A Fairfax Virginia Account Executive Agreement — Self-Employed Independent Contractor is a legally binding document that outlines the expectations, responsibilities, and compensation of an account executive who operates as a self-employed independent contractor in Fairfax, Virginia. This agreement establishes a clear understanding between the account executive and the hiring party (client or company) to avoid any misunderstandings or potential disputes. The primary purpose of this agreement is to define the nature of the business relationship between the account executive and the hiring party. This includes the agreement that the account executive works on a self-employed basis, responsible for managing their own expenses, taxes, and benefits, without being an employee of the hiring party. The key components of a Fairfax Virginia Account Executive Agreement — Self-Employed Independent Contractor include: 1. Identification of Parties: This section includes the legal names and contact information of both the account executive and the hiring party. 2. Scope of Work: The agreement must specify the specific services the account executive will provide to the hiring party, such as account management, sales, or marketing support. 3. Term and Termination: This section outlines the duration of the agreement and the conditions under which either party can terminate the contract, including notice periods and reasons for termination. 4. Compensation: The agreement details the compensation structure, including the rates, payment frequency, and any additional expenses or reimbursements agreed upon. 5. Intellectual Property: It is essential to address the ownership and usage rights of any intellectual property (such as presentations, reports, or creative content) created during the account executive's engagement. 6. Confidentiality: This section ensures that the account executive maintains the confidentiality of any sensitive information they gain access to during their engagement. 7. Non-Compete and Non-Disclosure: The agreement may include terms regarding non-compete clauses, stating that the account executive cannot engage in similar activities or work for competitors during or after the agreement. 8. Indemnification and Liability: The parties must allocate responsibility for any potential losses, damages, or liabilities arising from the account executive's actions. Types of Fairfax Virginia Account Executive Agreements — Self-Employed Independent Contractor may include: 1. Sales-focused account executive agreement: Specifically outlines the responsibilities and expectations of an account executive responsible for generating sales and building client relationships. 2. Marketing account executive agreement: Focuses on an account executive's responsibilities in developing and implementing marketing strategies, managing campaigns, and analyzing performance. 3. Key account executive agreement: Tailored for an account executive who primarily handles important or strategic accounts, requiring a higher level of responsibility and ongoing relationship management. In summary, a Fairfax Virginia Account Executive Agreement — Self-Employed Independent Contractor provides clarity and protection for both parties involved. It is crucial to seek legal advice when drafting or entering into such agreements to ensure compliance with relevant laws and to protect the rights and interests of all parties involved.

Fairfax Virginia Account Executive Agreement - Self-Employed Independent Contractor

Description

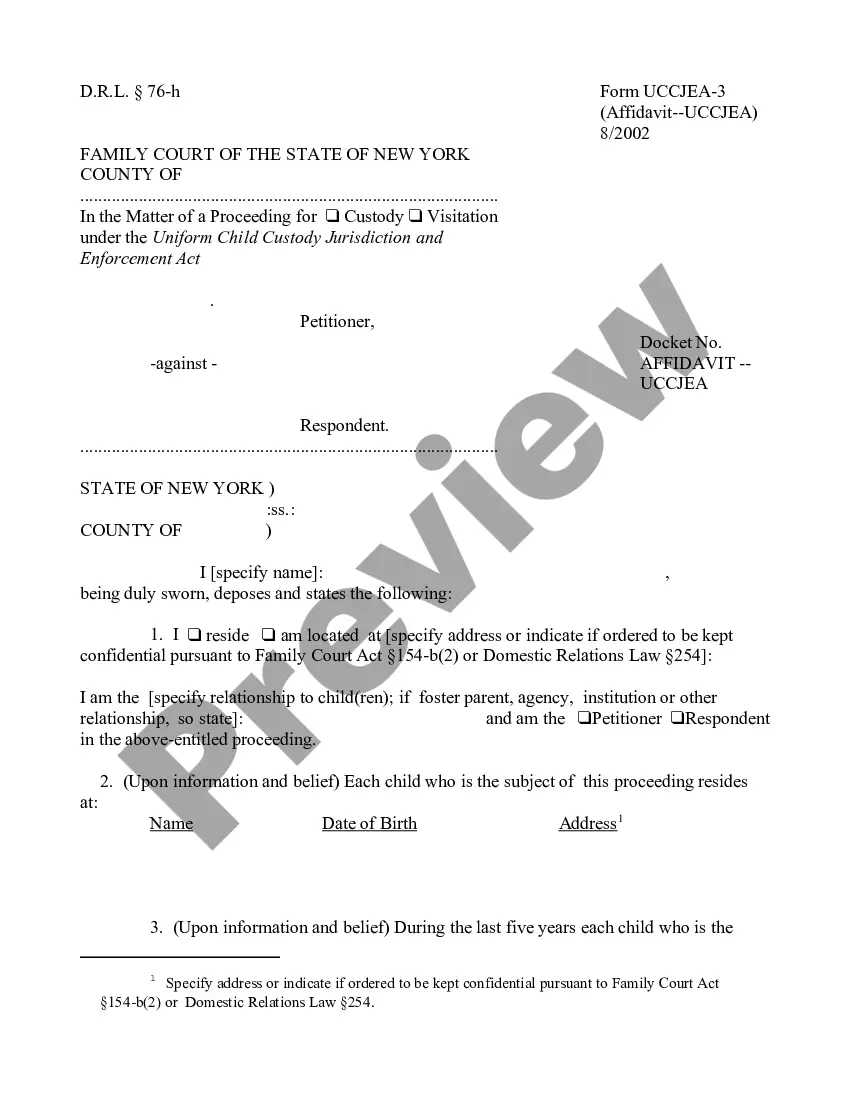

How to fill out Fairfax Virginia Account Executive Agreement - Self-Employed Independent Contractor?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Fairfax Account Executive Agreement - Self-Employed Independent Contractor.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Fairfax Account Executive Agreement - Self-Employed Independent Contractor will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Fairfax Account Executive Agreement - Self-Employed Independent Contractor:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Fairfax Account Executive Agreement - Self-Employed Independent Contractor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Elements of a Construction Contract Name of contractor and contact information.Name of homeowner and contact information.Describe property in legal terms.List attachments to the contract.The cost.Failure of homeowner to obtain financing.Description of the work and the completion date.Right to stop the project.

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship.

While your contract may contain much more information, here are seven general sections that should be included in any contract between an independent contractor and client. Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.

A California Independent Contractor Agreement is a contract between an independent contractor and a client where the client hires an individual or an organization in the state of California.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

Independent contractors have total control over the work being performed, generally set their own hours, pay for their own business expenses, and provide their own equipment, liability insurance, and office space.