Collin Texas Account Executive Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions of the relationship between an account executive and a client/company in the Collin, Texas area. This agreement serves as a guide for both parties involved, ensuring clarity and setting expectations for the working relationship. The Collin Texas Account Executive Agreement generally covers various aspects such as payment terms, scope of work, confidentiality, termination provisions, and dispute resolution. By clearly defining these terms, both parties can protect their rights and minimize potential conflicts that may arise during the course of the business relationship. Keywords: Collin Texas, Account Executive Agreement, Self-Employed Independent Contractor, terms and conditions, relationship, client/company, working relationship, payment terms, scope of work, confidentiality, termination provisions, dispute resolution. There may not be different types of Collin Texas Account Executive Agreement — Self-Employed Independent Contractor, but variations of this agreement may exist depending on the specific industry or the nature of the services provided. For example: 1. Collin Texas Sales Account Executive Agreement — Self-Employed Independent Contractor: This agreement specifically focuses on the sales aspect of the account executive's role, outlining targets, commissions structure, and any additional sales-related responsibilities. 2. Collin Texas Marketing Account Executive Agreement — Self-Employed Independent Contractor: This variation of the agreement emphasizes the marketing responsibilities of the account executive, including tasks such as developing marketing strategies, managing campaigns, and analyzing results. 3. Collin Texas Account Executive Agreement — Self-Employed Independent Contractor with Non-Compete Clause: In some cases, this agreement may include a non-compete clause to prevent the account executive from working with direct competitors or soliciting clients of the client/company for a certain period after the agreement ends. 4. Collin Texas Account Executive Agreement — Self-Employed Independent Contractor with Commission-Based Compensation: This variation of the agreement may outline a commission-based compensation structure, specifying commission percentages, thresholds, and any applicable terms or conditions. It's important for both parties involved to thoroughly review and understand the specific terms within their Collin Texas Account Executive Agreement — Self-Employed Independent Contractor to ensure compliance and a mutually beneficial working relationship.

Collin Texas Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Collin Texas Account Executive Agreement - Self-Employed Independent Contractor?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Collin Account Executive Agreement - Self-Employed Independent Contractor meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Collin Account Executive Agreement - Self-Employed Independent Contractor, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Collin Account Executive Agreement - Self-Employed Independent Contractor:

- Examine the content of the page you’re on.

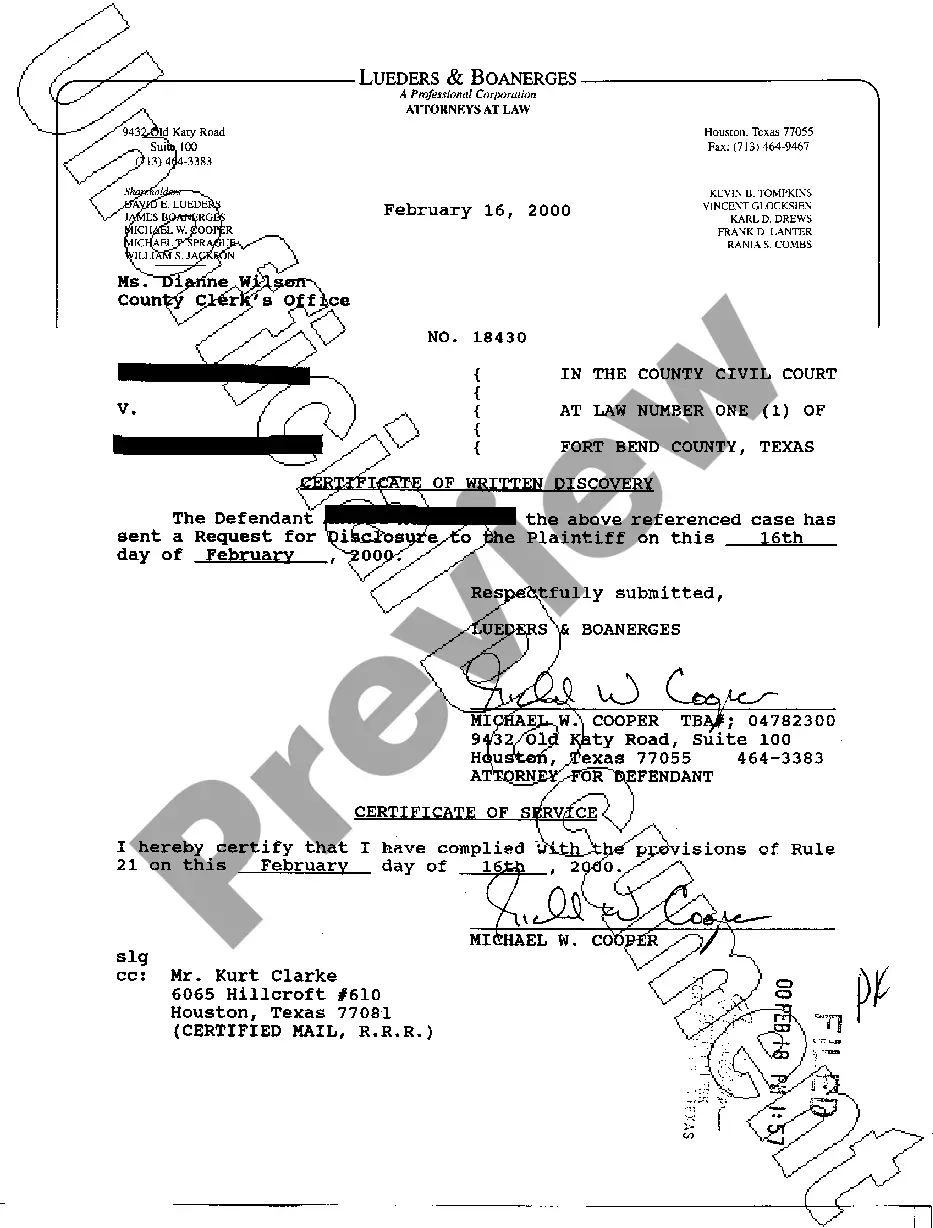

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Collin Account Executive Agreement - Self-Employed Independent Contractor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!