Broward Florida Temporary Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Broward Florida Temporary Worker Agreement - Self-Employed Independent Contractor?

Whether you intend to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Broward Temporary Worker Agreement - Self-Employed Independent Contractor is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to obtain the Broward Temporary Worker Agreement - Self-Employed Independent Contractor. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

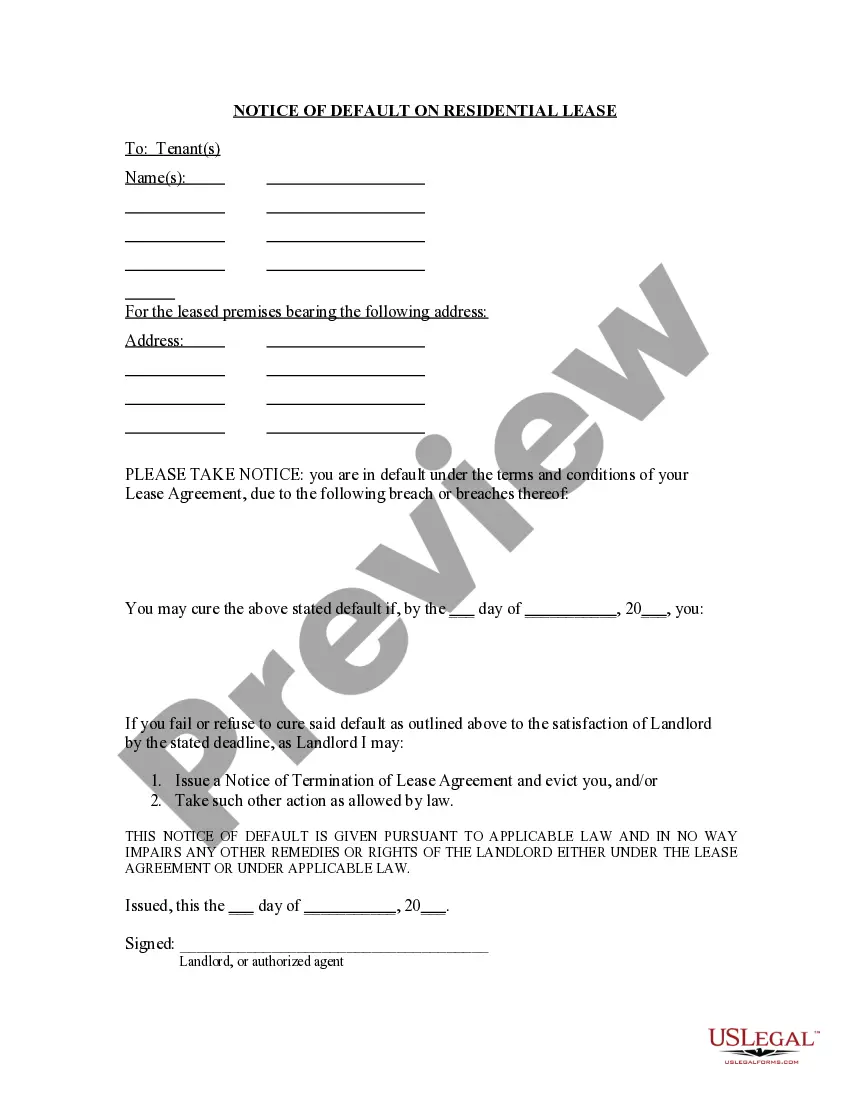

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Broward Temporary Worker Agreement - Self-Employed Independent Contractor in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Temporary employees and contract workers fulfill short-term business needs. A temporary worker is your employee or an employee of a staffing agency, whereas an independent contractor is a business entity, such as a sole proprietor or limited liability company (LLC).

How Do You Become Self-Employed? Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Assuming you are already registered with SARS personally, then by default your sole proprietorship will also be registered. If you are not yet registered with SARS, you can register at a physical SARS branch, or online through the SARS eFiling service.

How to become an independent contractor Identify your business structure.Choose and register your business name.Get business licenses and permit.Get a business number and find your taxation requirements.Get insurance for your business.Establish the requirements for your workplace safety.Manage your business well.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

Temporary employees and contract workers fulfill short-term business needs. A temporary worker is your employee or an employee of a staffing agency, whereas an independent contractor is a business entity, such as a sole proprietor or limited liability company (LLC).

How to become an independent contractor understand your tax obligations. visit Self-Employed Australia for information about super, insurance and workers compensation. register a business name (this is optional if you're trading under your personal name)

Minimum rates of pay 2022 rights under working time and whistleblowing legislation 2022 protection from discrimination. Self-employed individuals generally only have contractual rights, but they may also be protected: from discrimination 2022 under data protection legislation as 'data subjects'.