Bexar Texas Cook Services Contract - Self-Employed

Description

How to fill out Bexar Texas Cook Services Contract - Self-Employed?

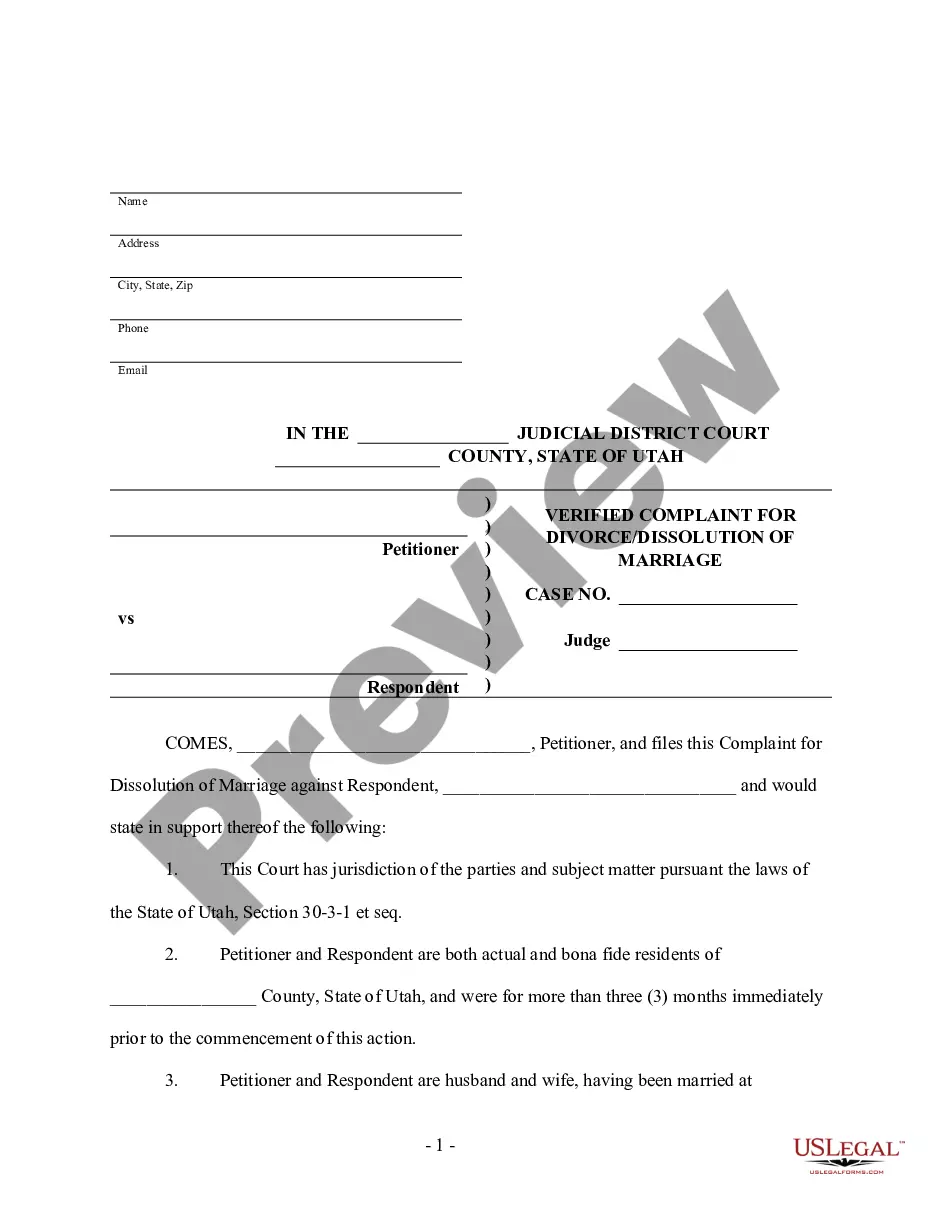

Are you looking to quickly create a legally-binding Bexar Cook Services Contract - Self-Employed or probably any other document to manage your own or business matters? You can go with two options: contact a professional to draft a valid document for you or create it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-compliant document templates, including Bexar Cook Services Contract - Self-Employed and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, double-check if the Bexar Cook Services Contract - Self-Employed is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Bexar Cook Services Contract - Self-Employed template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

How to become an independent contractor Identify your business structure.Choose and register your business name.Get business licenses and permit.Get a business number and find your taxation requirements.Get insurance for your business.Establish the requirements for your workplace safety.Manage your business well.

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

You set your own schedule One of the best parts of being an independent contractor is that you can choose your own work hours. Most employees get schedules telling them when and how long they have to work. For hourly workers, schedules often change from week to week.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Assuming you are already registered with SARS personally, then by default your sole proprietorship will also be registered. If you are not yet registered with SARS, you can register at a physical SARS branch, or online through the SARS eFiling service.

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.