The San Antonio Texas Self-Employed Commercial Fisherman Services Contract is a legal agreement that outlines the terms and conditions between a self-employed commercial fisherman and their clients in the San Antonio, Texas area. This contract is specifically designed to protect both parties involved and ensure a fair and mutually beneficial working relationship. Keywords: San Antonio Texas, self-employed, commercial fisherman, services contract This comprehensive contract covers various aspects of the self-employed commercial fisherman's services, ensuring clarity and understanding between the fisherman and their clients. It includes details on the services to be provided, such as fishing methodologies, equipment used, and target species. By outlining the specifics, this contract helps both parties establish clear expectations. Moreover, the San Antonio Texas Self-Employed Commercial Fisherman Services Contract addresses the financial aspects of the agreement. It outlines the pricing structure, payment terms, and any additional costs such as fuel or supplies. This ensures transparency and prevents any misunderstandings regarding the financial obligations of both parties. Additionally, the contract discusses the responsibilities and liabilities of each party. It highlights the fisherman's duty to comply with local, state, and federal fishing regulations and obtain the necessary licenses and permits. Furthermore, it specifies the client's responsibility to adhere to safety protocols and guidelines while on board the fishing vessel. In cases where unforeseen circumstances, such as extreme weather or equipment failure, may affect the completion of the services, the contract should include a section covering these contingencies. This section outlines the steps to be taken in such situations, including rescheduling or refunding options, to protect the interests of both parties. Types of San Antonio Texas Self-Employed Commercial Fisherman Services Contracts: 1. Single Trip Contract: This contract covers a specific fishing trip or excursion requested by the client, typically for a predetermined duration. It includes details about the date, time, and location of the trip, as well as the expected catch and any additional services, such as cleaning the fish. 2. Seasonal Contract: This contract is ideal for clients who require the services of a self-employed commercial fisherman for an extended period, such as an entire fishing season. It outlines the duration, frequency, and specific conditions of the services to be provided throughout the season. 3. Long-Term Contract: Suitable for clients who require ongoing fishing services throughout the year, this contract establishes a comprehensive framework for a continuous working relationship. It may include provisions for multiple fishing trips, maintenance and repairs of equipment, and any other recurring services. Whether it's a single trip, seasonal, or long-term contract, the San Antonio Texas Self-Employed Commercial Fisherman Services Contract is essential to safeguard the rights and duties of both parties involved. It provides a clear understanding of expectations, responsibilities, and financial commitments, enabling a successful and harmonious working relationship between commercial fishermen and their clients.

San Antonio Texas Self-Employed Commercial Fisherman Services Contract

Description

How to fill out San Antonio Texas Self-Employed Commercial Fisherman Services Contract?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft San Antonio Self-Employed Commercial Fisherman Services Contract without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid San Antonio Self-Employed Commercial Fisherman Services Contract on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the San Antonio Self-Employed Commercial Fisherman Services Contract:

