Cook Illinois Boiler And Radiator Services Contract - Self-Employed

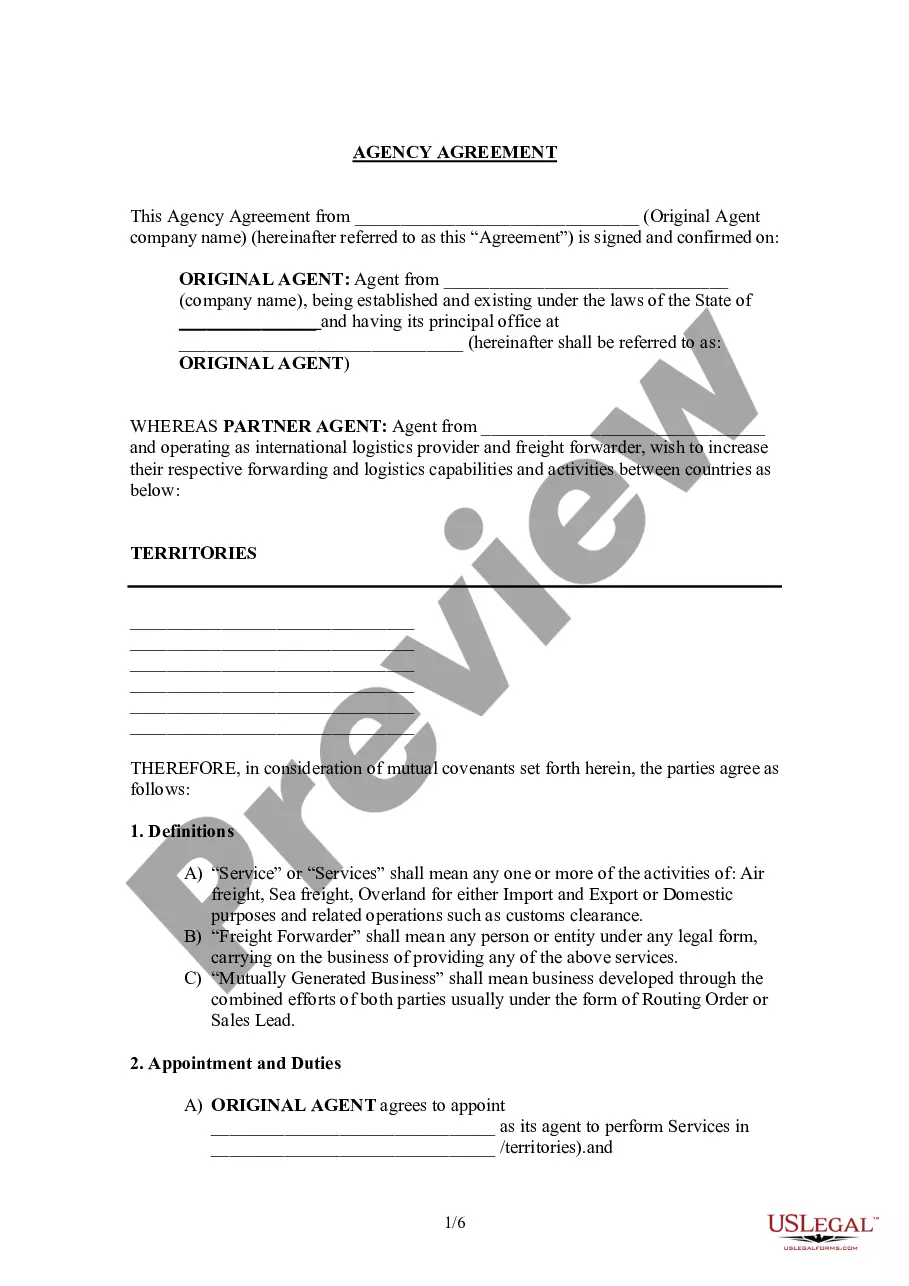

Description

How to fill out Boiler And Radiator Services Contract - Self-Employed?

How long does it usually take you to create a legal document.

Since every state has its own laws and regulations for various life scenarios, locating a Cook Boiler And Radiator Services Contract - Self-Employed that meets all local requirements can be exhausting, and acquiring it from a professional lawyer is frequently expensive.

Many online platforms provide the most common state-specific documents for download, but utilizing the US Legal Forms library is the most beneficial.

