Montgomery Maryland Psychic Services Contract - Self-Employed Independent Contractor

Description

How to fill out Montgomery Maryland Psychic Services Contract - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Montgomery Psychic Services Contract - Self-Employed Independent Contractor.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Montgomery Psychic Services Contract - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Montgomery Psychic Services Contract - Self-Employed Independent Contractor:

- Ensure you have opened the right page with your regional form.

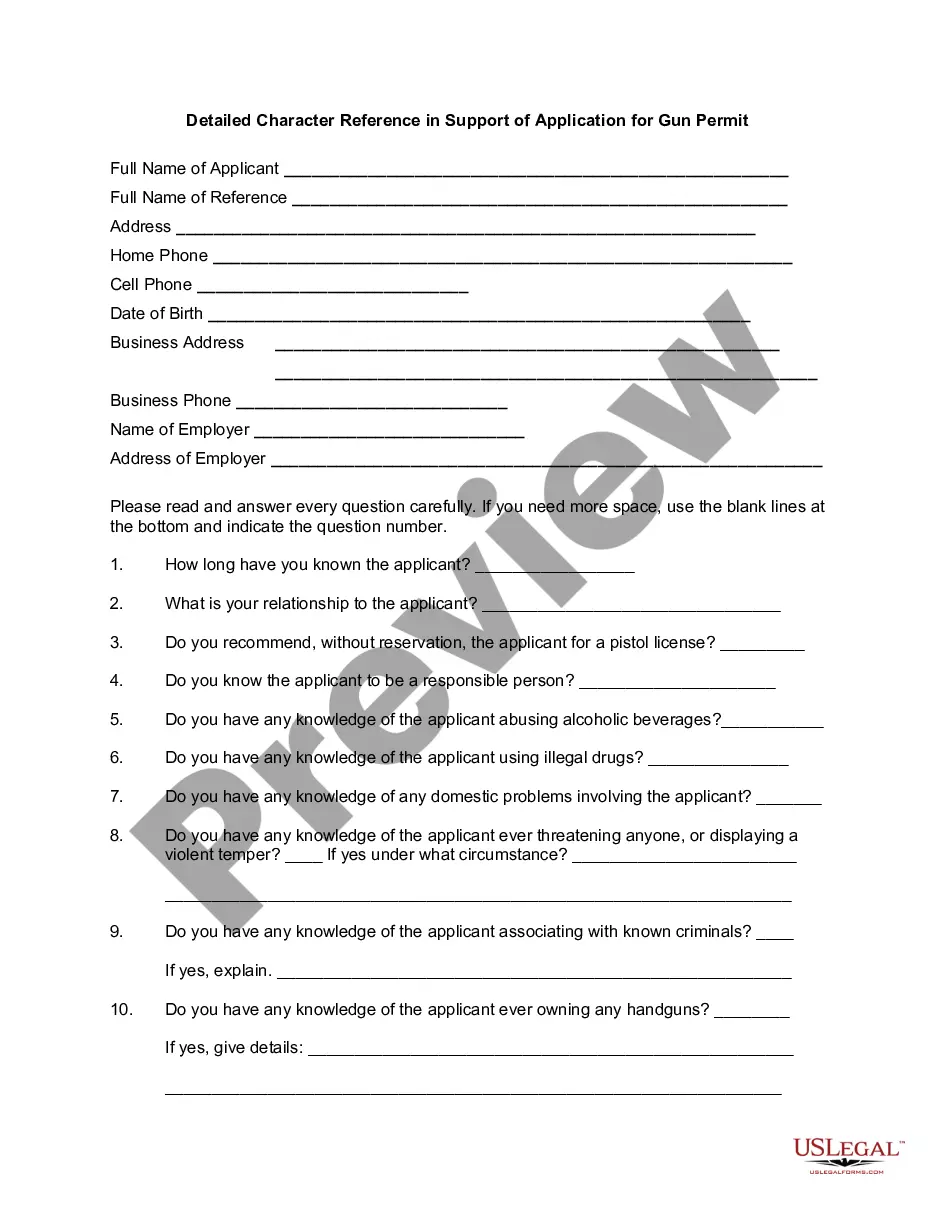

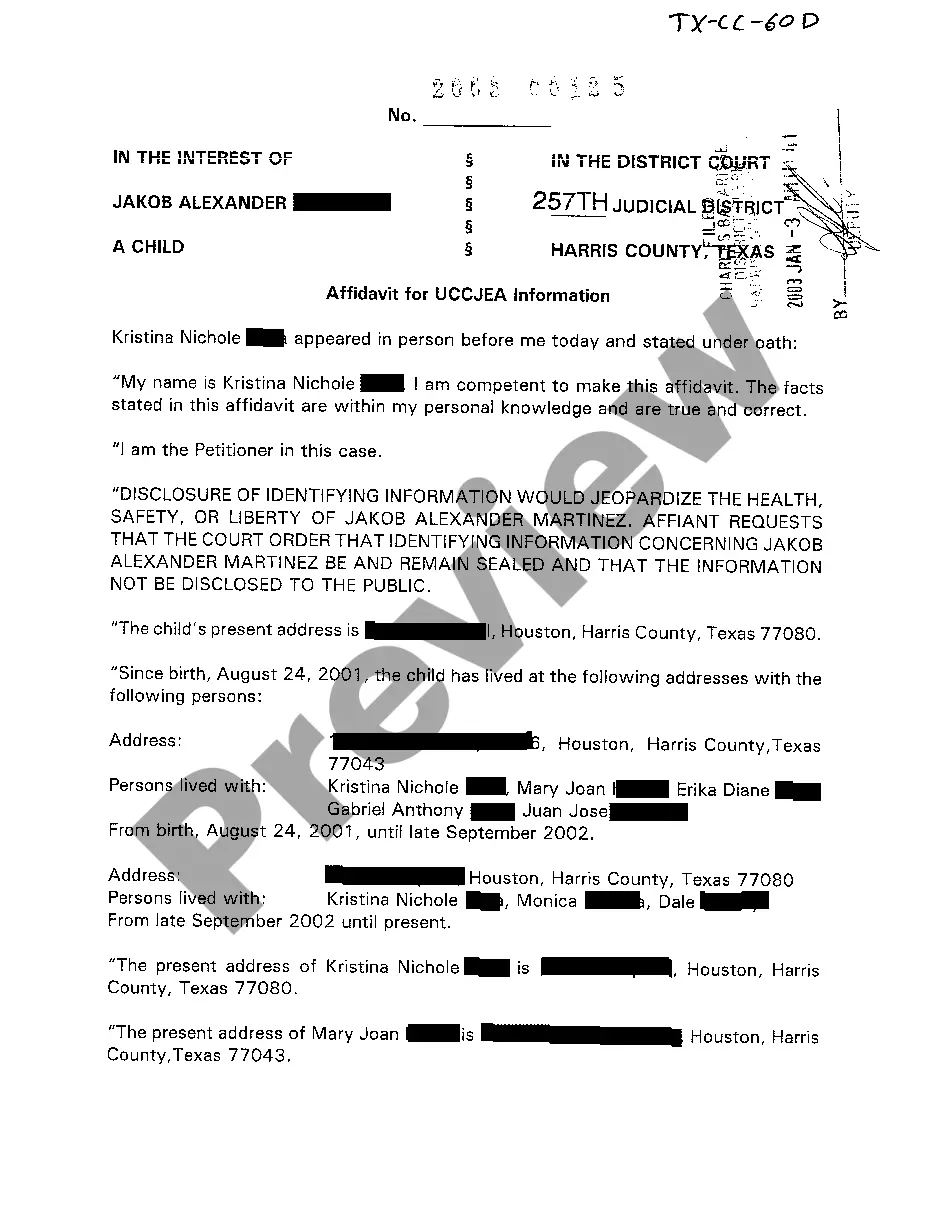

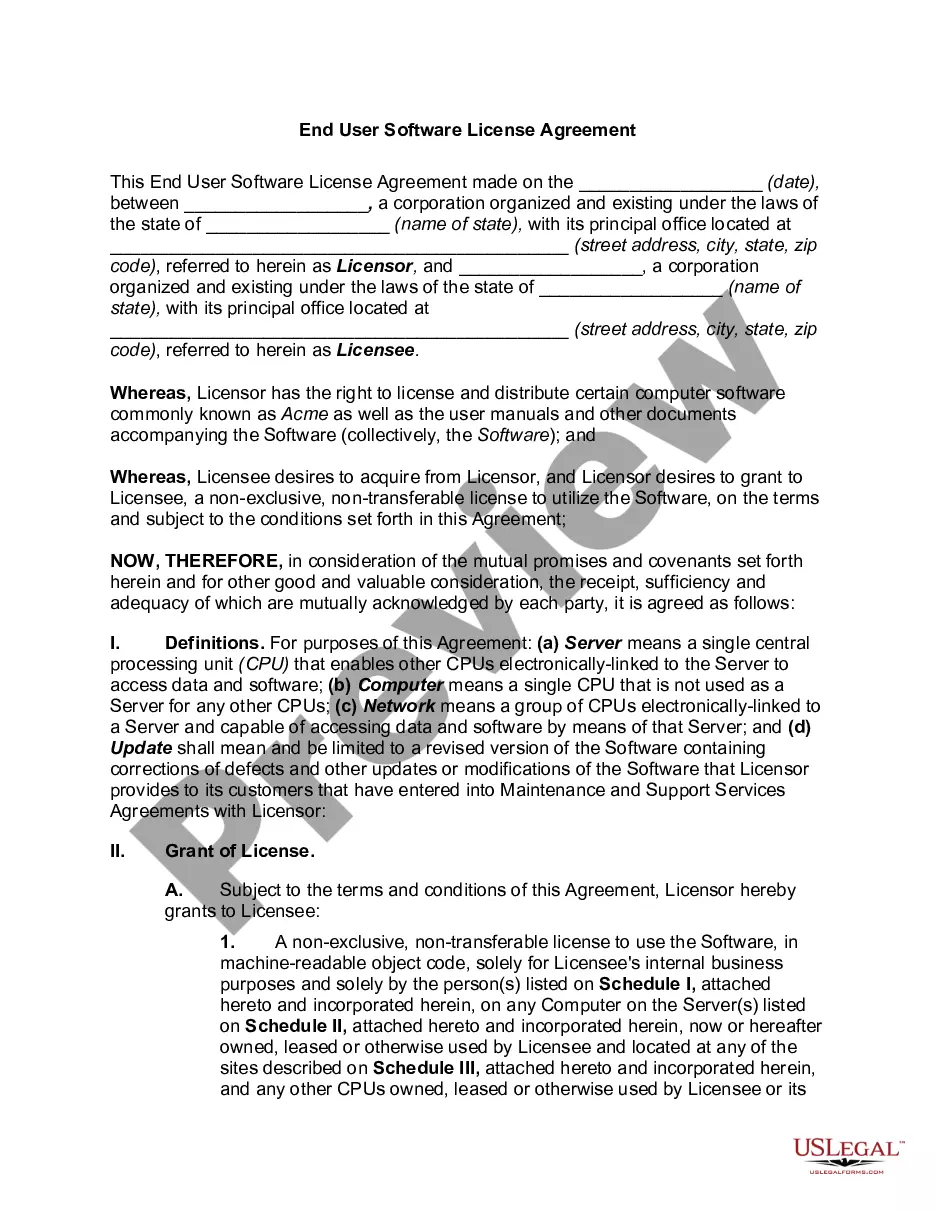

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Montgomery Psychic Services Contract - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Here's a look at the basic steps you'll need to take to create a simple and effective client contract: Include Contact Information of Both Parties.Specify Project Terms and Scope.Establish Payment Terms.Set the Schedule.Decide What Happens If a Contract Is Terminated.Determine Who Owns Final Copyrights.

Ten Tips for Making Solid Business Agreements and Contracts Get it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Some ways to prove self-employment income include: Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Although 'self-employment' is not defined in legislation, if a person is a business owner or contractor that provides services to other businesses, either directly or through a personal services company (PSC),1 they will generally be considered to be self-employed.