Kings New York Specialty Services Contact — Self-Employed offers a range of specialized services catering to the unique needs of self-employed individuals in New York. With expertise in various areas, Kings New York assists self-employed professionals in managing their business operations efficiently and effectively. One of the key services provided by Kings New York Specialty Services Contact — Self-Employed is personalized tax planning and preparation. This includes helping self-employed individuals navigate the complex tax regulations and maximize their tax deductions. Kings New York ensures that all self-employed clients comply with the tax laws while minimizing their tax liability. Another significant service offered by Kings New York is financial consulting and management. They provide expert guidance on financial matters such as budgeting, cash flow management, and investment strategies. By analyzing the unique financial situation of each self-employed client, Kings New York develops custom-tailored plans that align with their goals and help them achieve long-term financial success. In addition to tax planning and financial consulting, Kings New York Specialty Services Contact — Self-Employed also assists with business formation and structuring. They guide self-employed individuals through the process of choosing the right legal entity, such as a sole proprietorship, partnership, or limited liability company (LLC). Kings New York ensures that all necessary documents and registrations are completed accurately, enabling self-employed individuals to establish a strong foundation for their businesses. Kings New York further extends its support to self-employed professionals by offering bookkeeping and accounting services. They ensure that all financial records are accurately maintained, enabling self-employed individuals to have a clear view of their business's financial health. Kings New York helps self-employed individuals stay organized and streamlines their financial processes, saving them valuable time and effort. In summary, Kings New York Specialty Services Contact — Self-Employed provides a comprehensive range of services tailored specifically for self-employed individuals in New York. These services include tax planning and preparation, financial consulting and management, business formation and structuring, as well as bookkeeping and accounting. Through their expertise and personalized approach, Kings New York assists self-employed individuals in optimizing their financial well-being and achieving their business goals.

Kings New York Specialty Services Contact - Self-Employed

Description

How to fill out Kings New York Specialty Services Contact - Self-Employed?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Kings Specialty Services Contact - Self-Employed is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Kings Specialty Services Contact - Self-Employed. Follow the instructions below:

- Make sure the sample meets your individual needs and state law requirements.

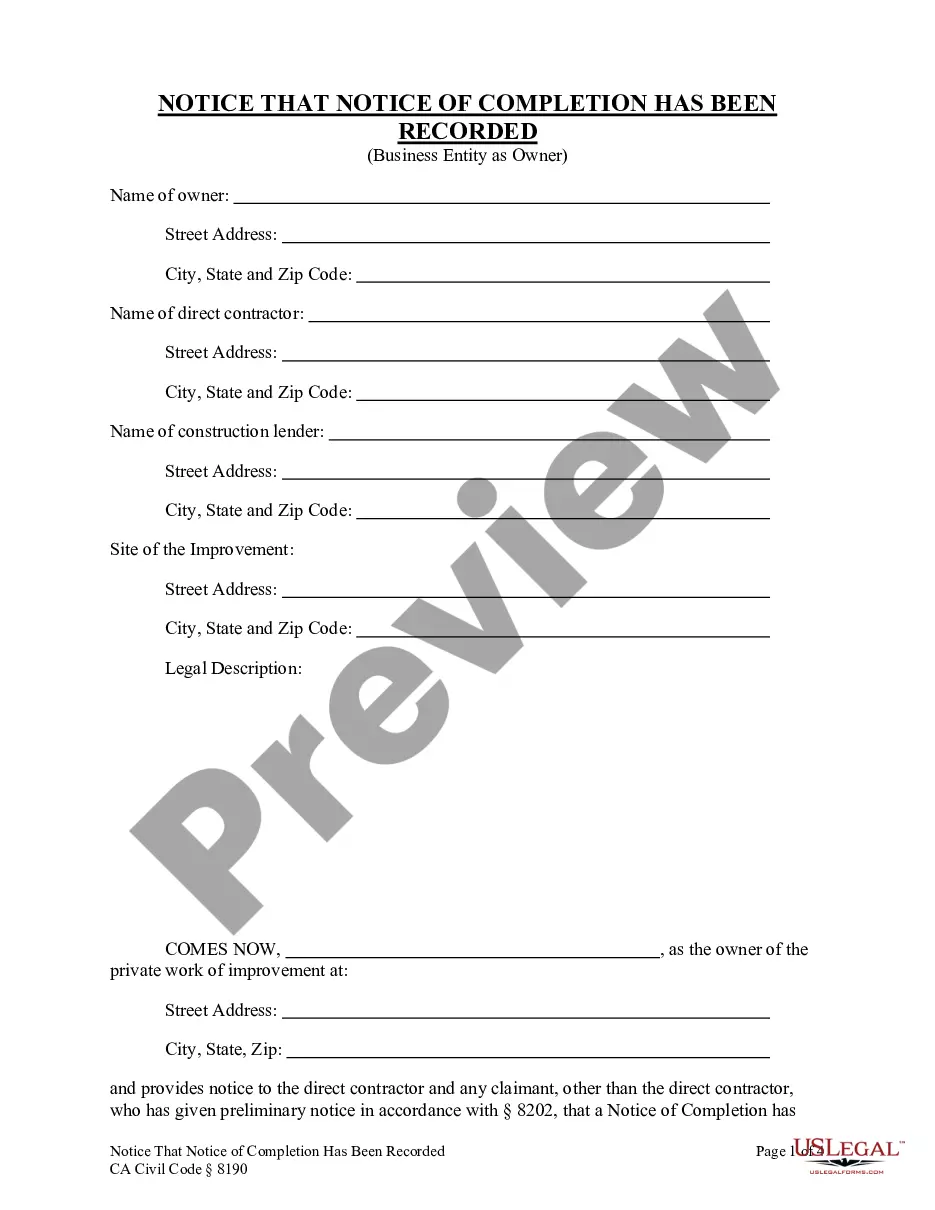

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Kings Specialty Services Contact - Self-Employed in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!