Choose the subscription plan that fits you best. Create an account on the platform or Log In to continue to payment options. Pay through PayPal or with your credit card. Change the file format if necessary. Click Download to save the Cook Boiler And Radiator Services Contract - Self-Employed. Print the document or use any preferred online editor to fill it out electronically. Regardless of how many times you need to utilize the purchased document, you can find all the templates you’ve ever saved in your account by accessing the My documents tab. Give it a try!

- US Legal Forms is the largest online collection of templates, organized by states and applications.

- In addition to the Cook Boiler And Radiator Services Contract - Self-Employed, you can find any particular document to manage your business or personal affairs, in accordance with your county regulations.

- Experts validate all templates for their accuracy, so you can be confident in preparing your documents properly.

- Using the service is incredibly straightforward.

- If you already possess an account on the platform and your subscription is active, you simply need to Log In, select the desired template, and download it.

- You can store the file in your account at any time in the future.

- Alternatively, if you are new to the platform, there will be some additional steps to complete before you receive your Cook Boiler And Radiator Services Contract - Self-Employed.

- Check the details of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re confident in the chosen file.

Form popularity

FAQ

Becoming an independent contractor in Illinois involves several key steps. First, establish your business entity by filing the appropriate paperwork with the state. Make sure you understand the specific requirements for the Cook Illinois Boiler And Radiator Services Contract - Self-Employed, as they may influence your operations. Utilize platforms like uslegalforms to ensure your contracts and legal documents adhere to state regulations and properly protect your business interests.

To become a 1099 contractor, you first need to register your business with the state of Illinois. After that, keep accurate records of your earnings and expenses, as you'll report this information on your tax return. It's also essential to have contracts in place with your clients, including terms that align with the Cook Illinois Boiler And Radiator Services Contract - Self-Employed. Additionally, you may want to consult a tax professional to understand your obligations regarding self-employment taxes.

Yes, there can be time limits for independent contractors in Illinois related to contracts and tax obligations. For example, contracts may specify completion dates or deadlines for payments. It's essential to be aware of these time constraints if you are working under a Cook Illinois Boiler And Radiator Services Contract - Self-Employed to avoid potential penalties.

Independent contractors in Illinois must report their earnings and expenses accurately for tax purposes. They should maintain detailed records of their income and any related expenses to maximize deductions. Ensuring compliance with these reporting requirements is crucial for those operating under a Cook Illinois Boiler And Radiator Services Contract - Self-Employed.

If you need to report a contractor in Illinois, you should contact the appropriate state agency or regulatory body overseeing licensing in your industry. For instance, in the case of Cook Illinois Boiler And Radiator Services Contract - Self-Employed, you may want to reach out to the Department of Financial and Professional Regulation. Providing detailed information and documentation can help ensure that your report is taken seriously.

The independent contractor rule in Illinois establishes guidelines for determining whether a worker qualifies as an independent contractor or an employee. This rule involves examining factors such as control over work, investment in equipment, and opportunity for profit or loss. It's essential for individuals working under a Cook Illinois Boiler And Radiator Services Contract - Self-Employed to familiarize themselves with these criteria.

The statute of independent contractors in Illinois defines how individuals are categorized for employment purposes. This classification impacts taxation, benefits, and legal responsibilities. If you're involved in Cook Illinois Boiler And Radiator Services Contract - Self-Employed, understanding this statute is vital for maintaining compliance and protecting your rights.

A 1099 employee receives a 1099 form for tax purposes while an independent contractor operates as a self-employed individual. 1099 employees typically work for a single company without being considered traditional employees, while independent contractors may work for multiple clients simultaneously. Those offering services under a Cook Illinois Boiler And Radiator Services Contract - Self-Employed should select the classification that best represents their business model.

The 2 year contractor rule in Illinois generally refers to stipulations regarding how workers are classified. If you have worked in a business as a contractor for two consecutive years, they may be required to switch your classification to an employee for tax purposes. This rule is essential to understand for those offering Cook Illinois Boiler And Radiator Services Contract - Self-Employed.

To become an independent contractor in Illinois, you should first identify your area of expertise and the services you want to offer. Next, you need to register your business, obtain any required licenses or permits, and ensure you comply with local regulations. For those in the field of Cook Illinois Boiler And Radiator Services Contract - Self-Employed, having the right certifications is crucial.