Title: Wake, North Carolina Self-Employed Independent Contractor Pyrotechnical Service Contract — A Comprehensive Overview Introduction: In Wake, North Carolina, individuals looking to hire self-employed independent contractor pyrotechnics need a legally binding agreement to establish the terms and conditions of their service. This detailed description aims to provide an extensive understanding of the Wake North Carolina Self-Employed Independent Contractor Pyrotechnical Service Contract, its purpose, and potential variations. Key Terms: 1. Wake, North Carolina: Refers to the specific geographical location where the self-employed independent contractor pyrotechnical services are being rendered — Wake County in North Carolina. 2. Self-Employed Independent Contractor: Denotes an individual offering pyrotechnical services to clients on a contract basis, operating as an independent entity responsible for their own tools, insurance, and work arrangements. This status establishes a non-employment relationship with the hiring party. 3. Pyrotechnical: A trained professional specializing in the design, setup, and execution of fireworks displays. 4. Service Contract: A legally binding agreement that outlines the terms and conditions agreed upon between the self-employed pyrotechnical and the hiring party for the provision of pyrotechnical services. Purpose and Components of the Service Contract: The Wake, North Carolina Self-Employed Independent Contractor Pyrotechnical Service Contract serves several crucial purposes, including: 1. Defining Scope of Services: Explicitly outlines the specific pyrotechnical services to be provided, such as fireworks setup, execution, and cleanup. 2. Duration and Schedule: Specifies the start date, end date, and hours of operation for services. It may also include contingencies for unforeseen circumstances or delays. 3. Payment and Compensation: Clearly states the agreed-upon rate of payment, invoicing terms, and any additional expenses related to the provision of services, such as travel or permit fees. 4. Safety Guidelines and Obligations: Highlights safety standards, licensing requirements, and safety protocols that the pyrotechnical must follow to ensure the well-being of both themselves and the hiring party. 5. Insurance and Liability: Outlines the required insurance coverage and the responsibility of the pyrotechnical to provide their own liability insurance in case of accidents, damages, or injuries. Types of Wake, North Carolina Self-Employed Independent Contractor Pyrotechnical Service Contracts: While the specific nature of the service contract may vary depending on the parties involved and the project requirements, some common variations include: 1. Single Event Pyrotechnical Service Contract: Designed for the provision of pyrotechnical services for a one-time occasion, such as a wedding, corporate event, or celebration. 2. Long-Term Contract for Pyrotechnical Services: Suitable for ongoing or multiple events, this contract establishes a long-term working relationship between the pyrotechnical and the hiring party. 3. Pyrotechnical Consulting Service Contract: When the pyrotechnical offers advisory or consulting services to the hiring party, this contract defines the scope, duration, and compensation for the consultation period. Conclusion: The Wake, North Carolina Self-Employed Independent Contractor Pyrotechnical Service Contract is a vital tool to safeguard the interests of both self-employed pyrotechnics and the clients who hire them. By defining the parameters and expectations of the professional relationship, this contract ensures a smooth and legally compliant experience for all parties involved.

Wake North Carolina Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

How to fill out Wake North Carolina Self-Employed Independent Contractor Pyrotechnician Service Contract?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Wake Self-Employed Independent Contractor Pyrotechnician Service Contract, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Wake Self-Employed Independent Contractor Pyrotechnician Service Contract from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Wake Self-Employed Independent Contractor Pyrotechnician Service Contract:

