Palm Beach Florida Self-Employed Instrument Repair Technician Services Contract

Description

How to fill out Palm Beach Florida Self-Employed Instrument Repair Technician Services Contract?

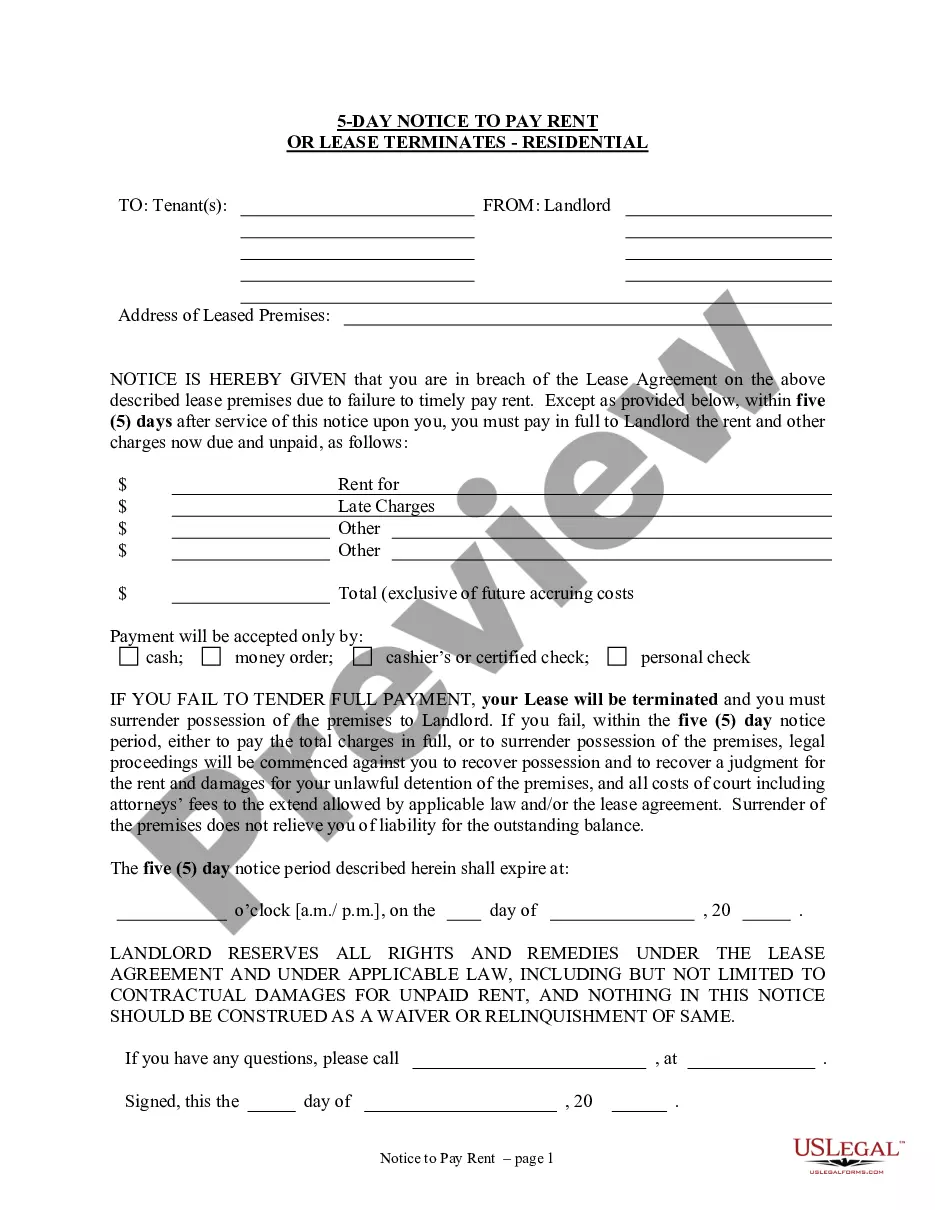

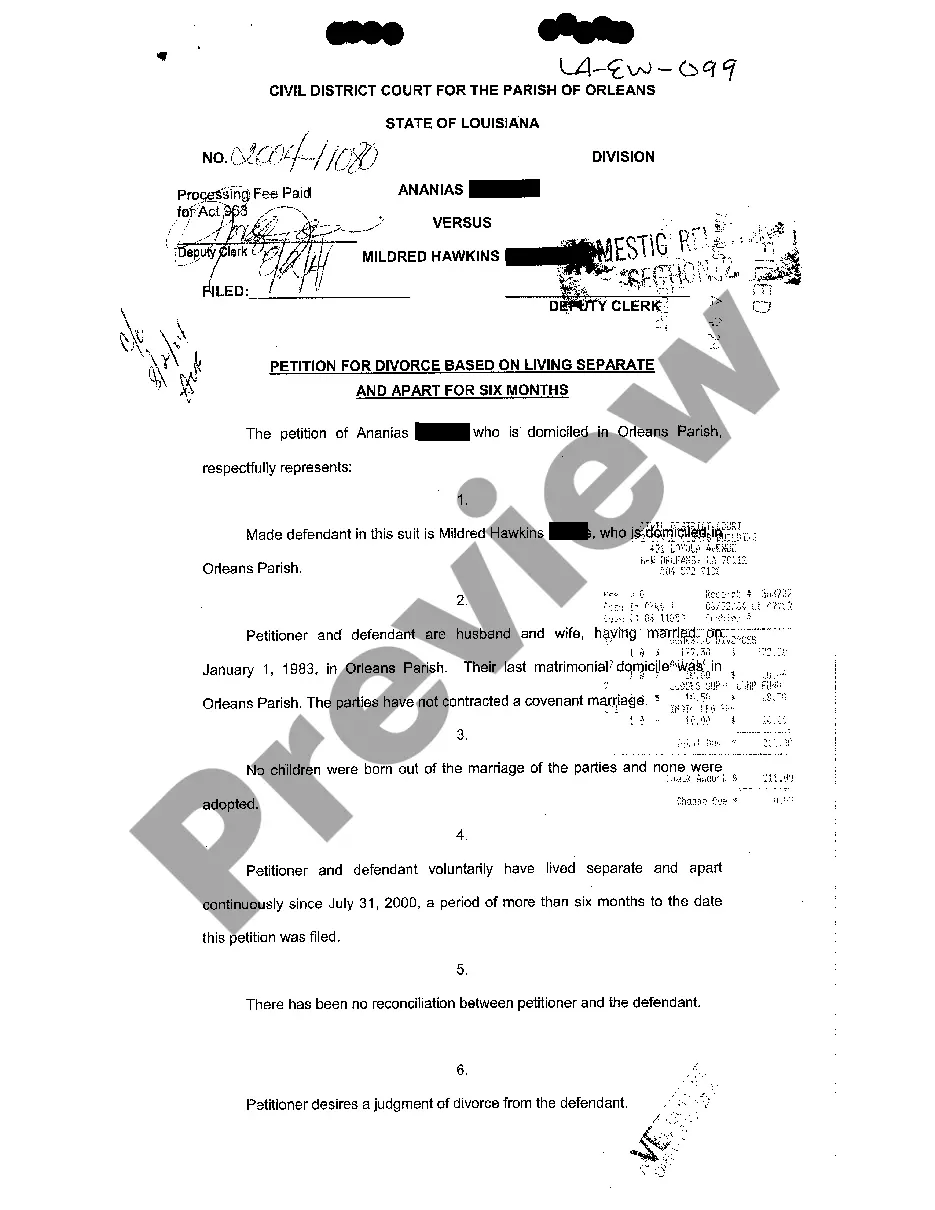

Do you need to quickly create a legally-binding Palm Beach Self-Employed Instrument Repair Technician Services Contract or probably any other form to take control of your personal or corporate affairs? You can go with two options: contact a professional to write a valid document for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant form templates, including Palm Beach Self-Employed Instrument Repair Technician Services Contract and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, double-check if the Palm Beach Self-Employed Instrument Repair Technician Services Contract is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Palm Beach Self-Employed Instrument Repair Technician Services Contract template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the templates we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Charges for repairs of tangible personal property needing only labor or service are not taxable. The repair person must keep documentation to prove no tangible personal property was joined with or attached to the repaired item. Sales tax applies even if the parts are provided at no charge.

Start a musical instrument repair business by following these 10 steps: Plan your Musical Instrument Repair Business. Form your Musical Instrument Repair Business into a Legal Entity. Register your Musical Instrument Repair Business for Taxes. Open a Business Bank Account & Credit Card.

