Fulton Georgia Beauty Consultant Services Contract - Self-Employed

Description

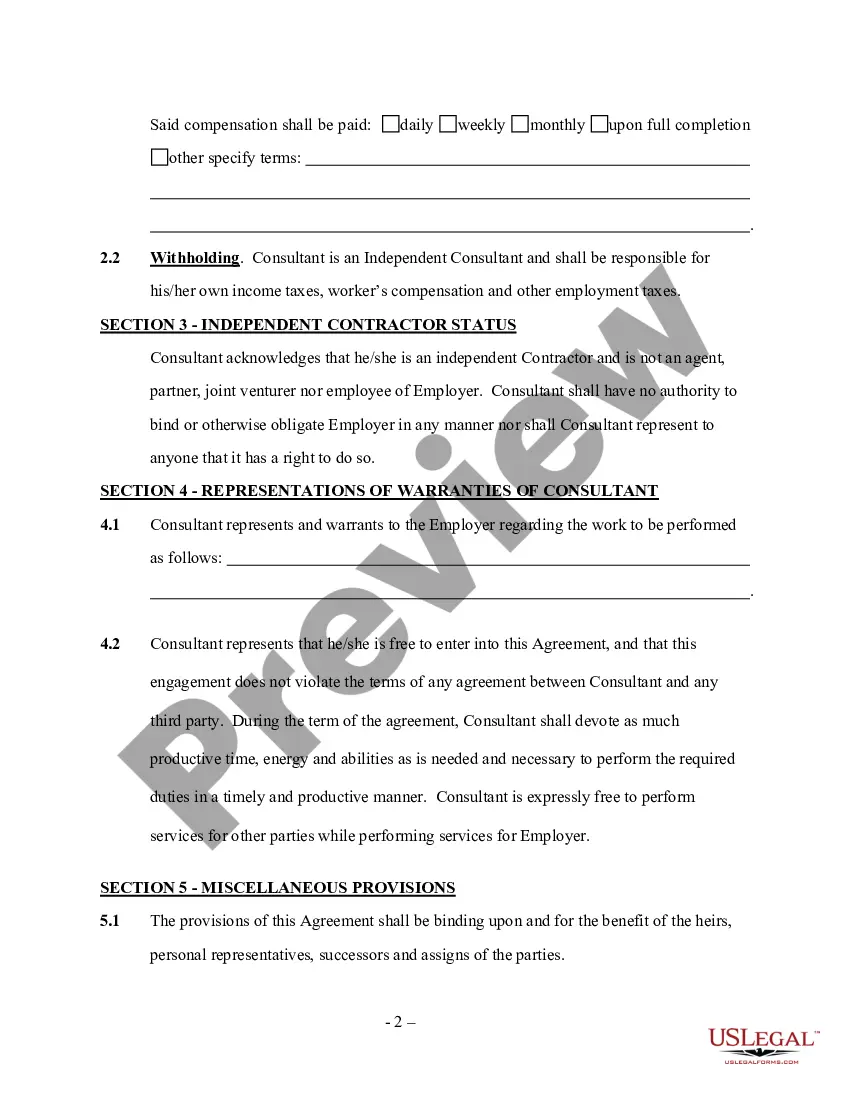

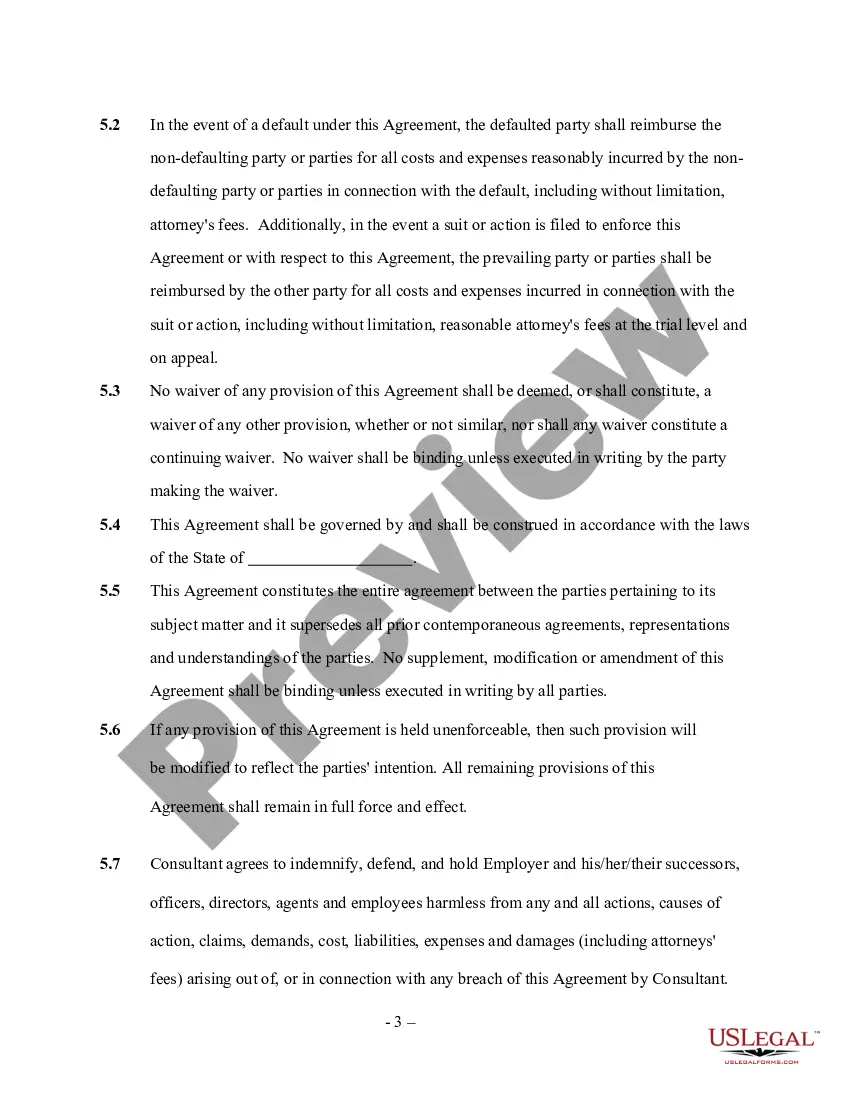

