Santa Clara California Disability Services Contract — Self-Employed is a legal agreement that outlines the terms and conditions under which self-employed individuals with disabilities can utilize the disability services offered in Santa Clara, California. This contractual arrangement ensures that independent contractors with disabilities have access to necessary support and accommodations to enhance their employment opportunities and overall quality of life. The Santa Clara California Disability Services Contract — Self-Employed aims to provide comprehensive assistance, resources, and personalized support to self-employed individuals with disabilities, enabling them to effectively perform their job responsibilities and thrive in their chosen field. This contract typically includes provisions that address various aspects, including: 1. Accommodation Services: This type of disability service contract focuses on providing necessary workplace accommodations to self-employed individuals with disabilities. It ensures that the person's workspace is adapted to meet their specific needs, providing accessible tools, equipment, and modifications that enable them to perform their tasks effectively. 2. Career Development and Training: Some disability service contracts in Santa Clara, California, prioritize career development and training opportunities for self-employed individuals with disabilities. These contracts focus on offering support through skills training programs, educational courses, and workshops that enhance their professional growth and competitiveness in the job market. 3. Counseling and Guidance: Certain disability service contracts emphasize counseling and guidance services for self-employed individuals with disabilities. These contracts aim to provide emotional support, mentorship, and advice, helping them navigate the unique challenges they may face in their entrepreneurial journey. 4. Financial Assistance: Another type of Santa Clara California Disability Services Contract — Self-Employed focuses on providing financial assistance to individuals with disabilities who are self-employed. These contracts may offer grants, loans, or subsidies, helping them establish and sustain their business ventures, cover startup costs, and invest in necessary equipment or technologies. 5. Networking and Business Development: Some disability service contracts aim to foster networking and business development opportunities for self-employed individuals with disabilities. These contracts provide access to professional networks, mentorship programs, and connections with potential clients or partners, facilitating their growth and success as entrepreneurs. 6. Legal and Administrative Support: Certain disability service contracts specialize in providing legal and administrative support to self-employed individuals with disabilities. These contracts ensure that these individuals have access to professional assistance for tasks such as contract drafting, copyright/trademark registration, tax compliance, and other business-related legal matters. Overall, the Santa Clara California Disability Services Contract — Self-Employed aims to empower self-employed individuals with disabilities, enabling them to thrive professionally and enjoy equal opportunities in the business world. The contract type may vary based on the specific focus of the services offered, which can include accommodation services, career development, counseling, financial assistance, networking, legal support, or a combination of these areas.

Santa Clara California Disability Services Contract - Self-Employed

Description

How to fill out Santa Clara California Disability Services Contract - Self-Employed?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Santa Clara Disability Services Contract - Self-Employed, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Santa Clara Disability Services Contract - Self-Employed from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Santa Clara Disability Services Contract - Self-Employed:

