Montgomery Maryland Technical Writer Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the specific terms and conditions between a technical writer and their client for services rendered in the Montgomery County, Maryland area. This agreement serves to protect the rights and responsibilities of both parties involved. Keywords: Montgomery Maryland, Technical Writer Agreement, Self-Employed, Independent Contractor, legal document, terms and conditions, services, client, Montgomery County. There may be variations of the Montgomery Maryland Technical Writer Agreement — Self-Employed Independent Contractor, depending on the specific circumstances and requirements of the parties involved. Different types of agreements that fall under this category can include: 1. Montgomery Maryland Technical Writer Agreement — Individual Contractor: This type of agreement is tailored for technical writers who work as individual contractors, providing their services on a freelance basis. 2. Montgomery Maryland Technical Writer Agreement — Agency Contractor: In certain cases, technical writers may be engaged through a technical writing agency. This type of agreement outlines the relationship between the agency, the writer, and the client. 3. Montgomery Maryland Technical Writer Agreement — Non-Disclosure Agreement (NDA): In situations where sensitive information or trade secrets may be shared during the course of the writer's engagement, an NDA may be included as part of the agreement to ensure the protection of confidential information. 4. Montgomery Maryland Technical Writer Agreement — Work-for-Hire: In this arrangement, the technical writer agrees to assign all rights and ownership of the written content to the client upon completion, and the client assumes full control over the usage, reproduction, and distribution of the content. 5. Montgomery Maryland Technical Writer Agreement — Consultancy Agreement: A consultancy agreement may be used when the technical writer is also expected to provide expert advice and guidance, along with their writing services. It is important for both parties to carefully review the terms and conditions of the Montgomery Maryland Technical Writer Agreement — Self-Employed Independent Contractor before entering into the agreement. Specific details related to compensation, project scope, timelines, intellectual property rights, termination clauses, and dispute resolution procedures should all be clearly defined to ensure a successful working relationship.

Montgomery Maryland Technical Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Montgomery Maryland Technical Writer Agreement - Self-Employed Independent Contractor?

