San Jose California Disability Services Contract — Self-Employed refers to a legally binding agreement between a self-employed individual and a disability services organization in San Jose, California. This contract outlines the terms and conditions under which the self-employed professional will provide disability services to individuals in need. The primary purpose of the San Jose California Disability Services Contract — Self-Employed is to establish a clear understanding of the rights, responsibilities, and expectations of both parties involved. It ensures that the self-employed individual is compensated fairly for their services and that the disability services organization receives high-quality assistance. The keywords relevant to this contract include: 1. San Jose, California: Signifies the location where the contract is applicable, indicating that the services will be rendered within the San Jose area. 2. Disability Services: Indicates that the contract pertains to services aimed at assisting individuals with disabilities, which may include physical, mental, or developmental disabilities. 3. Contract: Emphasizes the legally binding agreement between the self-employed individual and the disability services organization, outlining the terms and conditions of their partnership. 4. Self-Employed: Describes the status of the individual providing the disability services, emphasizing their independent contractor role rather than being an employee. 5. Terms and Conditions: Refers to the specific provisions, obligations, and requirements agreed upon by both parties involved in the contract. 6. Compensation: Denotes the financial agreement between the self-employed individual and the disability services organization, including the payment terms, rates, and methods of payment. 7. Expectations: Highlights the mutually agreed-upon standards and goals that the self-employed professional is expected to meet while providing disability services. 8. Rights and Responsibilities: Establishes the rights of both parties and outlines the duties and obligations that each must abide by during the duration of the contract. Different types of San Jose California Disability Services Contract — Self-Employed may include: 1. In-Home Disability Services Contract: Specifically outlines the provision of disability services within individuals' homes or residential settings. 2. Job Coaching Disability Services Contract: Focuses on offering support and vocational guidance to individuals with disabilities in finding and maintaining employment. 3. Therapy or Counseling Disability Services Contract: Details the agreement for therapeutic or counseling services provided to individuals with disabilities to address mental health needs. 4. Assistive Technology Disability Services Contract: Establishes the terms for providing and maintaining assistive technology devices or equipment to enhance individuals' independence and accessibility. 5. Transportation Disability Services Contract: Specifies the obligations for providing transportation assistance to individuals with disabilities, ensuring they have access to necessary appointments, therapies, or activities. These variations of San Jose California Disability Services Contract — Self-Employed cater to specific needs within the disability services sector, showcasing the diverse range of services and expertise available to support individuals with disabilities in San Jose, California.

San Jose California Disability Services Contract - Self-Employed

Description

How to fill out San Jose California Disability Services Contract - Self-Employed?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like San Jose Disability Services Contract - Self-Employed is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the San Jose Disability Services Contract - Self-Employed. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

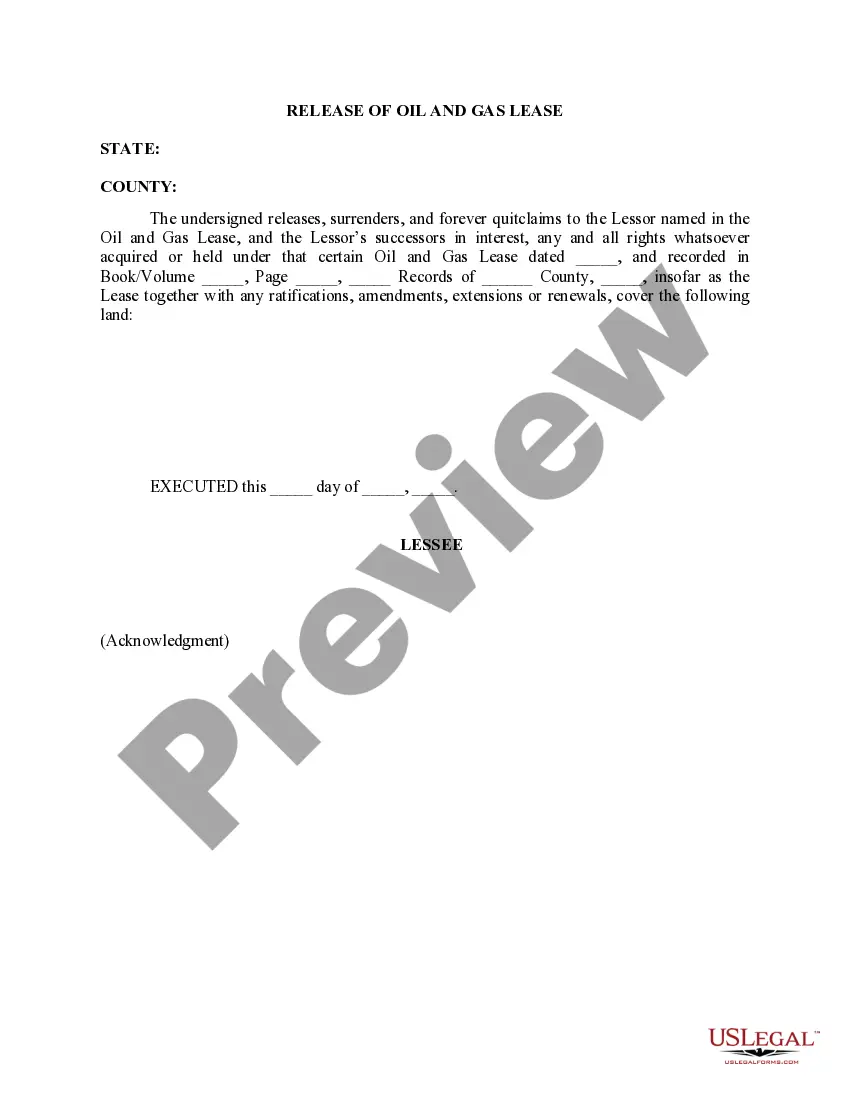

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Disability Services Contract - Self-Employed in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

I'm an independent contractor, can I still qualify for Paid Family Leave (PFL) or State Disability Insurance (SDI)? A. If you are an independent contractor, you can opt in to Paid Family Leave (PFL) and State Disability Insurance (SDI) by applying for the Disability Insurance Elective Coverage (DIEC) program.

Go with term life insurance. Term life insurance provides life insurance coverage for a specific amount of time and if you die during that term, your family will receive a payout from the insurance policy. It's much less expensive and by far a better value than whole life and other types of cash value insurance.

Covers Your Bills With disability insurance, you can cover as much as 60% of your income. If you make $4,000 each month, the insurance will pay as much as $2,400 a month. While it isn't as much as you were making, it might be enough to help you survive during this tough time.

Self-employed individuals may qualify for SSDI if: They have paid Social Security taxes. While employees pay into the Social Security system automatically when taxes are deducted from their paychecks, self-employed workers must pay these taxes on their own. They have accurately reported their income.

If you choose to apply as a self-employed person, we will take into account your earnings from both self-employment and employment as an employee when we calculate your weekly benefit amount, as long as your earnings from both sources are eligible.

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC).

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC).

Self-Employment and Social Security Insurance Self-employed individuals may qualify for SSDI if: They have paid Social Security taxes. While employees pay into the Social Security system automatically when taxes are deducted from their paychecks, self-employed workers must pay these taxes on their own.

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC).

If you earn income through freelance or contract work, you can qualify for disability insurance. As with all business owners at risk of losing some or all of their income due to illness or injury, you should strongly consider buying disability coverage.