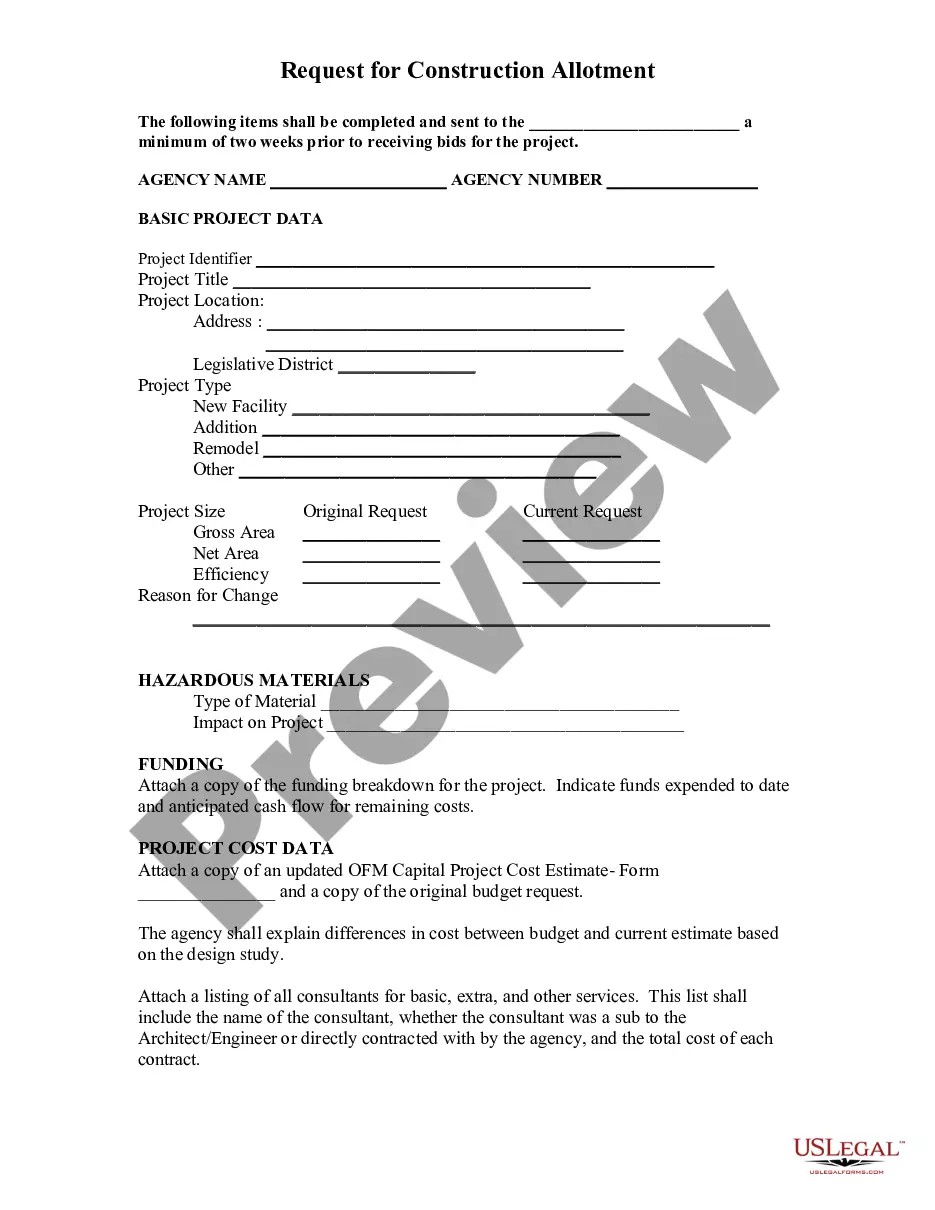

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

You'll also need to provide copies of the T4A to your suppliers. The T5018 form is a record of what you paid a subcontractor for construction services during the previous fiscal year. The T5018s and T5018 Summary need to be filed with the CRA on or before the date that is 6 months after the end of your fiscal year.

You have to fill out T4 slips for all individuals who received remuneration from you during the year if: you had to deduct CPP/QPP contributions, EI premiums, PPIP premiums, or income tax from the remuneration. the remuneration was more than $500.

Generally, a contractor or freelancer will receive a T4 slip from each of their clients for the jobs completed within the specified tax period. This slip will provide a total dollar amount for each job, which will help you track and record your income and calculate taxes owing.

The T5018, Statement of Contract Payments is an information slip that is used to report the total contract payments made to you by a contractor in a calendar year or fiscal period. The amount shown may include goods and services tax/harmonized services tax and provincial/territorial sales tax, where applicable.

Essentially, a subcontractor is a contractor who is working for another contractor. If you're thinking about hiring a subcontractor, you should understand the process as well as the legalities.

The Law Is Clear Certain factors will define a worker as an independent contractor in every case: not relying on the business as the sole source of income, working at his or her pace as defined by an agreement, being ineligible for employer provided benefits and retaining a degree of control and independence.

The T5018 is only for companies in the construction sector. So, if your firm earns more than half its revenue in other areas, you do not need to issue slips and file a T5018 summary. Construction companies are required to file if a contractor was paid more than $500 total during the year ? even if they received cash.

If you have received any self-employment income throughout the past year, you report it as a T4A vs. T4. While the T4 and T4A slips may seem similar, the T4 includes more detail around various payroll contributions that you have as an employee.

The main determining factors for whether you should incorporate your business are overall income and plans for expansion. If you're an independent contractor with no plans to expand into a small business, sole proprietorship is likely to be the better option.

Subcontractors include individuals or businesses that are registered for the goods and services tax/harmonized sales tax (GST/HST), and non-GST/HST registrants that are below the $30,000 limit for GST/HST registration purposes.