Franklin Ohio Social Worker Agreement - Self-Employed Independent Contractor

Description

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

Managing legal documents is essential in the contemporary world. Nonetheless, you do not always have to seek expert help to draft certain ones from the beginning, such as the Franklin Social Worker Agreement - Self-Employed Independent Contractor, using a service like US Legal Forms.

US Legal Forms offers over 85,000 documents across various categories ranging from living wills to real estate contracts and divorce paperwork. All documents are categorized according to their applicable state, making the search process less daunting. You can also discover informational resources and guides on the website to simplify any tasks related to document completion.

Here’s how you can acquire and download the Franklin Social Worker Agreement - Self-Employed Independent Contractor.

If you are already a member of US Legal Forms, you can find the necessary Franklin Social Worker Agreement - Self-Employed Independent Contractor, Log In to your account, and download it. Certainly, our platform cannot completely replace a legal expert. If you are facing a particularly complex case, we advise consulting with a lawyer to review your document prior to signing and submitting it.

With over 25 years of experience in the industry, US Legal Forms has established itself as a reliable supplier of various legal documents for millions of clients. Join today and obtain your state-compliant paperwork with ease!

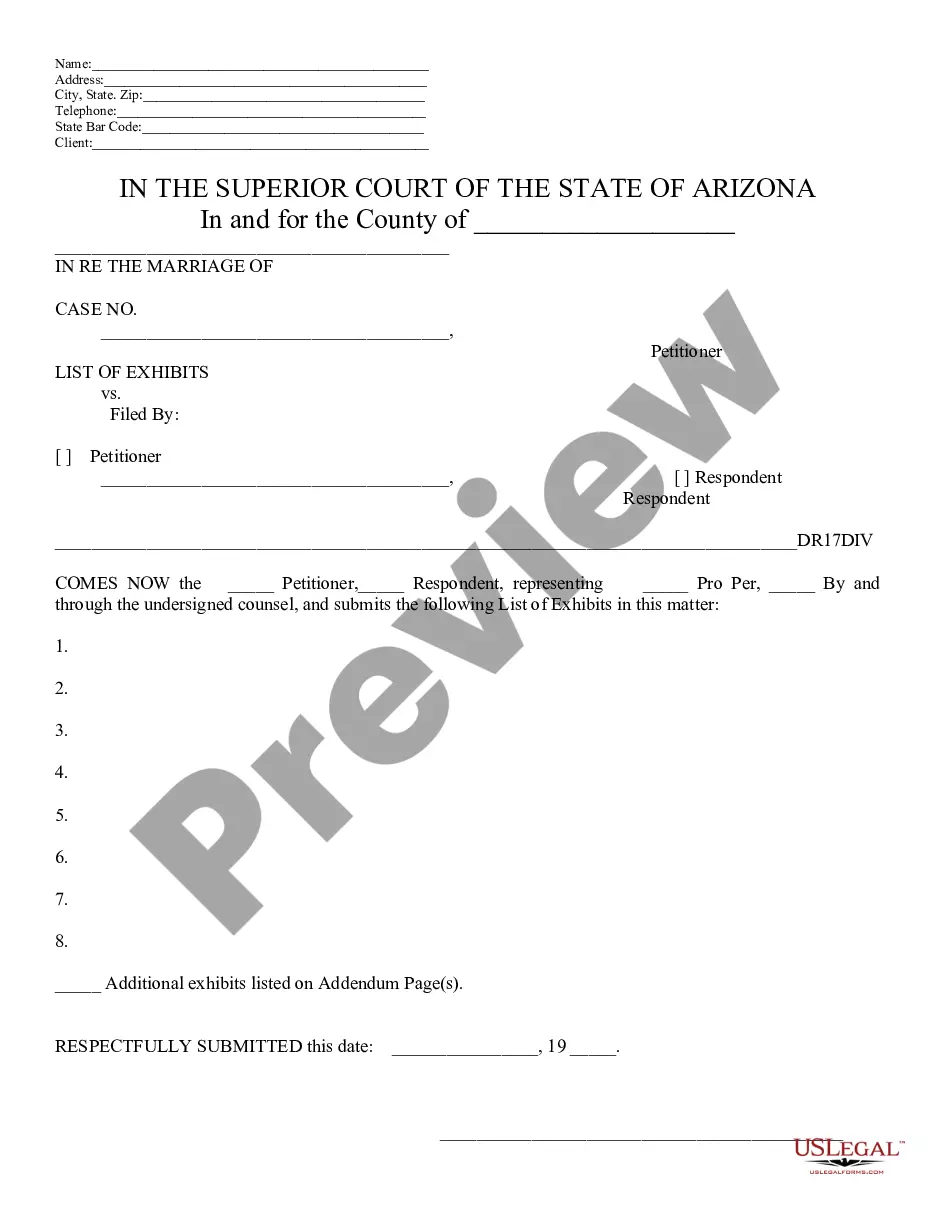

- Review the document’s preview and outline (if available) to gain an overview of what you will receive after downloading the form.

- Confirm that the template you select is relevant to your state/county/region, as state laws can influence the legality of certain documents.

- Examine related forms or restart your search to find the appropriate document.

- Click Buy now and create your account. If you already possess one, choose to Log In.

- Select the pricing plan, then an appropriate payment method, and purchase the Franklin Social Worker Agreement - Self-Employed Independent Contractor.

- Opt to save the form template in any provided file format.

- Navigate to the My documents tab to re-download the document.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Can I employ self-employed staff? Having multiple income streams is not uncommon nowadays and that means you can be both employed and self-employed. If you are looking to hire someone who is self-employed as an employee, there are no rules that say that person is ineligible.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Can a sole proprietor hire employees? A sole proprietor can hire employees. There is no limit to the number of workers you can employ. As an employer, you are responsible for all employment administration, recordkeeping, and taxes.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Yes. Once you get going as a sole trader you can employ people just as you would do in a limited company, but you have to tell HMRC that you are doing so. The process of setting up as an employer is the same for sole traders as for limited companies: Step 1 is to register as an employer.

Not necessarily. Being an independent contractor puts you in one category of self-employed. An independent contractor is someone who provides a service on a contractual basis. If you're an independent contractor, you may be hired to complete a particular project or to work for a specific amount of time.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.