination and Renewal: The Wake North Carolina Insurance Agent Agreement typically includes provisions on termination and renewal. It may outline the conditions under which either party can terminate the agreement, including notice periods and breach of contract scenarios. Renewal clauses may specify terms for extending the agreement after the initial term expires. 6. Confidentiality and Non-Disclosure: Insurance agent agreements often include provisions regarding the protection of confidential information. These clauses prohibit the agent from disclosing any sensitive or proprietary information about the insurance company, its clients, or trade secrets. It is important to note that the specific details of the Wake North Carolina Insurance Agent Agreement may vary between insurance companies or even individual agents within the Wake area. Different insurance companies might have their own variations of this agreement tailored to their specific needs and preferences. Therefore, it is crucial for both parties to carefully review and negotiate the terms before signing the agreement to ensure a mutually beneficial working relationship.

Wake North Carolina Insurance Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Wake North Carolina Insurance Agent Agreement - Self-Employed Independent Contractor?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Wake Insurance Agent Agreement - Self-Employed Independent Contractor, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the latest version of the Wake Insurance Agent Agreement - Self-Employed Independent Contractor, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Wake Insurance Agent Agreement - Self-Employed Independent Contractor:

- Glance through the page and verify there is a sample for your region.

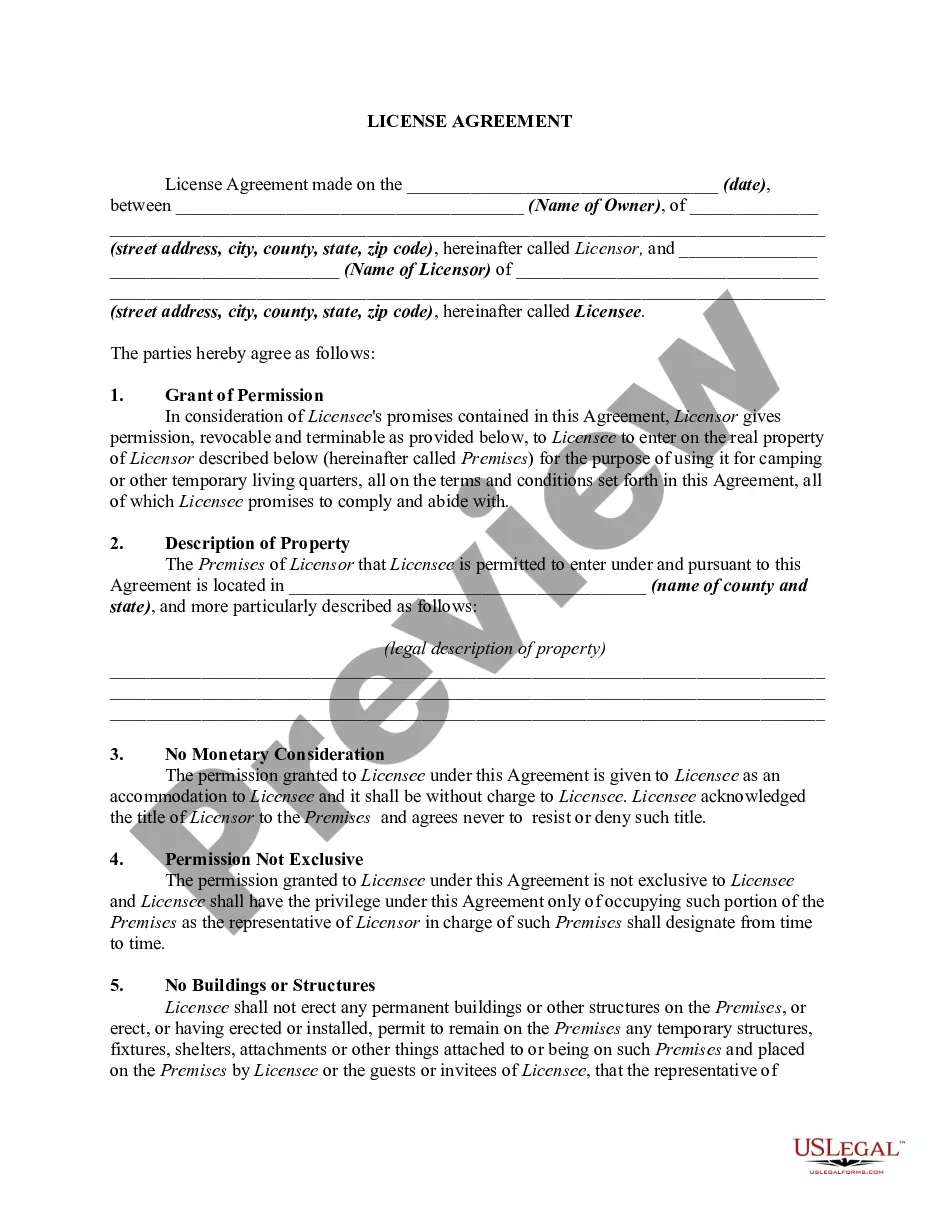

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Wake Insurance Agent Agreement - Self-Employed Independent Contractor and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!