Bexar Texas Hauling Services Contract - Self-Employed

Description

How to fill out Bexar Texas Hauling Services Contract - Self-Employed?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life situation, locating a Bexar Hauling Services Contract - Self-Employed meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Apart from the Bexar Hauling Services Contract - Self-Employed, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Bexar Hauling Services Contract - Self-Employed:

- Check the content of the page you’re on.

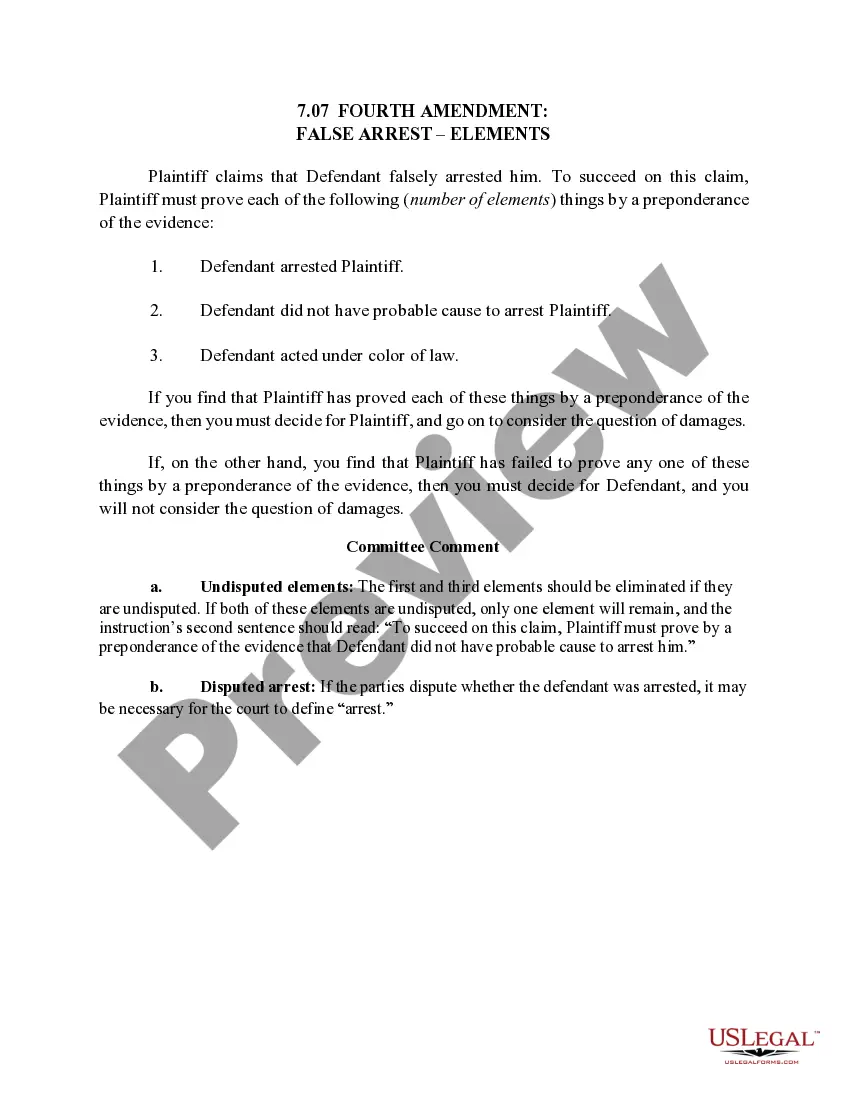

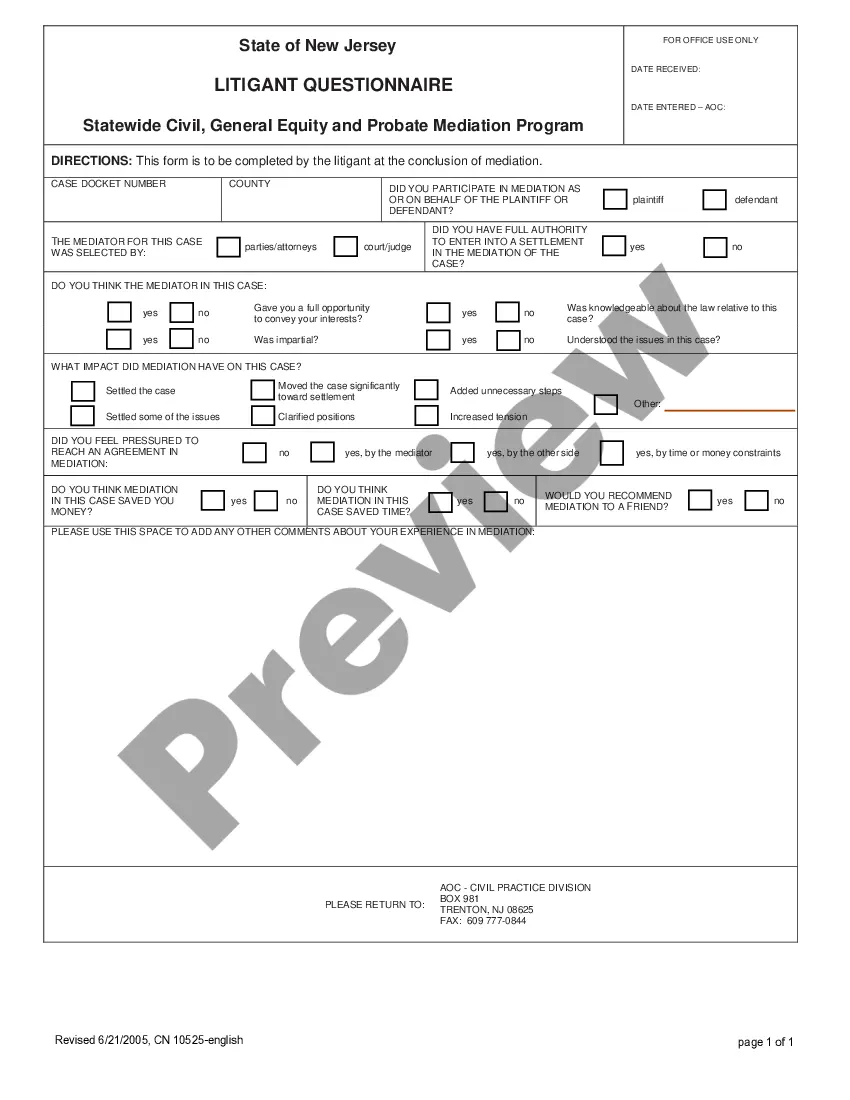

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Bexar Hauling Services Contract - Self-Employed.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Each client a contractor invoices for more than $600 is required to send the contractor a Form 1099. This form lists what they've paid them over the course of the prior tax year. Typically, a contractor will get Form 1099 from a client in Januarythe beginning of tax season. The client also sends a copy to the IRS.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

A basic rule of thumb that most people suggest would be to determine your hourly rate as a permanent employee, and then add 50-75%. If you were earning $65,000/year, that equates to $31.25/hr. By adding 50%, your rate would be $47/hr, and at 75%, your rate would be $55/hr.

As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Although 'self-employment' is not defined in legislation, if a person is a business owner or contractor that provides services to other businesses, either directly or through a personal services company (PSC),1 they will generally be considered to be self-employed.

Form W-9. The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Some ways to prove self-employment income include: Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.