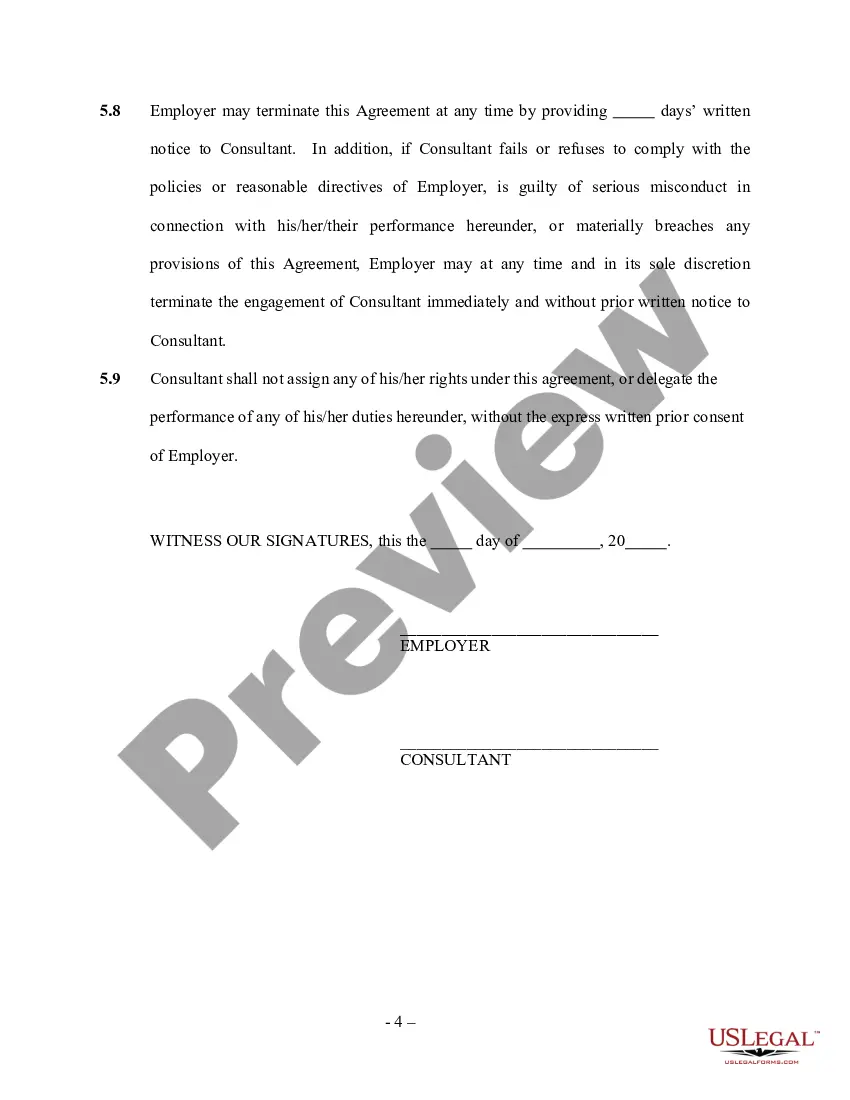

How to fill out Fulton Georgia Beauty Consultant Services Contract - Self-Employed?

