The Hennepin Minnesota Campaign Worker Agreement is a legal document that establishes the relationship between a campaign worker and a campaign organization. This agreement is specifically designed for self-employed independent contractors who wish to work on political campaigns in Hennepin County, Minnesota. Keywords: Hennepin Minnesota, campaign worker agreement, self-employed independent contractor, political campaign, legal document, campaign organization, Hennepin County. Different types of Hennepin Minnesota Campaign Worker Agreement — Self-Employed Independent Contractor may include: 1. General Campaign Worker Agreement: This type of agreement outlines the general terms and conditions for campaign workers, including responsibilities, compensation, non-disclosure, and termination clauses. 2. Volunteer Campaign Worker Agreement: For individuals who wish to contribute their time and effort to a political campaign without expecting monetary compensation, this agreement sets forth the expectations and duties of the volunteer worker. 3. Paid Campaign Worker Agreement: For campaign workers who are paid for their services, this type of agreement details the payment terms, working hours, and other financial arrangements. 4. Door-to-Door Campaign Worker Agreement: This agreement is tailored for campaign workers who are primarily engaged in canvassing neighborhoods and interacting with voters door-to-door. It may include additional clauses specific to this type of campaign work, such as guidelines for approaching voters and distributing campaign materials. 5. Phone Bank Campaign Worker Agreement: Designed for campaign workers who specialize in conducting phone banking activities, this agreement addresses the unique responsibilities associated with making calls to potential voters and promoting campaign messages over the phone. 6. Campaign Manager Agreement: While not strictly a campaign worker agreement, this legal document may be relevant for individuals assuming campaign management roles. It defines the scope of the manager's responsibilities, compensation, and any additional terms of their engagement. Remember, it is crucial to consult with legal professionals or seek expert advice when drafting or entering into any campaign worker agreement to ensure compliance with state laws and regulations.

Hennepin Minnesota Campaign Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Hennepin Minnesota Campaign Worker Agreement - Self-Employed Independent Contractor?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Hennepin Campaign Worker Agreement - Self-Employed Independent Contractor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Hennepin Campaign Worker Agreement - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Hennepin Campaign Worker Agreement - Self-Employed Independent Contractor:

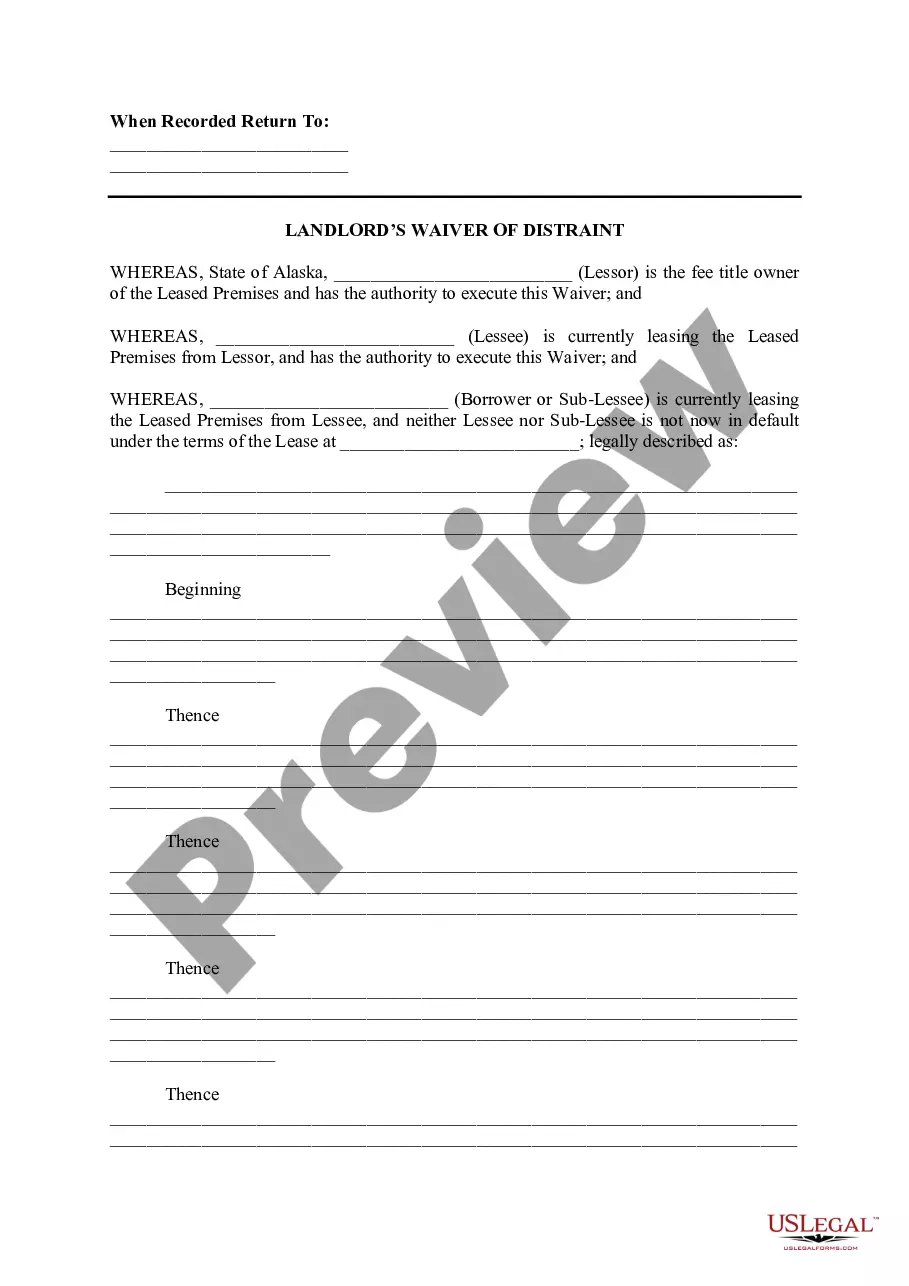

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

The company pays its contractors, but contractors aren't employees. Instead, independent contractors are self-employed (also known as a ?business for self?); they can operate and work for several clients simultaneously. Companies often use independent contractors to avoid hiring staff for short-term needs.

7 Terms you should include in an independent contractor agreement? Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement? State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

A worker is an independent contractor if you have the right to control or direct only the result of the work and not how to work is performed. Independent contractors pay self-employment tax on their earnings.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How can I apply? You can apply through the Minnesota Unemployment Insurance program. But DEED asks that you apply in a specific way. There are specific questions about your status as an independent contractor or with self-employment.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.