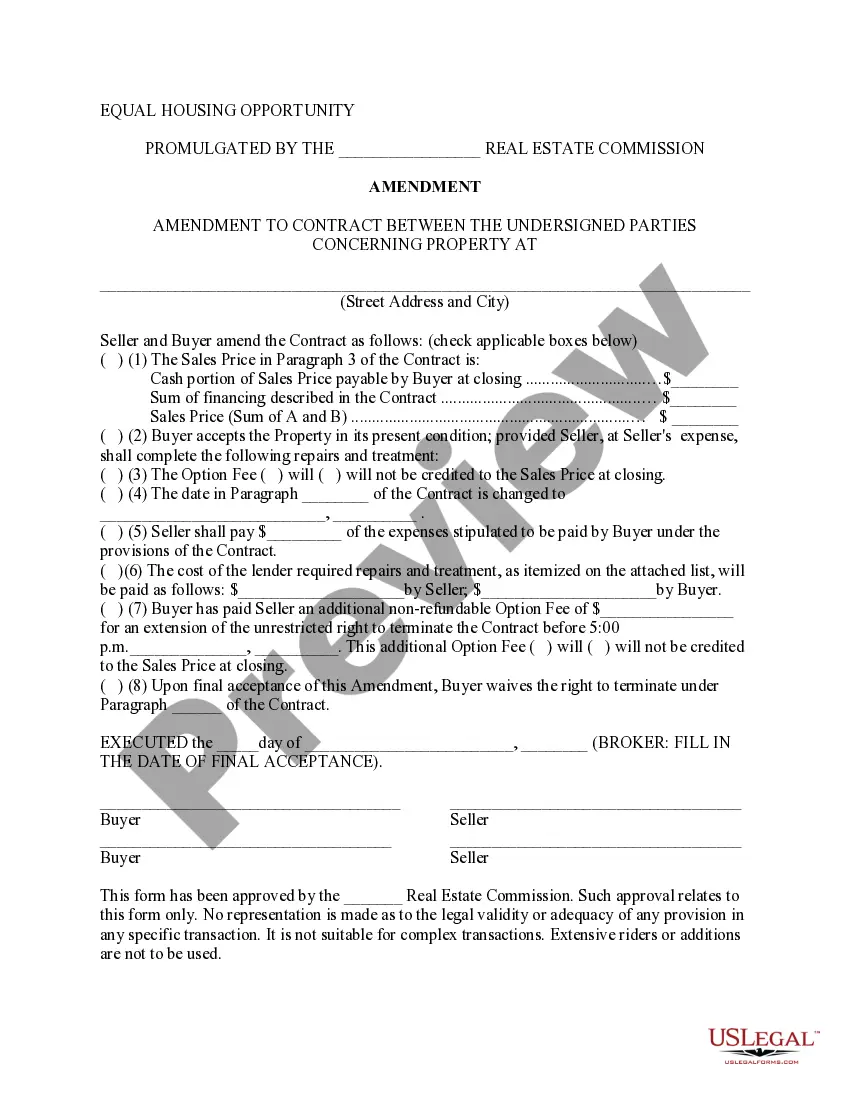

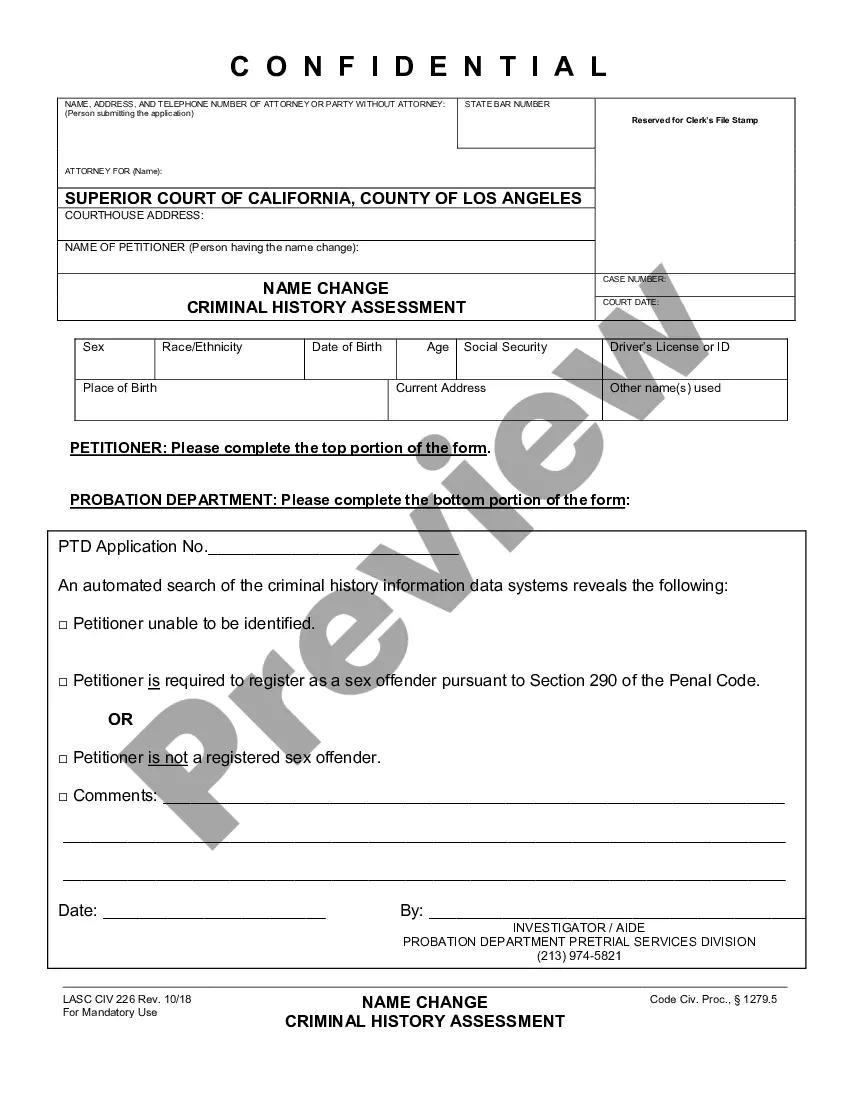

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

Electricians, plumbers, carpenters, bricklayers, painters, hair stylists, wedding planners, auto mechanics, florists, and many other skilled workers that specialize in a trade can be regarded as independent contractors.

There are no hour laws for freelancers. If a contractor works over 40 hours weekly, that's the contractor's concern rather than that of the business owner.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A 1099 employee is not an employee of your business, but an independent contractor. That means that the person technically is self-employed, and you pay for a service the person provides. That service may be a set amount of hourly work or the completion of a defined project.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

While duration is only one factor among many that determines whether a worker is a contractor or an employee, six months is usually recommended as a safe duration and one-year should usually be considered an outside limit, assuming that the other independent contractor criteria are met.

You are considered a self-employed fisherman if you catch fish for profits and not for sport, and also if you also meet at least one of the following criteria: You either own or lease the boat used to catch fish. You either own or lease the gear used to catch fish.

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.