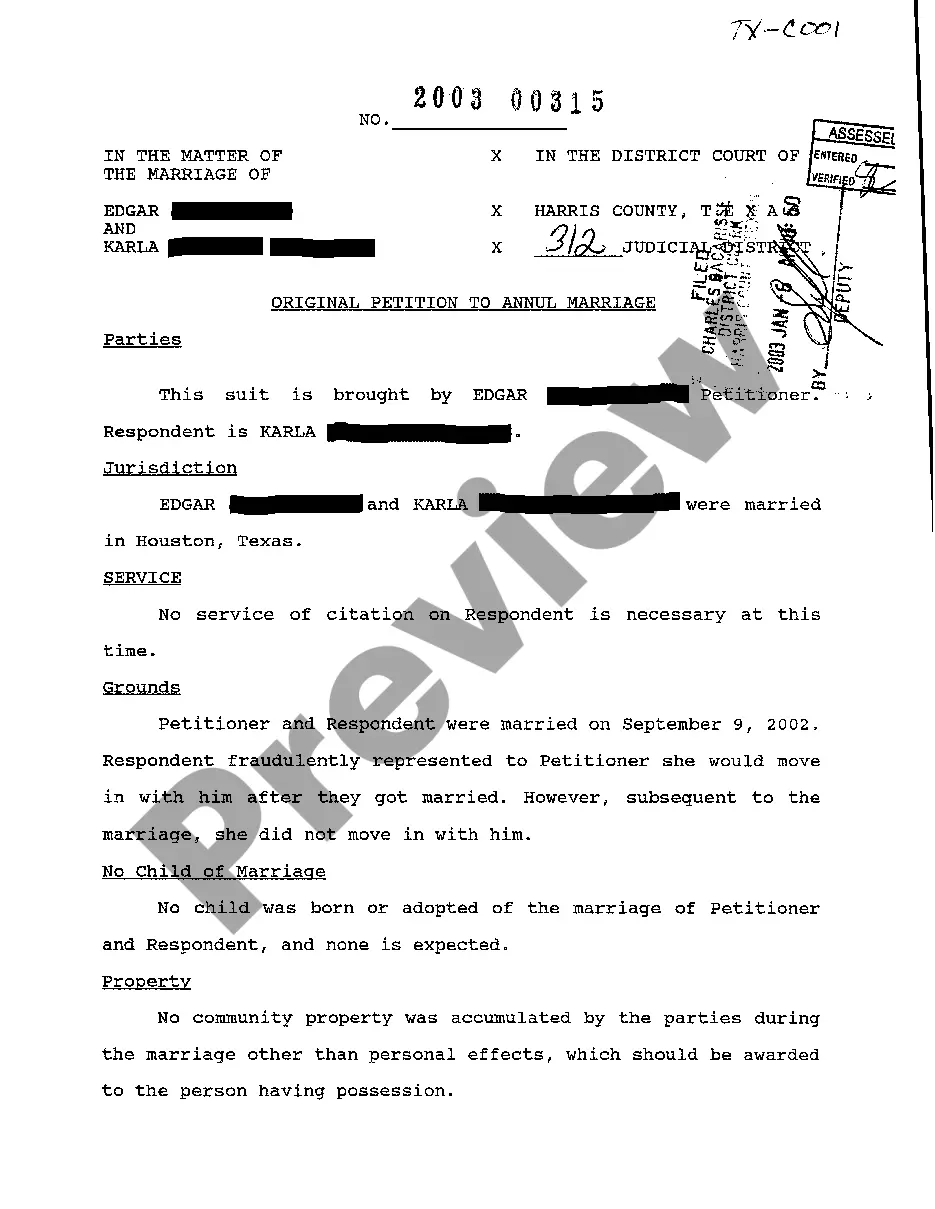

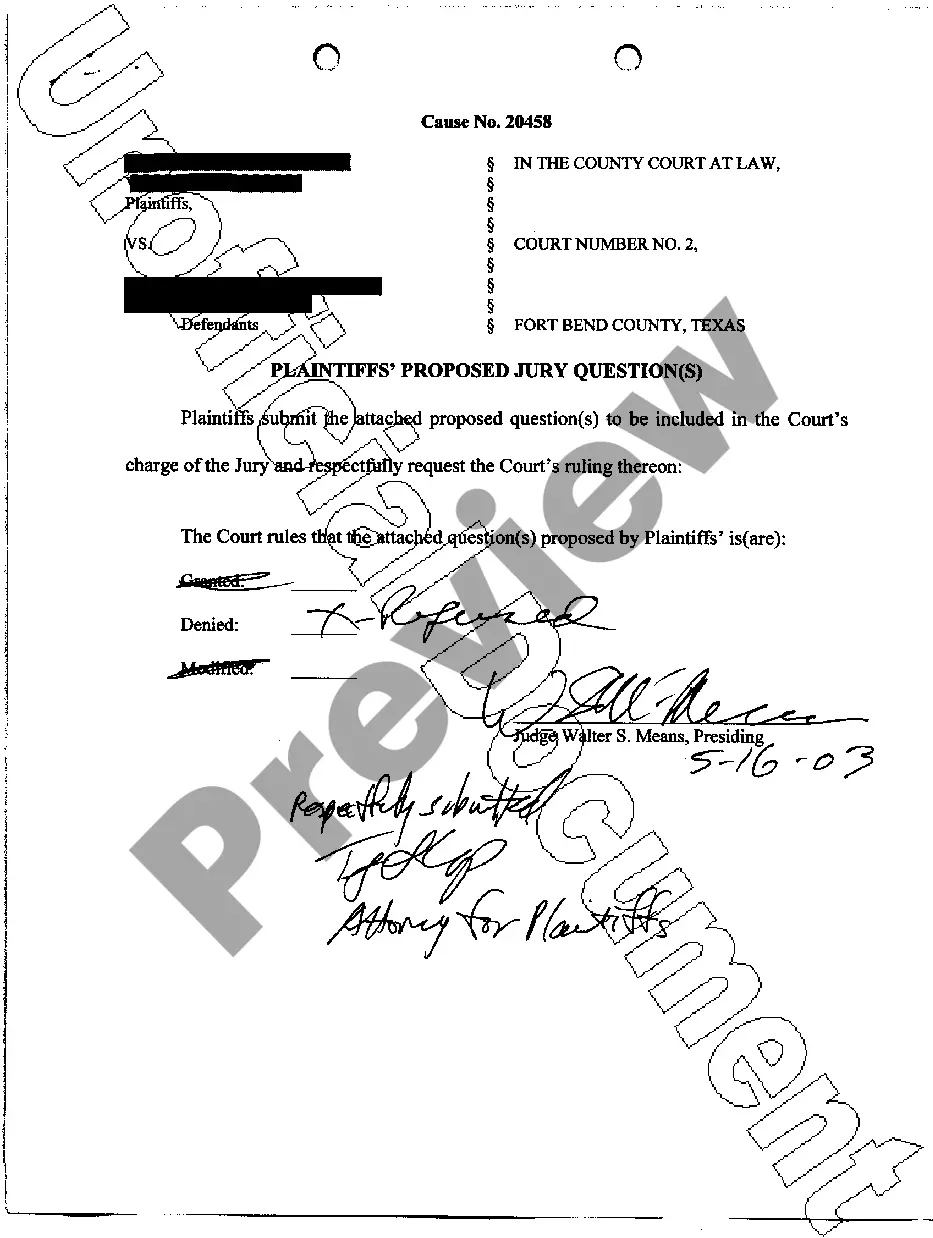

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Fulton Beauty Consultant Services Contract - Self-Employed, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the latest version of the Fulton Beauty Consultant Services Contract - Self-Employed, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fulton Beauty Consultant Services Contract - Self-Employed:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Fulton Beauty Consultant Services Contract - Self-Employed and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Pay self-employment tax As an independent consultant you are considered self-employed, so if you earn more than $400 for the year, the IRS expects you to pay your own tax. The self-employment tax rate is 15.3% of your net earnings.

Question: What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

When to call yourself a consultant You should call yourself a consultant if you have left hourly rates behind and charge exclusively for the value of the solutions you provide. Calling yourself a consultant will help you attract high-paying, high-profile clients to your business.

A contracts consultant is professional who contractually provides advice to businesses on a particular area. They essentially book contracts with various companies, assisting them with a particular area of their expertise.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Protect yourself: Put your guidelines in writing -- and stick by them. Have a very clear discussion laying out your professional boundaries and ask your client to do the same. Come to an understanding about working hours and response times and agree on how you will schedule calls, meetings, and Skype sessions.

A consultant is a person who's an expert in a particular field who gives professional advice to individuals and businesses in their area of expertise, usually on a temporary or contract basis until a particular need has been met.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Contracts play an essential role in the relationships that consultants have their clients. These legally binding documents tell a client what work you will perform, how long you expect the project to take, what compensation you expect, and more.