Tarrant Texas Recovery Services Contract — Self-Employed: A Comprehensive Overview In Tarrant County, Texas, individuals and businesses often rely on recovery services contracts to tackle challenging situations related to debt collection, repossessions, and asset recovery. This contract outlines the terms and conditions under which self-employed professionals in the recovery services industry operate to assist clients in recovering outstanding debts or lost assets. Keywords: Tarrant Texas, recovery services contract, self-employed, debt collection, repossession, asset recovery, terms and conditions, outstanding debts, lost assets. 1. Debt Collection Recovery Services Contract — Self-Employed: This type of recovery services contract specifically caters to clients who require assistance in collecting overdue payments or outstanding debts. Self-employed professionals specializing in debt collection mediate between debtors and creditors, negotiating payment plans and implementing legal actions if necessary, with the ultimate goal of recovering the owed amounts. 2. Repossession Recovery Services Contract — Self-Employed: In situations where a debtor fails to fulfill their financial obligations, creditors may opt for repossession to regain a lost asset, such as a vehicle or valuable equipment. Self-employed recovery professionals experienced in repossession work within the legal framework to repossess the asset in question, as outlined in the repossession recovery services contract. 3. Asset Recovery Services Contract — Self-Employed: When valuable assets go missing or are wrongfully withheld, individuals or companies may seek the services of self-employed recovery professionals who specialize in asset recovery. These professionals employ various legal and investigative techniques to locate and reclaim the asset or secure financial compensation for the loss suffered. Tarrant Texas Recovery Services Contract — Self-Employed: Regardless of the specific type, a Tarrant Texas recovery services contract typically includes the following key elements: 1. Scope of Services: The contract clarifies the types of recovery services offered by the self-employed individual, defining the specific areas of expertise, whether it's debt collection, repossession, or asset recovery. 2. Responsibilities and Obligations: Both parties involved, i.e., the self-employed recovery professional and the client, have clearly defined responsibilities outlined in the contract. This ensures a mutual understanding of each party's expectations, timeframes, and necessary cooperation. 3. Payment Terms: The contract establishes the financial aspects of the agreement, including the fee structure, payment schedules, and any additional costs incurred during the recovery process. Clarity regarding compensation is essential to avoid misunderstandings or disputes. 4. Confidentiality and Compliance: In the recovery services industry, sensitive information related to debtors, creditors, and assets is often shared. The contract includes clauses pertaining to confidentiality, ensuring that all parties are committed to safeguarding sensitive data. Moreover, it highlights the importance of adhering to regulatory requirements and industry best practices. 5. Termination Clause: The contract outlines the circumstances under which either party can terminate the agreement, including breach of contract, non-performance, or any other valid reason. By entering into a Tarrant Texas Recovery Services Contract — Self-Employed, both clients and self-employed recovery professionals can establish a binding agreement that promotes transparency, fairness, and professionalism throughout the debt collection, repossession, or asset recovery process.

Tarrant Texas Recovery Services Contract - Self-Employed

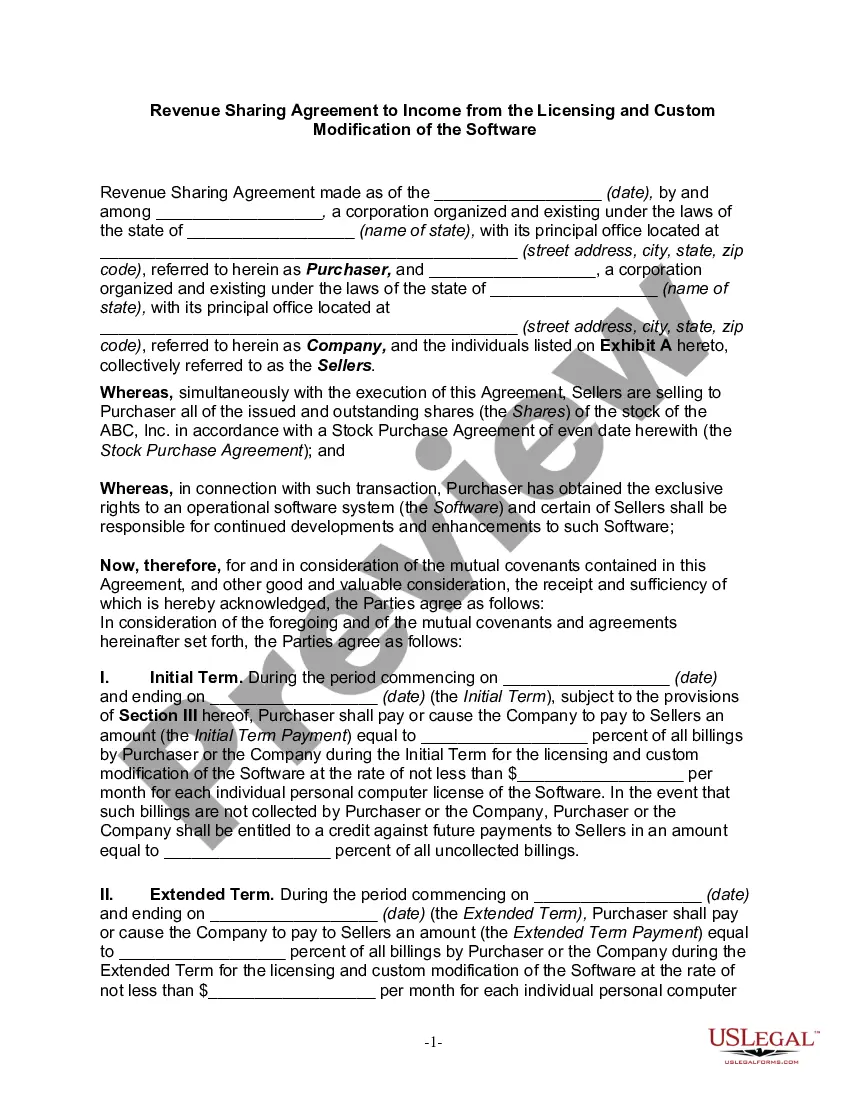

Description

How to fill out Tarrant Texas Recovery Services Contract - Self-Employed?

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Tarrant Recovery Services Contract - Self-Employed, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the current version of the Tarrant Recovery Services Contract - Self-Employed, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Tarrant Recovery Services Contract - Self-Employed:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Tarrant Recovery Services Contract - Self-Employed and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!