Who can file a Florida Mechanics Lien? Florida construction law gives mechanics lien rights to direct contractors, subcontractors, material suppliers, equipment lessors, and laborers when they perform work for the permanent benefit of land or real property (as per §713.01(15) definition of improvement).

Who Can Claim A Lien On My Property? Contractors, laborers, materials suppliers, subcontractors and professionals such as architects, landscape architects, interior designers, engineers or land surveyors all have the right to file a claim of lien for work or materials.

Technically speaking, there are no specific job qualifications for auto repair workers in general. The state of California, for example, has no formal certification or training requirements to work in a repair shop.

Costs for starting a shop vary, but generally include: Business license: $50 to $100. ASE certifications: $36 registration fee, one time, plus $39 per certification, except L1, L2, and L3 certs which are $78. Insurance: $4,000/yr. Mechanic's hydraulic lift: $3,700. Diagnostic machine: $5,000 to $10,000.

Individual auto mechanics do not need to be licensed in Florida. If you wish to improve your job prospects, however, you can become certified in specific auto service and repair skills through ASE.

FLORIDA'S CONSTRUCTION LIEN LAW ALLOWS SOME UNPAID CONTRACTORS, SUBCONTRACTORS, AND MATERIAL SUPPLIERS TO FILE LIENS AGAINST YOUR PROPERTY EVEN IF YOU HAVE MADE PAYMENT IN FULL. UNDER FLORIDA LAW, YOUR FAILURE TO MAKE SURE THAT WE ARE PAID MAY RESULT IN A LIEN AGAINST YOUR PROPERTY AND YOUR PAYING TWICE.

While no certifications are required, you must register with the local tax office and obtain a business license.

Although you don't need formal qualifications to become a mechanic, a lot of mechanics start off with an apprenticeship or some form of structured training, either full-time or while on the job.