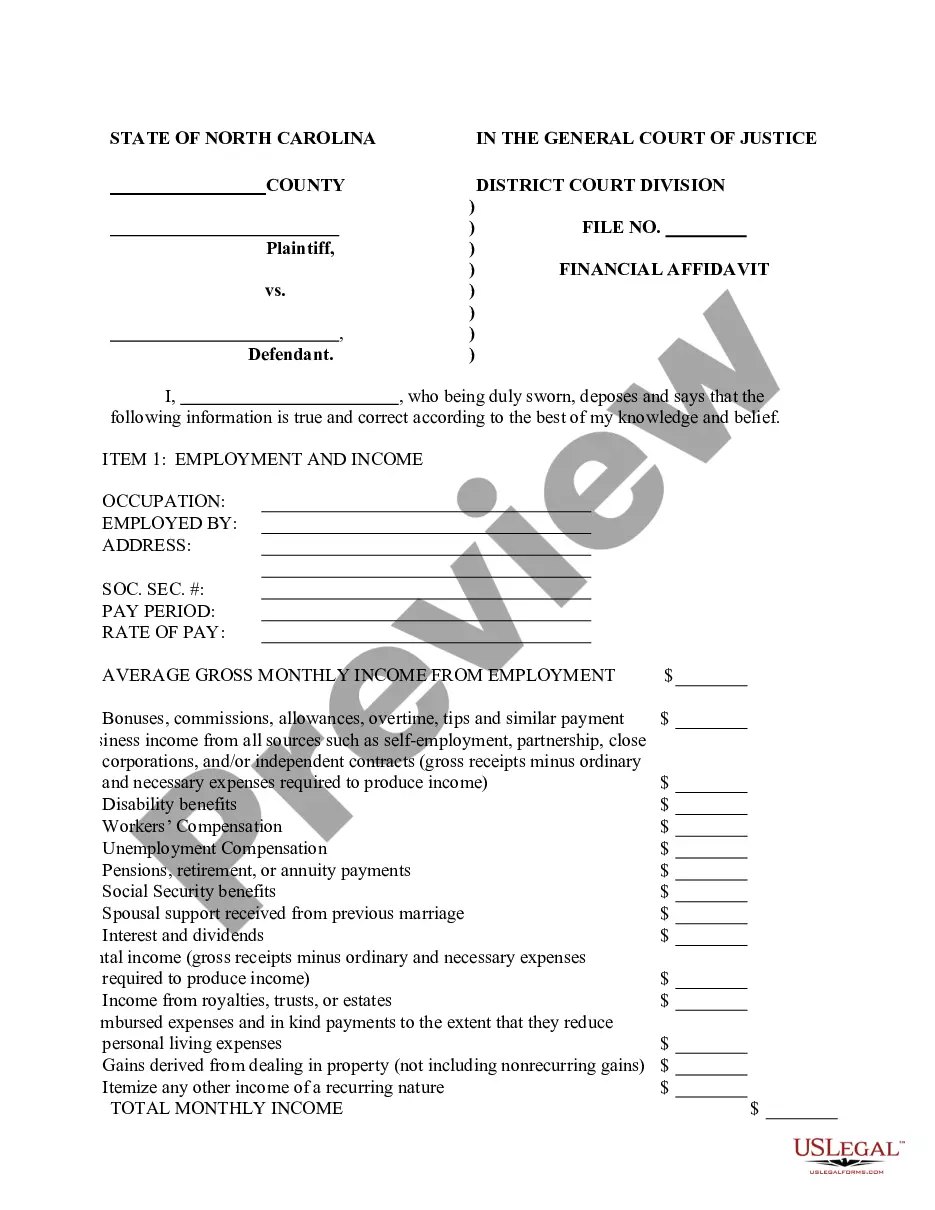

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Montgomery Technical Writer Agreement - Self-Employed Independent Contractor, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Montgomery Technical Writer Agreement - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Montgomery Technical Writer Agreement - Self-Employed Independent Contractor:

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

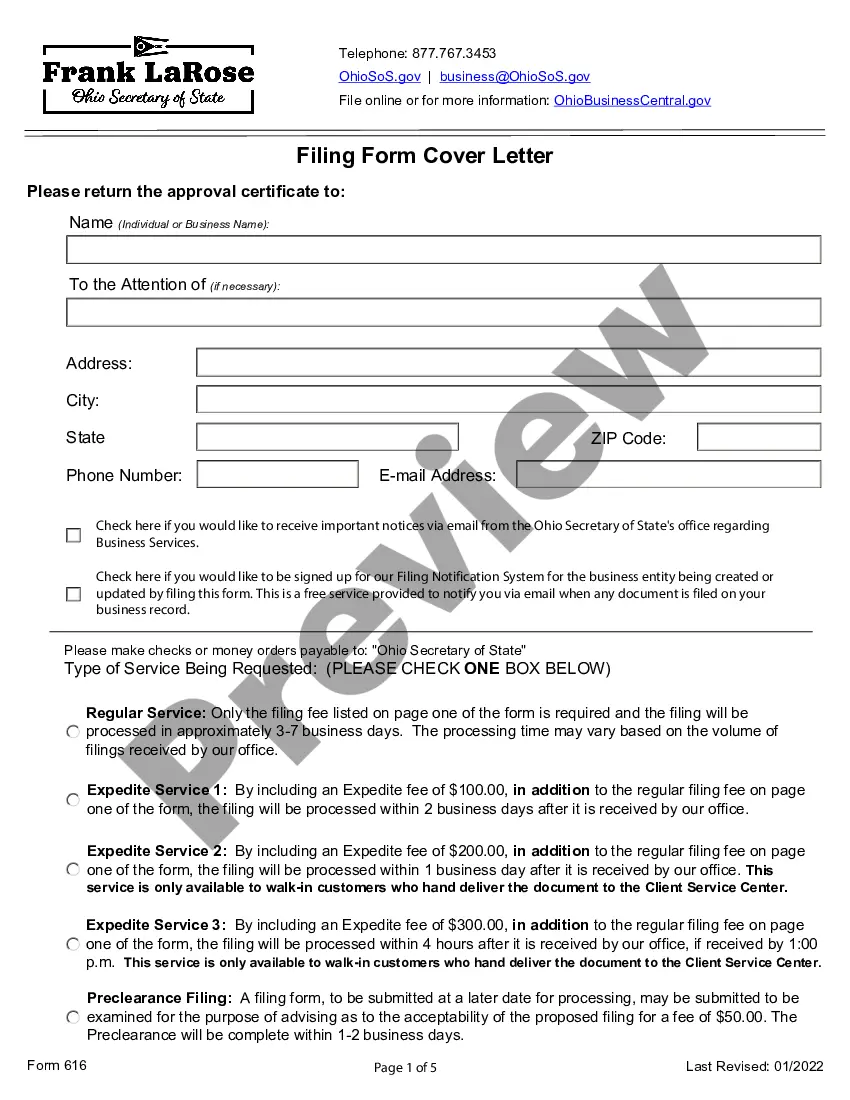

- Click on the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

Some ways to prove self-employment income include: Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

A federal court panel has unanimously ruled that it's not a violation of freelance journalists' First Amendment rights for the state of California to restrict their ability to work and be published as independent contractors.

While an employer automatically owns the copyright of work created by an employee, an independent contractor generally retains ownership unless their work falls into one of nine categories that the Copyright Act considers made for hire: a contribution to a collective work, a part of a motion picture or audiovisual work

California Governor Newsom has signed Assembly Bill 2257,exempting freelance writers, musicians, artists and others from the stringent rules established by the 'ABC' test for independent contractors, which makes them more likely to be reclassified as employees. This article explains.