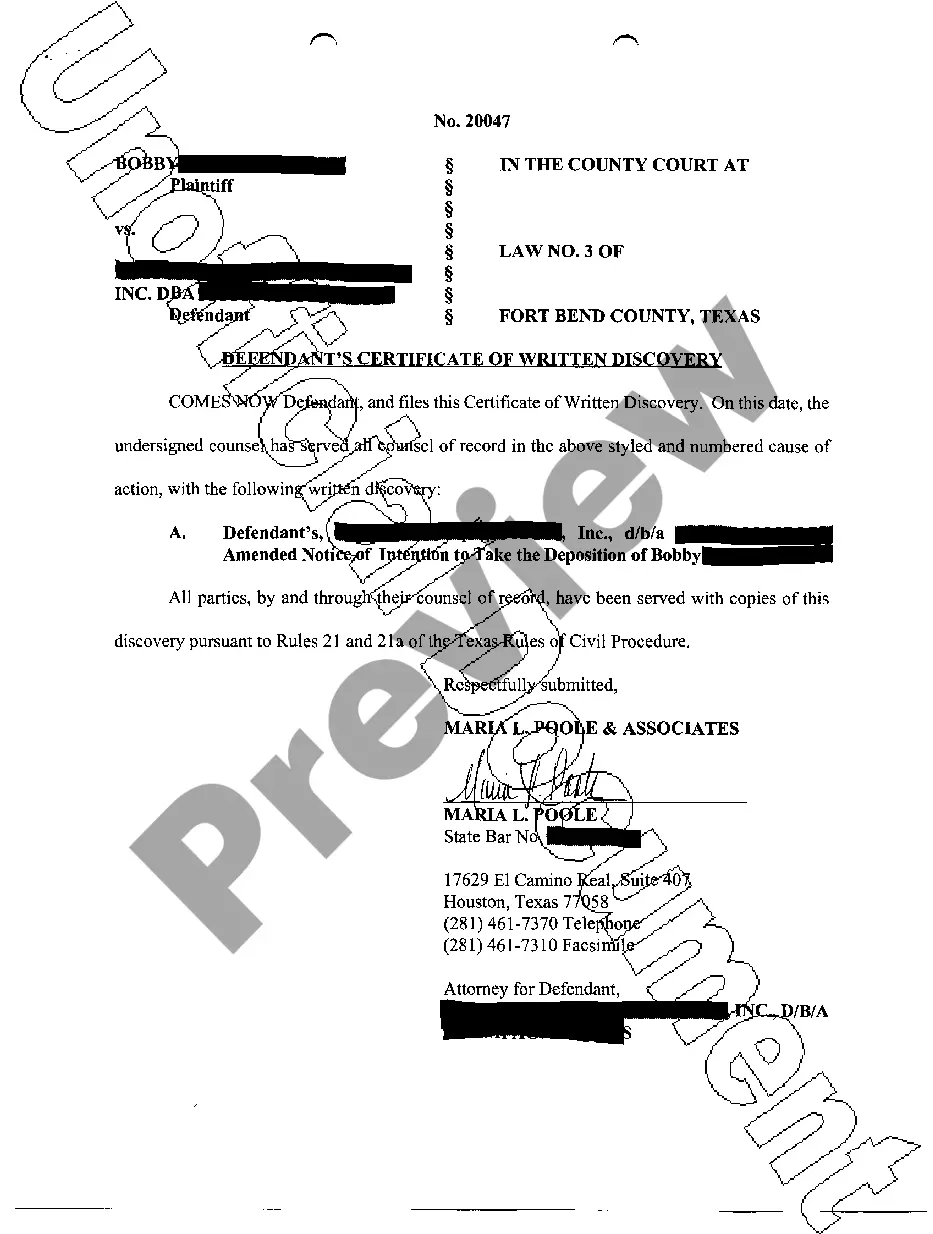

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Self-employed individuals may qualify for SSDI if: They have paid Social Security taxes. While employees pay into the Social Security system automatically when taxes are deducted from their paychecks, self-employed workers must pay these taxes on their own. They have accurately reported their income.

I'm an independent contractor, can I still qualify for Paid Family Leave (PFL) or State Disability Insurance (SDI)? A. If you are an independent contractor, you can opt in to Paid Family Leave (PFL) and State Disability Insurance (SDI) by applying for the Disability Insurance Elective Coverage (DIEC) program.

If you earn income through freelance or contract work, you can qualify for disability insurance. As with all business owners at risk of losing some or all of their income due to illness or injury, you should strongly consider buying disability coverage.

Requirements to File a Claim Be employed or actively looking for work at the time your disability begins. Have earned at least $300 from which State Disability Insurance (SDI) deductions were withheld during your base period. Learn more with Calculating Benefit Payment Amounts.

If you earn income through freelance or contract work, you can qualify for disability insurance. As with all business owners at risk of losing some or all of their income due to illness or injury, you should strongly consider buying disability coverage.

Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form. Create your own form with all of the required information. Visit your nearest Employment Tax Office to pick up a form.

Self-Employment and Social Security Insurance Self-employed individuals may qualify for SSDI if: They have paid Social Security taxes. While employees pay into the Social Security system automatically when taxes are deducted from their paychecks, self-employed workers must pay these taxes on their own.

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC).

Although it's possible to start a business or start working for yourself while receiving disability, it can result in serious consequences if the SSA decides that your work is SGA and stops your benefits.

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC).